I think it is extraordinary that I meet so many people who are absolutely, and 100% convinced that they cannot understand finance or how to invest in the Indian stock market. Their reason oftentimes is that it is extremely dry, or it will be too difficult for them to understand. I am not sure how many of them make any effort at all.

Those who have not obtained any formal education in finance (kind of like me!), but want to learn about stock market basics and become independent investors face yet another difficulty–How much should they learn?

First– finance, the amount you need to learn to be an extremely successful investor, is neither dry nor difficult.

Second-the list of topics presented below, if understood correctly, will be more than sufficient knowledge for anyone who wants to be a successful investor.

Of course, going through this material (and even learning it) will be easy, what is difficult is to practice it and actually do some research on your own. Neither I, nor anyone else can do that for you.

Nevertheless, once you understand the basics of how broader economy impacts the Indian stocks market (Read – economic cycles) and how your psychology plays a role in investing (Read – What do you need to be a successful stock investor), you should be ready to start analyzing stocks yourself.

Keep in mind that using fundamental analysis as your basis for investing could be frustrating in the short term as stock prices are mostly unpredictable in the short term. However, in the long term, fundamental analysis has time and again proved to be the safest and the most successful approach to investing.

Watch this video lesson to understand the basics of fundamental analysis (for subscribed members).

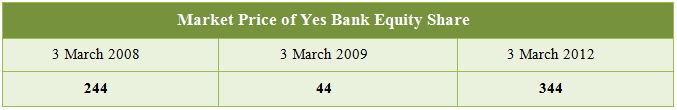

The below rather dramatic and volatile price movement of this stock is a case in point:

In hindsight it sure is exciting to look at these prices and talk about them. When did you buy? When did you sell? How does one know when it’s the right time to buy/sell?

The other approach (i.e. fundamental analysis) is to check if the business is reasonably valued, expected to improve earnings in future, and is run by efficient and competent people. If you answer yes to all, just buy and forget for a few years.

If you are someone who wants to follow the latter approach, then the material presented below will prove to be extremely beneficial in helping you learn about stock market basics. Approach it like a systematic well organized ‘to do list’:

| Have you studied the business? | Do you understand the business i.e. what does the company do? Make a one page profile of the company asking questions presented on this page — Create Company Profile |

| Have you studied those who are responsible for running the business? | This is perhaps the most important aspect of any corporate research and perhaps also the one which is frequently ignored. Before going any further, try to get an answer to such questions as:

“On this page you will find video lessons on things to check about the management before investing — Role of Corporate Governance (for subscribed members). |

FINANCIAL ANALYSIS

| Ratio Analysis | Key Ratios: Operating and Net Profit Margin Ratios measure in percentage terms, the profit being generated for each rupee of sales which the company makes. Operating Profit Margin measures the return being generated by the business purely from its operations while the Net Profit Margin indicates what is left for the owners (i.e. shareholder) after accounting for all other costs associated with conducting the business, such as depreciation, taxes etc. “>Video Link — Operating Profit Margin Ratio | Net Profit Margin Ratio Return on Capital Employed (ROCE) and Return on Equity (ROE) or Return on Net Worth (RONW) is used to measure the profitability of a company based on the funds with which the company conducts its business. While each ratio is a metric to measure returns, ROCE measures the overall return and ROE measures the return attributable only to the shareholders. Video Link — Return on Capital Employed | Return on Equity Ratio Video Link — Current Ratio Long Term Debt to Equity Ratio indicates the extent to which a company relies on external debt financing to meet its capital requirements. If a company can employ more debt and generate higher earnings than the amount needed to service the debt (i.e. interest charges), it improves the return to the shareholders as more earnings become available for distribution after payment of interest charges. Video Link — Long Term Debt Equity Ratio Interest Coverage Ratio measures a company’s operating profit (i.e. earnings before other income, interest, tax, depreciation and amortization) relative to the amount of interest charges which the company pays. It indicates the extent to which earnings are available to meet the interest expenses. A Higher Interest Coverage Ratio indicates that the company Video Link– Interest Cover Ratio |

Must Read – Key Things to keep in Mind when conducting Ratio Analysis – Ratio Analysis of financial statements

| Valuations | Price/ Book Value Ratio (P/B ratio) is used to compare the market price of the share to its book value and is calculated by dividing the Market Price per share by Book Value per share. P/B ratio usually works well only for companies which have large assets on their books such as, infrastructure and real estate companies, or companies in other manufacturing sectors–steel, automobiles etc.

Video Link — Intrinsic Value of Share Price Earnings Ratio (P/E Ratio) is the most commonly used method of valuing companies. It is arrived at by dividing the current market price of the equity share by its EPS. PE Ratio can be calculated by dividing the current share price by the trailing 12 months EPS i.e. reported EPS of the last 4 quarters. A high P/E ratio indicates that the investors are expecting the earnings (and accordingly the price of the company’s shares) to grow at a faster rate and vice versa. Video Link — Price to Earnings Ratio Discounted Cash flow (“DCF”) Analysis is a widely used model for determining the fairness of stock prices. The goal is to estimate the amounts and dates of expected cash receipts which the company is likely to generate in future and then arriving at the present value of (the sumof) all future cash flows using an appropriate discount rate. Video Link — DCF Analysis |