Over the last five days, the ITC stock has rallied almost 10%. Recently, GST Council recently made some changes in GST rates. The council however made no rate change in any of the cess sectors, including tobacco. This is a positive development for ITC. ITC stock has lagged behind in terms of performance. From a valuation perspective, this is one of the cheaper consumption-theme stocks in the FMCG space.

ITC Limited (“ITC” or the “Company”) has a diversified presence in Branded Packaged Foods, Personal Care, Education and Stationery, Agarbattis & Safety Matches, Lifestyle Retailing, Cigarettes & Cigars, Hotels, Paperboards & Specialty Papers, Packaging, Agri-business & IT.

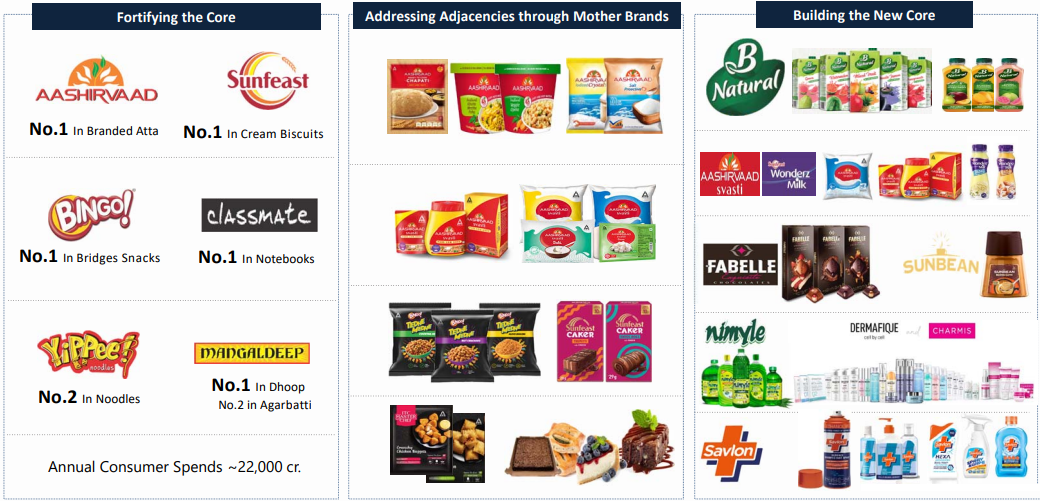

The Company has established a vibrant portfolio of 25 world- class FMCG brands including Aashirvaad, Sunfeast, Yippee!, Bingo!, B Natural, ITC Master Chef, Fabelle, Sunbean, Fiama, Engage, Vivel, Savlon, Classmate, Paperkraft, Mangaldeep, Aim and others.

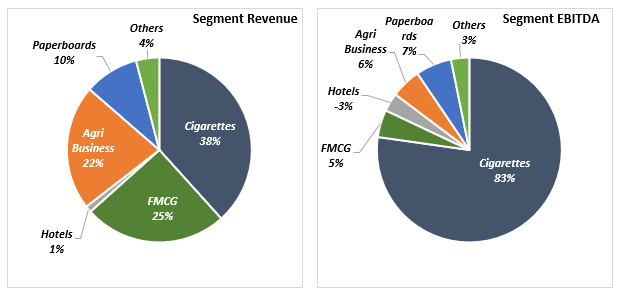

Over the years, ITC has achieved phenomenal growth in the non-cigarette FMCG category on the back of aggressive marketing and celebrity endorsements, but the Company still derives majority of its gross revenue and net profit from its cigarette division.

ITC’s Business Portfolio

ITC is one of India’s biggest professionally managed companies. Many large financial institutions hold varying amounts of stakes in ITC but no one exercises significant influence in decision making. This gives the management enormous freedom and autonomy in diversification.

The government of India, through its insurance companies and Specified Undertaking of Unit Trust of India (SUUTI), owns a 29.44% stake in ITC.

| Life Insurance Corporation of India | 16.25% |

| SUUTI | 7.93% |

| General Insurance Corporation of India | 1.76% |

| The New India Assurance Company Limited | 1.49% |

| The Oriental Insurance Company Limited | 1.11% |

Financial Performance

| Particulars | FY17 | FY18 | FY19 | FY20 | FY21 | |||||

| Revenue (In Rs. Cr.) | 42,776.61 | 43,448.94 | 48,352.68 | 49,404.05 | 49,272.78 | |||||

| Growth | – | 1.57% | 11.29% | 2.17% | -0.27% | |||||

| EBITDA (In Rs. Cr.) | 15,435.91 | 16,482.96 | 18,406.36 | 19,260.16 | 17,002.70 | |||||

| EBITDA Margin | 36.08% | 37.94% | 38.07% | 38.98% | 34.51% | |||||

| EBIT (In Rs. Cr.) | 14,283.12 | 15,246.68 | 17,009.75 | 17,615.25 | 15,357.11 | |||||

| EBIT Margin | 33.39% | 35.09% | 35.18% | 35.66% | 31.17% | |||||

| PBT (In Rs. Cr.) | 16,020.35 | 17,401.53 | 19,138.12 | 20,026.35 | 17,945.09 | |||||

| PAT (In Rs. Cr.) | 10,289.44 | 11,271.20 | 12,592.33 | 15,306.23 | 13,161.19 | |||||

| PAT Margin | 24.05% | 25.94% | 26.04% | 30.98% | 26.71% | |||||

| EPS (In Rs.) | 8.36 | 9.16 | 10.23 | 12.44 | 10.69 | |||||

| EPS Growth Rate | – | 9.54% | 11.72% | 21.55% | -14.01% | |||||

| Historic P/E (Closing Price of 31st March) | 33.53 | 27.90 | 29.32 | 13.12 | 20.58 | |||||

| CURRENT P/E | 20.83 | |||||||||

| CURRENT PE/ROE | 0.95 | |||||||||

| EV/EBITDA | 21.24 | 22.54 | 15.71 | 10.87 | 16.81 | |||||

| PE/ROE | 1.51 | 1.30 | 1.38 | 0.56 | 0.94 | |||||

| D/E | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | |||||

| Interest Coverage | NA | |||||||||

| ROCE | 33.02% | 31.17% | 30.94% | 29.33% | 28.01% | |||||

| ROE | 22.17% | 21.46% | 21.29% | 23.45% | 21.81% | |||||

Quarterly Performance

| Q1 FY 2021 | Q2 FY 2021 | Q3 FY 2021 | Q4 FY 2021 | Q1 FY 2022 | TTM | Q-o-Q % | Y-o-Y % | |

| Revenue | 9,774.07 | 13,147.81 | 14,124.48 | 14,342.27 | 14,240.76 | 55,855.32 | -0.71% | 45.70% |

| EBITDA | 2,945.56 | 4,401.00 | 4,785.02 | 4,871.12 | 4,443.74 | 18,500.88 | -8.77% | 50.86% |

| EBITDA Margin | 30.14% | 33.47% | 33.88% | 33.96% | 31.20% | 33.12% | ||

| PAT | 2,511.00 | 3,526.55 | 3,526.55 | 3,755.47 | 3,276.48 | 14,085.05 | -12.75% | 30.49% |

| PAT Margin | 25.69% | 26.82% | 24.97% | 26.18% | 23.01% | 25.22% | ||

| EPS | 2.04 | 2.74 | 2.87 | 3.05 | 2.66 | 11.32 | -12.75% | 30.49% |

Q1 FY 2022 Highlights:

- Strong sequential recovery momentum in Cigarettes led to volumes reaching nearly pre-Covid levels in Q4 FY21; second wave caused disruptions in convenience store operations during the quarter

- Cigarettes Segment Revenue and Segment EBIT up 33% and 37% y-o-y respectively

- Robust performance by FMCG-Others Segment; Revenue up 10.4% including Sunrise on a high base (LY+10.3%, LY comparable +18.8%) driven mainly by Hygiene products, Fragrances, Spices, Snacks, Dairy and Agarbattis

- Sales in the e-Commerce channel more than doubled y-o-y, taking its salience to 8% of Segment Revenue during the quarter

- Education & Stationery Products Business remains impacted due to continued closure of educational institutions

- Strong growth in external revenue of Agri Businesses driven by wheat, rice and leaf tobacco exports, leveraging strong customer relationships and robust sourcing network

- Paperboards, Paper and Packaging Segment Revenue up 54% and Segment EBIT up 145% driven by Value Added Paperboards, Décor paper and Carton packaging; significant improvement in profitability driven by richer product mix, higher realisations on the back of surge in global pulp prices and structural cost saving interventions

INVESTMENT RATIONALE

Dominant Position in Cigarettes Business with a Strong Distribution Network

ITC is the market leader in cigarettes commanding three-fourth of the domestic market share. Positive India’s demographics such as young population, growing disposable incomes and greater exposure to western lifestyles are favourable for an aspirational product such as cigarettes. In terms of distribution network, the cigarette business of ITC is a logistical marvel with ~2 million retail outlets. ITC made cigarettes have the deepest penetration and are available in the remotest areas of the country.

Strong Financial Position

ITC’s consolidated revenue and profit have grown at a compounded annual growth rate of 7% each over the past five financial years, the consolidated return on capital employed has been over 30% in each of the past five financial years. The Company operates with negligible debt and net worth of Rs. 60,347.34 Cr. The Company has a strong track record of generating free cash flows (average of ~Rs. 9,435 Cr. over the past five years), due to its cigarette business. The Company’s high cash reserves also give headroom for strategic acquisitions.

Focus on Expanding FMCG Business

For Q1 FY2022, the Company’s FMCG revenue was up 10% YoY to Rs. 3,726 Cr. on a comparable basis. Staples, Convenience Foods and Health & Hygiene products, representing around 75% of the portfolio (in base period excl. ESPB), recorded robust growth in the quarter. Taking the advantage of the favorable market, the Company came up with 100+ launches post lockdown. ITC, in its packaged food portfolio, has successfully created strong brands like Aashirvaad, Sunfeast and Bingo. With improving consumption dynamics, ITC can scale its existing portfolio (a 13x opportunity) through several brand extensions and enter new categories.

Focus on Acquisition

ITC has a history of highly rewarding acquisitions. The Company bought Savlon—an antiseptic liquid and soap brand and prickly-heat powder Shower to Shower from US-based multinational Johnson & Johnson in 2015 for an estimated sum of Rs 250-300 Cr. It had picked up the juice brand B Natural for Rs 100 Cr. in 2014. In 2020, it entered the home care market, acquiring the Nimyle brand of floor cleaners for an undisclosed sum. ITC also acquired spices manufacturer Sunrise Foods for Rs. 2,150 Cr. Sunrise also adds to ITC’s presence in spices through the Aashirvaad and MasterChef brands. Strong cash position gives the Company a further headroom for inorganic growth.

Focus on Expanding Personal Care Segment

ITC has also developed strong brands in the non-packaged food business (personal care, apparels, education & stationary, agarbatti), which contributes the remaining 25%. The personal care business continues to enhance market standing in the Fragrance and liquids (handwash & bodywash) categories. Personal care portfolio growth is driven by several innovative launches. Engage pocket deo now contributes more than a third of the deo portfolio; it has 11% market share in the deo segment. Fiama has become stronger in the shower gel business and is at number 2 with 18% market share. The shower gel business is ~10% of the soaps business.

RECENT LAUNCHES

Valuation Based on SOTP

| Business Segments | EBITDA (Rs. Cr.) | Multiple (x) | Enterprise Value (In Rs. Cr.) |

| Cigarettes | 15,838.46 | 11.5 | 1,82,142.29 |

| FMCG* | 14,756.88 | 10.4 | 1,53,471.55 |

| Hotels | 154.00 | 20 | 3,080.00 |

| Agri Business | 829.74 | 8.5 | 7,052.79 |

| Paperboards, Paper & Packaging | 1,305.33 | 10 | 13,053.30 |

| Total Enterprise Value | 3,58,799.93 | ||

| Debt (In Rs. Cr.) | 9.46 | ||

| Cash (In Rs. Cr.) | 4,659.02 | ||

| Market Cap | 3,63,449.49 | ||

| No. of Shares (In Cr.) | 1,230.88 | ||

| Price Per Share (Rs.) | 295.28 | ||

*FMCG – EV/Sales

INVESTMENT CONCERNS

Intense Competition from Other FMCG Players with strong brand portfolio and customer loyalty.

Tax rates on cigarettes have largely been stable for the past two years. Besides, India has banned e-cigarettes. In the Union Budget, the government hiked the excise duty by way of National Calamity Contingent Duty on cigarettes and other tobacco products. On cigarettes, NCCD increase ranges from Rs 200 – 735 per thousand, depending upon length of cigarette and on filter/non-filter basis. The tax increase is likely to affect earnings growth in the near term.

Stock Underperformance – Over the last 5 years, the stock has underperformed as compared to the broad market.

Very informative article rajat and thanks for sharing but if the stock hadn’t rallied 10% would you have still written it. I think most of us own the stock despite it’s non performance since 7 years. So to sum up is it going to behave the same way in coming months as reliance did since 2017. Thank you.