All prices and growth figures based on close of trading day on 18th November 2016.

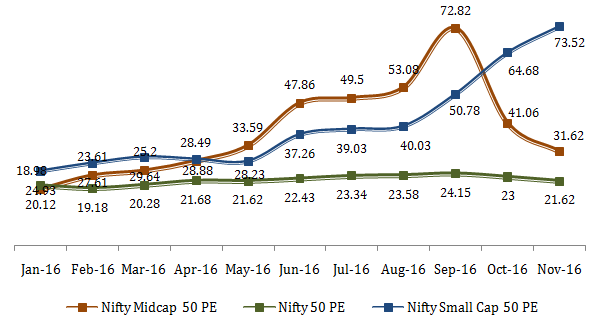

Over the past few years, mid and small cap stocks have run far ahead of their large cap peers in terms of valuations. Many mid and small cap stocks have given multi-bagger returns while large cap stocks have in comparison underperformed sharply. Though returns from mid and small cap stocks have looked impressive, increasing valuation differential between large cap stocks on one hand and mid & small cap stocks on the other should be a cause for concern for anyone still looking to get into this space. The premium at which small cap stocks currently trade over their large cap peers is at the highest level (see chart below).

Large Cap Vs Small Cap Stocks – Valuation Differential (Nifty)

Currently, Nifty is trading at 21.41 times and the Nifty Midcap 50 index is trading at 31.94 times its trailing EPS. Although the valuation gap between large and midcap stocks has narrowed, small cap stocks are trading at 72.49 times their trailing EPS, i.e., nearly four times as expensive as large cap stocks.

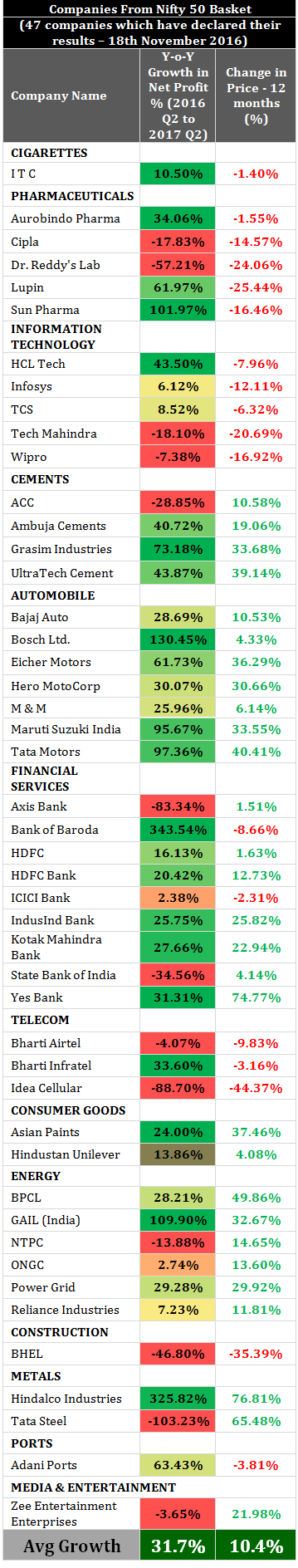

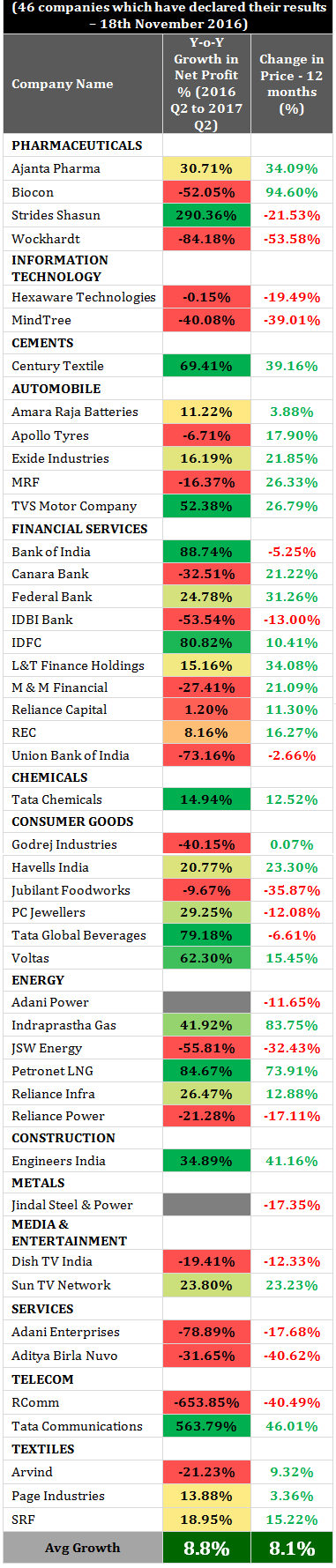

Earnings Growth and Stock Price Comparison (Q2 FY 2016 – Q2 FY 2017)

| Earnings Growth | Stock Price | PE | |

| Nifty 50 | 31.7% | 10.4% | 21.41 |

| Nifty Midcap 50 | 8.8% | 8.1% | 31.94 |

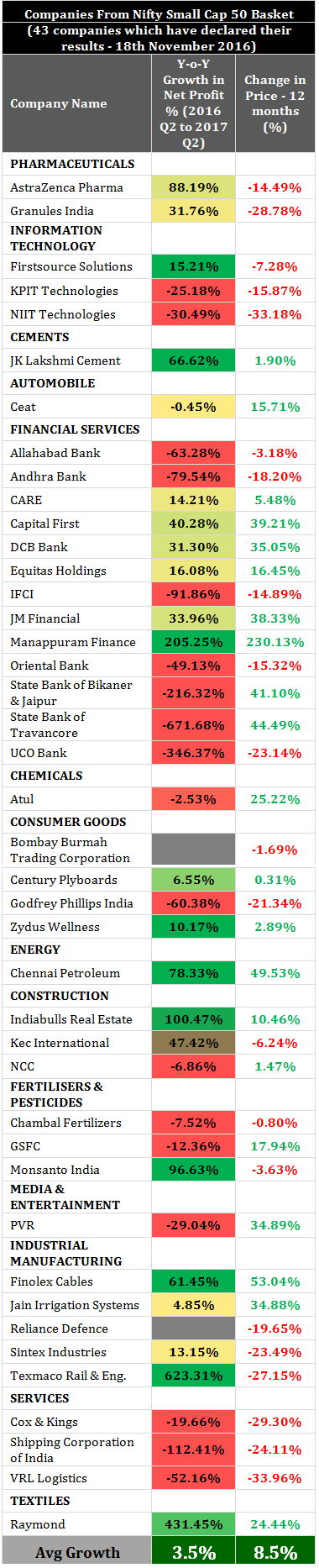

| Nifty Small cap 50 | 3.5% | 8.5% | 72.49 |

| Top 10 Nifty 50 Gainers | |

| Hindalco Industries | 76.81% |

| Yes Bank | 74.77% |

| Tata Steel | 65.48% |

| BPCL | 49.86% |

| Tata Motors | 40.41% |

| UltraTech Cement | 39.14% |

| Asian Paints | 37.46% |

| Eicher Motors | 36.29% |

| Grasim Industries Ltd. | 33.68% |

| Maruti Suzuki India | 33.55% |

| Top 10 Nifty Midcap 50 Gainers | |

| Biocon | 94.60% |

| Indraprastha Gas | 83.75% |

| Petronet LNG | 73.91% |

| Tata Communications | 46.01% |

| Engineers India | 41.16% |

| Century Textile | 39.16% |

| Ajanta Pharma | 34.09% |

| L&T Finance Holdings | 34.08% |

| Federal Bank | 31.26% |

| TVS Motor Company | 26.79% |

| Top 10 Nifty Small cap 50 Gainers | |

| Manappuram Finance | 230.13% |

| Finolex Cables | 53.04% |

| Chennai Petroleum Corporation | 49.53% |

| State Bank of Travancore | 44.49% |

| State Bank of Bikaner & Jaipur | 41.10% |

| Capital First | 39.21% |

| JM Financial | 38.33% |

| DCB Bank | 35.05% |

| PVR | 34.89% |

| Jain Irrigation Systems | 34.88% |

For the last few years, mid and small cap valuations have far exceeded the large-cap valuations. But fundamentals are yet to catch up with the market, especially in the case of small cap stocks. There are many companies in the mid and small cap basket which are repeatedly reporting losses like Adani Power, Jindal Steel, Reliance Defence.

Keep in Mind that unless the mid and small cap companies show very strong earnings growth to justify their valuations, they are clearly in bubble territory.

“VALUATION GAP BETWEEN LARGE CAP AND MIDCAP INDICES REMAIN HIGH, MAKING LARGE CAPS ATTRACTIVE FROM A RISK-REWARD PERSPECTIVE.”

Due to the increased valuation differential, investors should (in general) look to position themselves in large cap stocks than in midcaps. More importantly, there are many stocks in the large cap space which are comparatively better valued than their mid/ small cap peers.

Data in the table below compares the earnings growth of the constituent companies of the CNX Nifty 50 Companies with the growth in their stock prices.

Data in the table below compares the earnings growth of the constituent companies of the Nifty Mid Cap 50 Companies with the growth in their stock prices.

Data in the table below compares the earnings growth of the constituent companies of the Nifty Small Cap 50 Companies with the growth in their stock prices.

As usual succinct and super useful