In continuation of the article – Different Types of Life Insurance Policy Available, in this article, I am going to explain 2 more types of very lucrative life insurance saving plans.

2 Types of Life Insurance Saving Plans

- Assured Income Plan (Or Guaranteed Income Plan)

- Money Back Plan

[1] Assured Income Plan – This life insurance saving plan bundles an insurance cover and guaranteed payouts in the form of monthly income. Investors prefer to have some sort of guaranteed return in the form of monthly income and thus insurance companies are coming up with some new products to fulfill this requirement for investor.

How Does The Plan Work?

- Depending upon your age and the sum assured or insurance cover chosen, you pay an annual premium for a certain number of years.

- After the premium payment term is over, the policy starts giving a regular guaranteed payout for a certain number of years.

- At the end of the term, the policy would usually give the sum assured or a percentage of sum assured.

Example – Mr. ABC is 30 years old and opts for an Assured Income Plan.

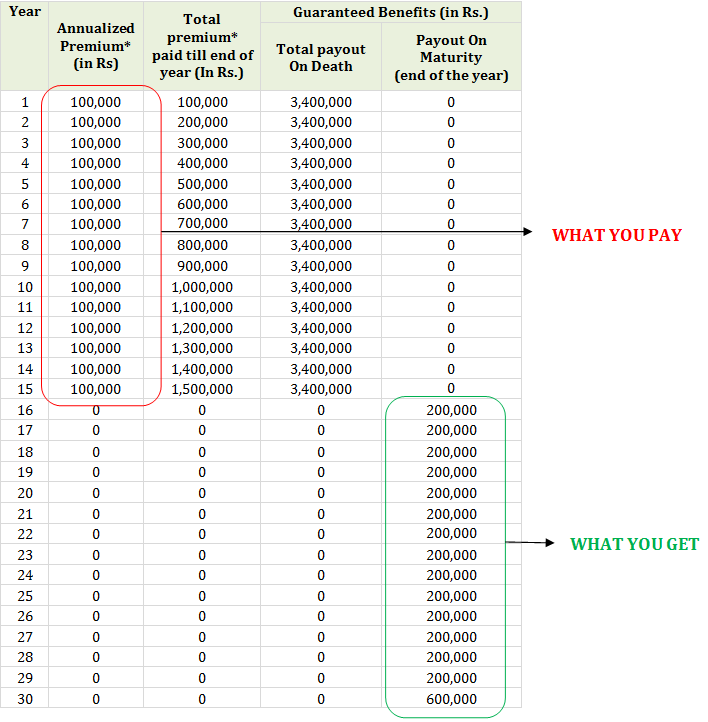

- He selects premium payment of 15 years with policy term of 30 years. (Different insurance companies have different premium terms like 5, 7, 10, 11, 15 years).

- He decides to pay Rs. 1,00,000/- as annual premium (excluding service tax) for a term of 15 years.

- In this case, his Sum Assured will be 34 times of annual premium, i.e. Rs. 34,00,000 (Sum assured terms vary with different companies and the entry age)

- He will start receiving guaranteed income benefit from 16th year which will be 2 times of annualized premium from the end of the 16th year to the end of 30th year.

- Plus, in the last year i.e., the end of the 30th year, he will enjoy an additional income which will be 4 times of annualized premium (this also varies depending upon age and the insurance company you choose).

Assured Income Plan Calculator

Illustration Table for Basic Plan:

Death Benefit

Now what happens, if Mr. ABC dies during the 4th policy year?

In such a case, his nominee will receive Rs. 2,00,000/- as the first payout when the death claim is settled and would also receive Rs. 2 lakhs as regular annual payouts, thereafter, for the next 26 years. The nominee will also receive Additional Benefits of Rs. 4,00,000/- along with the last installment. Alternatively, the nominee can choose to receive a lump sum amount of all the balance payouts minus 6.5%, i.e. an amount equal to Rs. 48.62 Lacs (Rs. 2 lacs multiplied by 26 years, minus 6.5%)

[2] Money Back Plan – Combination of insurance and savings. This Plan provides regular cash payouts at regular intervals as percentage of Sum Assured at equal intervals depending on the policy term chosen. The balance Sum Assured is paid out at maturity.

How Does The Plan Work?

- Choose the amount of insurance cover and product option you desire under this policy.

- Choose the term of your policy i.e. decide the number of years for which you wish to

- pay the premium i.e. 5/7/10 or 12 years

- At the end of the premium payment period, you will start receiving assured money backs at regular intervals.

Mr. ABC is 30 years old and opts for Money Back Plan.

- He opted for a sum assured of Rs. 5,00,000

- He chooses premium paying term of 10 years and pays Rs. 56,805 as premium.

- Regular Payouts – he chooses to receive 10% of Sum Assured every year for 9 years and 110% of Sum Assured on Maturity (Note different companies will have different payout plans).

- As per the plan, after Mr. ABC completes paying all his due premiums for 10 years;

- He will start receiving assured payout of 10% of the Sum Assured i.e. 50,000 as survival benefit for the next 9 years. (50,000*9 = 4,50,000)

- In addition, he will receive 110% of Sum Assured which is 5,50,000 on maturity date.

Death Benefit

In case of unfortunate demise during the policy term, the Death Sum Assured will be payable to your nominee.

For example, if Mr. ABC expires during the 4th policy year, his nominee will receive the Death Benefit. The Death Sum Assured shall be highest of the following:

- 10 times Annualized Premium, i.e. Rs. 56,805 *10 = Rs. 5,68,050

- 105% of total premiums paid as on date of death. i.e. 105% of (Rs. 56,805 *4) = Rs. 2,38,581

- Maturity Sum Assured which is equal to 110% of Sum Assured i.e. 110%* 5,00,000 = Rs. 5,50,000

- Absolute amount assured to be paid on death which is equal to the Sum Assured i.e. Rs. 5,00,000

In this case, the nominee will get Rs. 5,68,050 as death benefit.