Product – Kotak Special Situations Value Strategy PMS

Benchmark – Nifty 500

Portfolio Composition – the portfolio typically consists of 15-20 stocks

Kotak Special Situations Value Strategy PMS – Investment Philosophy

The portfolio shall be a mix of Value Opportunities and Special Situations.

- Value Opportunities – Investing in those stocks which are available at a significant discount from their current underlying values. Good quality companies will outperform the market irrespective of the sector they are in.

- Special Situations – This is the more flavorful and interesting part of Kotak Special Situations Value Strategy PMS.

- Special Situations are those investment operations whose results are dependent on happening or not happening of one or more corporate events rather than market events.

- Example of Special Situations

- Price Related – Securities bought at a discount to expected price guarantees by buyer in the form of de-listings, buy-backs, open offers, etc.

- Merger Related – Shares can be created at a discount to current market price

- Corporate Restructurings – Value unlocking due to corporate restructuring, assets sales, demergers, business triggers, etc.

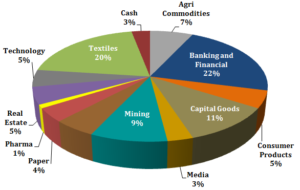

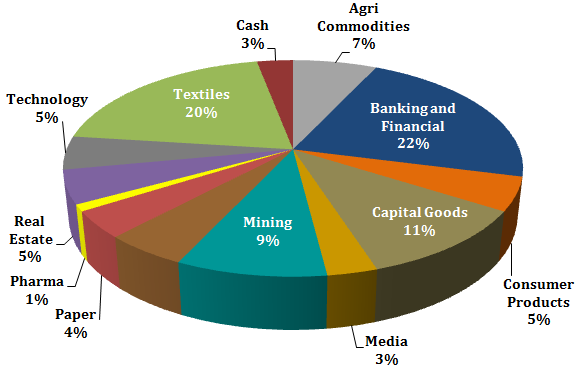

SECTOR ALLOCATION

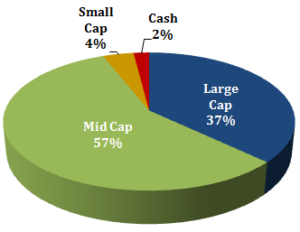

MARKET CAP BREAK UP

- Small Cap: below Rs. 1,500 Cr.

- Mid Cap: above Rs. 1,500 Cr. and below Rs. 10,000 Cr.

- Large Cap: above Rs. 10,000 Cr.

Top 10 Holdings

| Company Name | Weightage |

| Siyaram Silk Mills Ltd | 11.3% |

| Coal India Ltd | 9.5% |

| KRBL | 6.6% |

| Finolex Cables Ltd | 6.6% |

| Repco Home Finance Limited | 4.7% |

| ICICI Bank Ltd | 4.6% |

| Heritage Foods Limited | 4.6% |

| Ashiana Housing Ltd | 4.5% |

| WELCORP | 4.4% |

| NIIT | 4.4% |

Kotak Special Situation Value Strategy PMS Performance

| Particulars | Nifty 500 | Special Situations Value |

| Revenue CAGR FY18-20 | 15.9% | 18.0% |

| EBITDA CAGR FY18-20 | 13.0% | 20.0% |

| Return on Equity FY 18 | 15.0% | 23.0% |

| Net Debt/Equity FY 18 | 1.2 x | 0.2 x |

| FY 20 P/E | 15.7 x | 1 2.5 x |

| % | 3 Months | 6 Months | 1 Year | 2 Year |

| Kotak Special Situation Value Strategy PMS | -4.6 | -1.1 | 15.2 | 28.5 |

| Nifty 500 | -2.1 | 3.7 | 15.6 | 20.1 |

| % | 3 Year | 4 Year | 5 Year | Since Inception |

| Kotak Special Situation Value Strategy PMS | 24.0 | 36.6 | 34.1 | 28.8 |

| Nifty 500 | 12.0 | 15.9 | 15.4 | 15.6 |

FOR BENEFITS OF INVESTING IN PMS SCHEMES CALL – +91 8368931743.

LOOKING TO INVEST IN THIS SCHEME?

Here’s 3 benefits of investing in this scheme through us:

[2] We don’t charge a 2.00% upfront fee for this scheme (or for any other PMS scheme) which helps the investors get maximum upside.

[3] Your Commission Structure/Management fee and all other expenses will remain same or will be lower – CALL US TO CHECK!

[4] We will also give in a free subscription to our website.

[5] A word of caution of investing in PMS Scheme stocks on your own : Trying to buy above stocks on your own could be risky. Typically, by the time the fund makes a disclosure of the stocks they are holding, these stocks have already run up by well over 5-10%. Naturally, the fund manager wants you buy it on your own to take the prices higher after he purchases. The fund may not be holding the above disclosed stocks.

I opened a pms account with Kotak about 2 years ago and will strongly advice against it as I have lost nearly 20 lacs which is too much in two years time . Worst investment opportunity or I should say money sucking scheme

Let me see if I can help you – Your code? What was your investment amount?

I perfectly agree with Mr Akhil tandon,

I have lost a lost of money in Kotak special situations and do not know w ay forward. Requesting your advice

I advice you every one, be alert, do not put your hard earned money in the hand of inefficient people as I lost 50% of my principal amount in a year time, these fund managers are really stupid has no idea what they are doing.

Fully agree.I lost almost 30% of principal within one year. The PMS team is least sensitive about investors woes and hardly communicate nor explain. The fund manager himself seems to be not convinced of the strategy.

I see some pretty bad reviews here. Thankfully none of my clients are invested here.

I agree. Same is with me. I have lost 25 % of principal value in last 2 years.. Pathetic service. They do short term trading and keep booking the loss. Also buy third grade shares and manipulate reports to show wrong values. Don’t ever invest in Kotak PMS

Investing in Kotak PMS special situation is my worst investment decision. I lost almost 20 to 22% investment in last one and a half year,

I strongly advise not to fall in the web of words like unlocking values etc etc

Yes, this fund seems to be underperfoming in a very buoyant market.

This was my worst ever investment – lost 20 % in two years on a base of 40 Lakhs and just now closed it.

Worse than fund performance is the relationship management – my relationship manager vanished without trace in March end with mail bouncing and phones disconnected – but my PMS report shows his name as my RM even last week !! In fact there is no engagement / explanation for past one year on fund performance.

During last 2 years there were serious goofups – They took a blank KYC form from me at the start, entered wrong data into it – and ended up corrupting KYC in all my investments across several AMC’s – took months to rectify (Never give blank KYC form to anyone !!). Then I got a cheque delivered to me that should have been deposited automatically to the PMS current account – and I had a tough time finding out what it was.

Never again Kotak AMC !!

Sounds terrible. Was your RM working with Kotak or any other fund management firm?

I can not begin to explain the need to have a good advisor by your side. Yes, never give a blank KYC … At the least ask for a completed copy of KYC and all other documents before submission.

So, what is the best way forward. Cut your losses and liquidate this PMS?

Poor performance, Poor Kotak PMS management team, pathetic management of Kotak PMS team. Poor product knowledge of KOTAK PMS team selling products. Poor Coordination . They even manipulate reports if you ask them to send reports to you. The reports and the balance of cash lying as per your mobile app doesn’t match. Totally misguiding.

Also KOTAK PMS team claim that they study balance sheet of companies and choose the best shares to be bought in portfolio but practically the shares bought by them are worst performers.

After 2 years, have lost more than 30 % of total principle value in last 2 years. They are very frequently buying and selling shares after booking loss in bought shares.

Just call your financial advisor before investing 🙂

Sure. We have been negative on this for exactly 2 years now.

Do not loose your money. They brought down my money from 25 lac to 12.5 lac in 3 years. May be they are purposely looting by holding debt much companies or they don’t have enough experience to manage portfolios. Mutual funds are far better than this crap. They loot most of your money through fee.

Please think twice before investing in such offers, I have an equally horrendous experience with this PMS. Only Kotak makes the propaganda that their returns are brilliant and fantastic. Had they cared for their investors, at least they would have saved the principal, but in this scheme, they eroded all your investment and still claim they have done wonders!!!

I have invested in Kotak PMS in 2018 and since then almost 32% of the principal amount. Out of 28 months so far, they have made losses in 16 months, remained neutral in 3 months and booked marginal profit in 9 months. Month over month they have booked the losses and since the date of inception, the portfolio value never reached the principal amount. This is the worst investment experience, I have faced so far. I will never advise anybody to deal with Kotak PMS in future.

I have the exact same experience as all the previous comments. Invested with Kotak PMS in 2018. Only losses so far, they have brought down the initial capital significantly, that too at a time when just investing in mutual funds yourself would fetch handsome returns. Very uptight management that talks down to the investors. Steep charges that continuously get siphoned off in the name of fees, adding insult to injury. It has been a nightmare from the time i invested in this scheme. Will never advise anyone to open their PMS with Kotak.