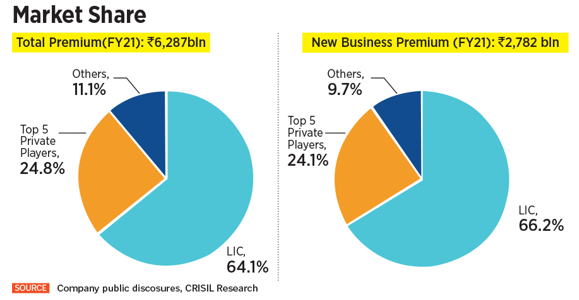

Life Insurance Corporation of India Limited (“LIC” or the “Company”) has been providing life insurance in India for more than 65 years and is the largest life insurer in India, with a 64.1% market share in terms of premiums.

The Company is the largest asset manager in India as at September 30, 2021, with AUM (comprising policyholders’ investment, shareholders’ investment and assets held to cover linked liabilities) of Rs. 39,55,892 Cr., which was:

(i) more than 3.3 times the total AUM of all private life insurers in India, (ii) approximately 16.2 times more than the AUM of the second-largest player in the Indian life insurance industry in terms of AUM, (iii) more than 1.1 times the entire Indian mutual fund industry’s AUM and (iv) 18.5% of India’s annualised GDP for Fiscal 2022.

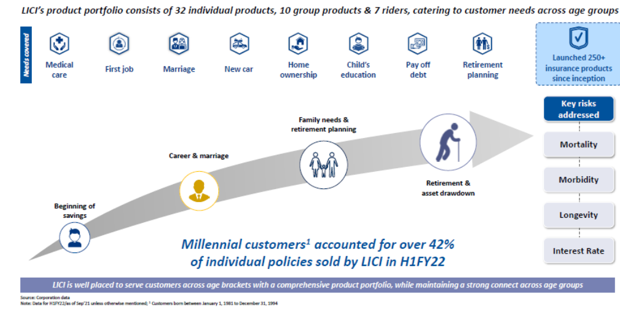

The Company has a broad, diversified product portfolio covering various segments across individual products and group products. Its individual products comprise (i) participating insurance products and (ii) non-participating products, which include (a) savings insurance products; (b) term insurance products; (c) health insurance products; (d) annuity and pension products; and (e) unit linked insurance products.

In addition, the Company offers riders that provide additional benefits along with the base product to cover for additional risks, such as accidental disability, death, critical illness and premium waiver on the death of the proposer. As at September 30, 2021, its individual product portfolio in India comprised 32 individual products (17 participating products and 15 non-participating products) and seven individual riders.

The Company’s top five selling individual products in India in terms of the number of new business policies sold for the six months ended September 30, 2021 were:

- LIC’s Jeevan Labh (22.32% of the total new business policies sold);

- LIC’s New Endowment Plan (18.65% of the total new business policies sold);

- LIC’s New Jeevan Anand Plan (9.05% of the total new business policies sold);

- LIC’s Aadhaar Stambh (8.77% of the total new business policies sold); and

- LIC’s Aadhaar Shila (6.86% of the total new business policies sold).

The Company’s omni-channel distribution platform for individual products currently comprises (i) individual agents, (ii) bancassurance partners, (iii) alternate channels (corporate agents, brokers and insurance marketing firms), (iv) digital sales (through a portal on its website), (v) Micro Insurance agents and (vi) Point of Sales Persons-Life Insurance scheme.

In FY 2019, FY 2020, FY 2021 and the six months ended September 30, 2021, its individual agents were responsible for sourcing 96.69%, 95.73%, 94.78% and 96.42% of its NBP for its individual products in India, respectively. It has the largest individual agent network among life insurance entities in India, comprising approximately 1.35 million individual agents as at March 31, 2021.

About the Offer

Life Insurance Corporation of India has filed the Draft Red Herring Prospectus (DRHP) with capital markets regulator SEBI. The insurer is looking to sell the Centre’s 5% equity stake in the Company via its upcoming IPO, the DRHP document showed. The Centre aims to offload a total of 31.62 Cr. equity shares to investors through the public offering of the 632.50 Cr. outstanding shares. The IPO will have a 50% reservation for Qualified Institutional Buyers (QIB), not 15% for Non-Institutional Investors (NII), and 35% reserved for retail investors.

In a major boost to its policyholders, the Company has reserved up to 10% of the offer size for this category. Further, the government, which owns 100% of LIC, plans to give a discount to the policyholders in the IPO. The government hasn’t as of now disclosed the issue size and is expected to announce in due course.

INVESTMENT RATIONALE

Largest Player in the Fast Growing and Underpenetrated Indian Life Insurance Sector

The Company is the largest life insurer in India in terms of GWP, NBP, number of individual policies issued and number of group policies issued for Fiscal 2021.For FY 2021, the Company issued approximately 21 million individual policies in India, representing approximately 75% market share in new individual policy issuances. For FY 2021, the Company’s market share in the Indian life insurance industry was 66.2% based on NBP.

The Indian life insurance market is the 10th largest life insurance market in the world and the fifth largest in Asia in terms of life insurance premium. Indicators such as insurance penetration, insurance density and protection gap point to the fact that the Indian life insurance market is still underinsured thereby presenting a huge potential for growth. The combination of (i) high GDP growth (expected to grow by 9.5% in 2022 and more than 6% until 2025); (ii) India being the third largest economy in the world in terms of purchasing power parity; (iii) an estimated increase of households in India in middle income category from 41 million in Fiscal 2012 to 181 million in Fiscal 2030, translating into a CAGR of 9% over this time period; (iv) rapid urbanization, in which the urban population is expected to increase from 34.9% of the total population in 2020 to 37.4% by 2025; and (v) the focus on financial inclusion and increasing preference towards financial savings with increasing financial literacy, are all key factors to propel the growth of Indian life insurance sector.

Diversified Product Portfolio

The Company has a broad, diversified product portfolio covering various segments across individual products and group products. As at September 30, 2021, its individual product portfolio in India comprised 32 individual products (17 participating products and 15 non-participating products) and seven individual optional rider benefits. As at September 30, 2021, the Company’s product portfolio in India comprised 10 group products. The Company is well placed to serve customers across age brackets with a comprehensive product portfolio, while maintaining a strong connect across age groups. Customers in the age bracket 27 to 40 years old accounted for approximately 42% of individual policies sold in Fiscal 2021. Although, its participating products dominates its portfolio, it also has a large market share in health insurance and annuity products. In health insurance provided by life insurance players, the Company had a market share in India of 46.9% and 53.6% in terms of GWP for FY2020 and FY2021, respectively.

Largest asset Manager in India with an Established Track Record of Financial Performance and Profitable Growth

LIC is the largest asset manager in India as at September 30, 2021, with AUM (comprising policyholders’ investment, shareholders’ investment and assets held to cover linked liabilities) of Rs. 39,55,892 Cr. As per the CRISIL Report, as at September 30, 2021, its investments in listed equity represented around 4% of the total market capitalisation of NSE as at that date. The Company has proven track record of strong financial performance. Its net profit on sale/redemption of policyholders’ investments (profit on sale/redemption of investments minus loss on sale/redemption of investments) (Policyholders’ Account) was Rs. 238,972.08 million, Rs. 193,874.82 million, Rs. 398,096.31 million and Rs. 232,465.30 million in Fiscal 2019, Fiscal 2020, Fiscal 2021 and the six months ended September 30, 2021 on a consolidated basis, respectively.

Harnessing Technology Capabilities

The Company has developed technological capabilities that help us provide a great customer experience and drive operating efficiencies. It has added technological capabilities across the customer journey from purchase to payments to claims processing. As at September 30, 2021, its portal had 17.58 million registered users and its mobile app for policyholders, available on both Android and iOS platforms, had 5.1 million registered users. Given its focus on and investments in information technology, it is well-positioned to capitalise on the increasing digitisation of the Indian economy. It has two apps for intermediaries to use at the pre-purchase stage:

- Sales App – this application provides intermediaries lead management, financial need analysis, quotes and illustrations, e-proposal and content management.

- LIC Quick Quotes App – this application provides intermediaries with premium quotation and benefit illustration, with a facility to compare quotes and view variations.

- The Company’s customers use of digital channels for payments to the Company has been increasing. For Fiscal 2019, Fiscal 2020, Fiscal 2021 and the six months ended September 30, 2021, payments made via digital channels represented 25.50%, 31.53%, 42.54% and 46.06% of payments by the number of individual policies with renewal premiums paid in India, respectively. The year over year growth in individual policyholders’ paying renewal premium by digital channels was 94.71% in terms of number of policies and 87.75% in terms of premium in Fiscal 2021.

INVESTMENT CONCERNS

Fall in the Policy Issuance

LIC has seen a drop in sales of its new policies. While in its DRHP, it says the Covid-19 pandemic has affected its business as most of the individual policies are sold through agents, LIC has been selling lesser policies since the start of April 2018. For example, during April 2018-March 2019, it sold 75 million new policies, which fell to 62 million during April 2019-March 2020, a drop of 17.33%. On that drop, LIC further lost in FY2021 during the pandemic and sold 52.54 million policies, fall of 15.25% on a year-on-year basis.

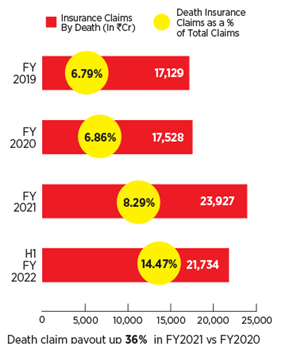

During April 2020-March 2021, LIC paid Rs. 23,927 Cr. as part of insurance claims by death, which is 36% higher than what it paid in FY2020, which was Rs. 17,528 Cr. But the impact of the second Covid-19 wave can be seen on its numbers from April-September 2021, when death claims skyrocketed to Rs. 21,734 Cr. for just the six months. Before the pandemic, death claims was around 6.8% of LIC’s entire pay-out of the portfolio, right now it is nearly 14.47% of its portfolio for just the half year, and it will be higher when full numbers are reported during the end of the year. For FY 2021 and six months ended September 30, 2021, a separate mortality reserve of Rs. 2,345 Cr. and Rs. 7,420 Cr., respectively, was provided for the Covid-19 pandemic on a consolidated basis.

Fall in Persistency Ratio and Lowest Solvency Ratio

Persistency ratio means the amount of money (premium) that an insurance company is yet to get from policy holders on their existing policy, and the ratio is measured in terms of the number of policies and premiums underwritten. When compared to its peers, LIC’s persistency numbers have been falling. Solvency ratio means if the Company has enough capital to cover its short-term and long-term commitments, in case all of its policy holders choose to withdraw, does LIC have the money to pay them all? The insurance regulator in India mandates minimum solvency ratio of 1.50, but LIC’s solvency ratio for FY2021 was 1.76 percent and in FY2020 it was 1.55 percent. When compared to its peers in India, it has lowest solvency metric.