What are Foreign Institutional Investors (FIIs)?

FIIs are overseas entities registered in India and allowed to invest in the Indian stock markets. FII money forms a big part of the overall pie of investment in Indian stocks.

FII money is often termed as ‘hot money’ as FIIs buy/sell a large number of shares in Indian markets on a daily basis. A single FII (i.e. on an individual basis) can hold up to 10% of the paid up capital of a company.

Also read: Economic Indicators

Foreign Portfolio Investors Regulations, 2014

Maximum allowable FII Holding Limits

A few days back a friend of mine asked me – what’s the maximum that FIIs can hold in the Indian stock markets?

Different threshold limits apply for different industry sectors with respect to FII holding in stocks belonging to that sector. Take the example of the BSE Sensex which constitutes of 30 companies. Since BSE Sensex stocks belong to different sectors, the maximum allowable FII holding will be calculated as an aggregate of the maximum allowable FII holding in each company.

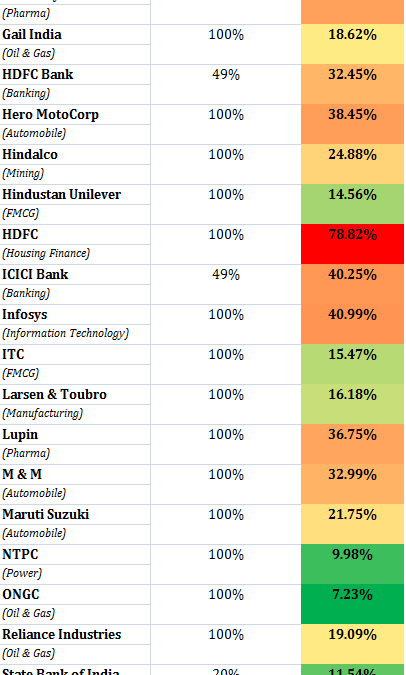

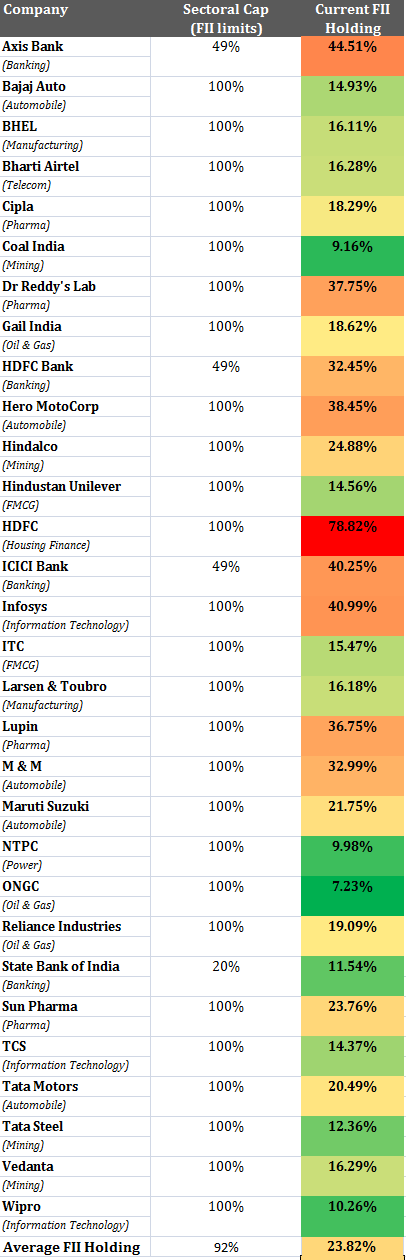

FII Holding BSE Sensex Stocks for Quarter Ended June 2015

The maximum which FIIs can hold in a company depends upon how much the company allows them to hold.

Explanation

Companies can increase the limit for FII holding by a board resolution up to the sectoral cap (mentioned above) allowed in that particular sector.

In reality however, many companies have not passed a resolution to allow FIIs to hold more than 24% limit which is what is allowed in all sectors other than (i) atomic energy; (ii) lottery business; (iii) gambling and betting; (iv) business of chit fund; and (v) Nidhi companies.

Note: The table above compares the maximum allowable FII limits (notified by the government) to the actual current FII holdings. The actual limit to which an FII can invest in a particular company will vary based on how much FII limit has that particular company approved. For example, while TCS has not yet approved FII holding above 24%, Infosys board has approved FII holding up to 100% (i.e. the maximum allowable FII holding in the information technology sector).

Technically, FII holding in BSE Sensex stocks could reach 92%. That will happen in case all companies approve maximum allowable FII limit for their company (and promoters sell all their holding to FIIs, and further, if FIIs for some reason decide to buy all of it). In reality, this is unlikely to happen for obvious reasons.

Between 2005 and 2015, FII holding in BSE Sensex stocks ranged between 20-30%.

Promoters, domestic institutions and retail investors are the other main categories of investors in Indian stock markets. Note that in addition to FIIs, there could be other categories of foreign capital investments in the company such as FDI and NRI investments.

Where to Check FII Buying / Selling Activity

A handy link to check daily / monthly FII and DII trading activity: FII | DII Trading Activity Details