Incorporated on Dec 21, 1994, Jaiprakash Power Ventures Limited (“Jaypee Power” or the “Company”) is part of India’s leading Infrastructure conglomerate – Jaypee Group. The Company is primarily engaged in the business of development, owning and operating power generation plants including hydro and thermal power plants. The Company currently operates the largest hydroelectric power plant in private sector in India – Jaypee Karcham Wangtoo.

This Stock Analysis report presents a long term outlook and the future prospects of Jaypee Power.

The Company has not declared any dividend over the last 5 financial years.

Liquidity and Credit Analysis

Jaypee Power’s average current ratio over the last 5 financial years has been 1.02 times but Jaypee Power’s average long term debt equity ratio over the 5 financial years has been 3.02 times which indicates that the Company operates with extremely high debt and may struggle if revenues don’t pick up soon.

Jaypee Power’s average interest coverage ratio over the last 5 financial years has been 1.55 times this indicates that the Company can meet its short term debt obligations without difficulty.

High Debt to Equity Ratio

Power projects are capital intensive and have high gestation periods. Further, given the aggressive expansion plans undertaken by the Company, the debt to equity ratio of the Company has remained at high levels for the past several years. The increased finance costs and other fixed costs have also had an impact on the growth of net profit, in spite of high EBITDA growth.

The Company operates with a high debt to equity ratio of ~3 times and has not declared any dividends in the past 5 years.

Risks Relating to Power Projects

Power Sector is a highly capital-intensive industry with long gestation periods. Revenue generation could take many years after the initial conceptualization of a project. Since most of the projects have a long gestation period (4-5 years of construction period and operating period of over 25 years), the uncertainties and risks involved are high.

Delay in commissioning of projects is also a concern as it leads to delay in inflow of revenues. At the same time, power companies have to incur costs on the delayed projects, thus affecting margins and overall profitability which could have a negative impact on the share price.

Fuel Constraint – Coal

Constrained availability of fuel for power sector continues to be one of the key concerns affecting the power generation in India which is predominantly based on fossil fuel i.e. coal and gas. The production of coal as well as gas has not kept pace with demand. This fuel supply constraint affects the capacity addition plans undertaken by power generation companies which in turn impacts the revenue stream and puts pressure on margins.

While Jaypee Power has firm fuel supply agreements, any shortage or delay in the delivery of coal could have a negative impact on the share price.

Diversification efforts to augment growth

Jaypee Power is the largest hydropower producer in the private sector in India with 1,700 MW of operational capacity (Source: Company). The Company has 3 operative hydro power plants namely:

- 300 MW Jaypee Baspa-II hydro power plant in Himachal Pradesh;

- 400 MW Jaypee Vishnuprayag hydro power plant in Uttarakhand;

- 1000 MW Jaypee Karcham Wangtoo hydro power plant in Himachal Pradesh.

Expansion of hydro-thermal power capacity

As part of its growth plan, the Company is developing various power plants and has lined up various projects to expand its hydro-thermal power capacity to 13,470 MW by 2019 (Source: Company’s website). The Company is diversifying its fuel mix for power plants in line with the Government of India’s objective of 60:40 Thermal: Hydro mix, by 2019. The Company is actively taking steps to increase its capacity and has a robust project pipeline which reflects strong revenue visibility for the Company in the coming years.

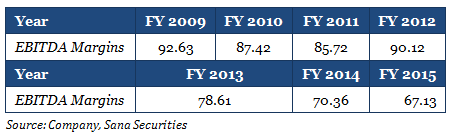

High EBITDA Margins Likely to Stay Consistent

Jaypee Power has been operating with consistently high EBITDA margins, mainly due to zero fuel costs on hydro power projects. Even if commissioning of thermal power projects brings down EBITDA margins in future, the high mix with hydro based projects will cushion the fall in this margin. Upon commissioning of all the units of Nigrie Thermal Power Project and its other projects under different stages of development, the Company is expected to post significant increase in EBITDA in the coming years.

Firm Fuel Supply Agreements

The Company, in order to implement its thermal power projects has entered into a fuel supply agreement with Central Coalfields Limited; South Eastern Coalfields Limited. The Company has also entered into a joint venture with Madhya Pradesh State Mining Corporation Limited to mine the two captive coal blocks, the Amelia (North) and Dongri Tal – II (both in Madhya Pradesh). These coal blocks contain sufficient coal reserves to fuel the Nigrie thermal project over the long term.

In addition, the Company is expected to benefit from the government directive in FY 2012 to Coal India Limited (CIL) to sign fuel supply agreements with power producers. The agreement puts CIL in commitment to supply at least 80 % of the committed coal delivery to the power producers.

________________________________

** The stock analysis of Jaypee Power including the financial analysis report linked above, is for information purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis. Click the link for an updated list of the midcap companies in India.

it is little late . but not too much late to get this info . thanks for this mail .

Thanks Vaibhav. I think you still have time 🙂

Have around 800 shares of JP Hydro power.. What to do.. Hold or sell, booking huge loss..

At what Price did you buy them? I think you may as well hold on to it now. Soon you may find a place in the BOD.