From time to time people write in to me looking to get associated in some way. Most of them are looking for jobs in the financial services space. This is unusual as I don’t have any academic background in finance. What I have is a very keen interest in this area. My background here.

Nevertheless, we thought we will write a blog on this for the benefit of everyone.

The finance industry is very wide and comprehensive. It offers a variety of positions and opportunities catering to a number of different skills and interests like chartered accountants, investment bankers, market/ equity/ commodity analysts etc. In addition, pursuing a career in finance offers a great competitive challenge especially at the entry level. Most of the finance jobs require a master’s degree or an MBA. As a way to advance their professional credentials some go for certification courses like Certified Financial Analyst (CFA), Certified Public Accountant (CPA) etc.

Like every industry, jobs in finance are also cyclical in nature – when the economy and the stock market is doing well i.e. it is going through a bull phase, there are plenty of finance jobs, but when the economy and the stock market is going through recession or a bear phase, people start getting fired and there is not much to do out there.

If you are looking to make a career in finance – the most important thing to remember – What jobs have the greatest compatibility with your skills/interest and where to find them? Do not jump on and pick any high paying job when the economy is good. You will end up getting fired sooner or later once the economy goes down. Try to find what you are cut out for.

How to Find Jobs in Finance

Finance jobs exist in every company operating in almost every industry. There are 2 ways to find these job openings – [1] Offline and [2] Online. When you are looking offline, keep in mind that recruitment agencies will not be the best place if you are seeking good positions. Instead, focus on specialized recruiters who could provide both a good financial job opportunity and the right career advice. Another way could be your university’s placement cell which can put you in touch with some the right people. And the best way – Pick up the phone and get on a call with someone over at the firm / company you want to work with. Trust me when I say this, most good and lasting talent gets placed this way. Just make sure you call the person who is in his job which he was cut out for. If he is someone who just picked a high paying job but cares little for where he is, you will be wasting your time calling him. Do some research and find out about people who love doing what they are doing.

Industry conferences and job trade fairs are another option you could consider in finding a good job. But before you go to any of these events, be aware about the direction of the market and the demand for the position you are looking for. Again, what plays a major role at such events is your personal interaction and ability to meet and talk with people.

When looking online, there are different portals where you can get a number of job opening in different fields of finance. Services offered by these portals could be either free or premium/paid. Some of the online portals are: naukri, indeed, times jobs etc. Another online platform available is ‘LinkedIn’ – an online business oriented social networking site. You can use this platform in finding a job, making connections with business professionals. I remember as a student and even as a young professional whenever I used to do ‘searching for jobs’, I only used LinkedIn – to connect with people and to start a conversation with them. Till date I hire only those who show the willingness to call me and talk about what they are up to. Somehow – good talent is never available on fee based resume directories.

The key in finding a good job is – research, locate/identify and start a conversation.

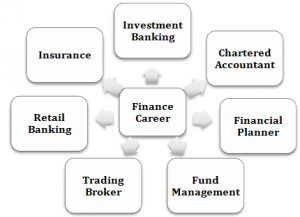

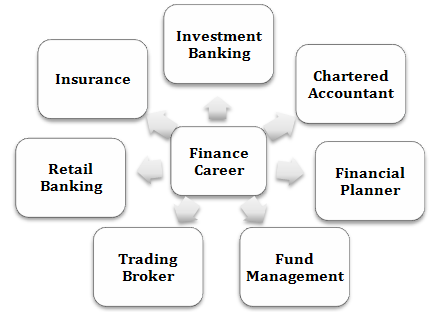

Types of Jobs in Finance

There are diverse Jobs in the finance sector. There are many career opportunities for finance professionals. Different jobs require different skill sets, present different working environment and culture, so while choosing among the different options, it is always better to first analyze your own skills/abilities and then select the one which is in line with your long term interests and abilities. If you are good at interpersonal skills you might do well on the sell side, if you are good with numbers and data, you might do well in accounting. Just make sure that you are not the only one who feels that you are good at something. Oftentimes there is a thin line between wanting something and having the knack for it. I may want to be a fighter pilot but if my eyesight is bad, it doesn’t help does it?

The essence or the crux of getting a good and worthy job in finance is – Do your research first to find out options which suit your abilities/skills rather than spending time and effort in exploring other interesting possibilities which you don’t belong to.

Different Types of Jobs in Finance

- Commercial banking: Commercial banks offer a range of financial services, from deposits like fixed, term and savings accounts to loans (personal, car loan etc). Career options available in this category include cashier, loan officers, operations, and marketing and branch managers.

- Investment banking: One of the strongest financial career options – Investment Banker. These jobs deal with facilitating buying and selling companies and assets, the issue and sale of shares via Initial Public Offerings and QIPs etc, providing strategic and financial advice to both corporations and wealthy individual investors. Working in an investment banking firm would allow you to have interactions with issuers of securities, commercial bankers, auditors, lawyers and other private equity and mergers and acquisitions professionals.

- Hedge Funds: Hedge funds are very similar to any money management firms in that they also manage portfolio of investments for institutions and wealthy individuals using strategies such as long, short, derivatives positions. They are known for taking more risk and are more focused on providing high returns. Common roles at hedge funds include portfolio manager, security analyst, and research associates.

- Private Equity: While hedge funds and money management firms usually buy and sell securities in publicly listed companies private equity firms usually purchase stakes in unlisted companies and buy anything between a small to a very large stake. This is why they are often doubled up as business mentors who invest money in return for a large stake in a business/ plan which they think can succeed. Some of the largest and most well-known private equity firms include Blackstone, Kohlberg Kravis Roberts (KKR) and Credit Suisse. Job opportunities in any reputed private equity firms include investment bankers, analysts, research associates, data analytics and their functions include analyzing potential purchases, negotiating deals, raising finance, or attempting to improve operations and profitability of the companies in which the firm acquires a stake.

- Venture Capital: A specific type of private equity firm – Venture capital firms specialize in providing capital to new or startup companies. A Venture Capital professional’s main job includes evaluating young/ start-up companies.

- Financial planning: Financial planners help individuals in developing plans which match their present as well as future financial needs. Their main task is to review a client’s financial goals and generate an appropriate plan for saving and investing which fits the client’s individual needs. Generally, financial planners have advanced degrees (in addition to an MBA) such as Certified Financial Planner (CFP) and the Certified Financial Advisor (CFA) etc.

- Insurance: Jobs in Insurance involves helping clients, both corporate as well as retail in determining potential risks and advising them about how they can protect themselves from any future losses on account of these risks. Jobs in this category include sales representative, customer service representatives or you can secure a job of actuary (professional statistician) whose main task includes computing risks and premium rates based on historical, quantitative data sets.

- Other jobs includes: Stockbrokers, Chartered Accountants, Company Secretary, Private Bankers, Corporate Finance Executives, Equity Research Analyst etc.