When to use: Long Call Ladder Option Strategy is used when the investor is moderately bullish on the stock and expects less volatility. This strategy is an extension of the Bull Call Spread Strategy. In this case, the investor sells an additional call option.

How it works: In a long call ladder option strategy you buy 1 in-the-money call option; sell 1 at-the-money call option and sell 1 out-of-the-money call option of the same underlying stock with the same expiry date. You believe that the market will be bullish until expiry.

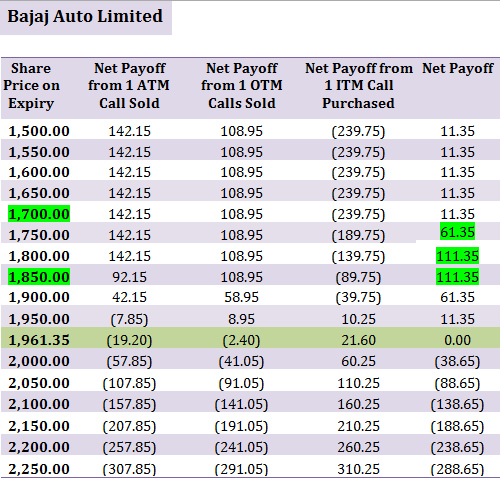

For example: On 3rd September 2013, the share of Bajaj Auto Limited was trading at Rs. 1,800, you decide to buy an in-the-money call options with a strike price of Rs. 1,700 at a premium of Rs. 239.75. At the same time you sell an at-the-money call option with a strike price of Rs. 1800 at a premium of Rs. 142.15 and an out-of-the-money call option with a strike price of Rs. 1,850 at a premium of Rs. 108.95, all expiring on 26th September 2013.

Risk/Reward: In the long call ladder option strategy, your maximum risk will be unlimited and you will start incurring losses when the underlying stock falls below the breakeven point (i.e. Rs. 1,961.35 calculated as: Sum of the strike prices of the two short calls – strike price of the long call + net premium received). The maximum reward/profit which you will make from this trade is limited.

In our example above, the investor will make the maximum profit once the price of the underlying stock is between Rs. 1,800 (i.e. the ATM short call strike price) and Rs. 1,850 (i.e. the OTM short call strike price).

For the long call option: If the price of Bajaj Auto stock rises above Rs. 1,700 (i.e. the strike prices for the long call option), you can exercise your long call option, but the price of the stock must rise above Rs. 1,939.75 (i.e. the strike price of the long call option + the amount of premium you paid for the long call option) for you to exercise your option and make a profit.

For the short call options: If the price of the share stays below Rs. 1,800 and/or Rs. 1,850 (i.e. the strike price of the 2 short call options) until expiry, you will retain partial or the entire premium amount (depending upon where the price of the share settles). If however the price rises above Rs. 1,800 and/or Rs. 1,850, the buyer of the call option may exercise his option and make a profit based on how far above does the stock price rises.

The table below clarifies the net payoff of the long call ladder option strategy at different spot prices on expiry:

How to use the Long Call Ladder Option Strategy Excel calculator

Just enter your expected spot price on expiry, option strike price and the amount of premium, to estimate your net pay-off from the Strategy.

Note: The example and calculations are based assuming a single share though in reality options are based on lots of many shares. For example Bajaj Auto’s call option contract is for 125 shares. Accordingly the net premium received will be Rs. 1,418.75 for 3 lots (i.e. 11.35*125) in our example.

Also Note: Unlike the buyer of an option who only pays the premium to buy the option, the seller of an option must deposit a margin amount with the exchange. This is because he takes an unlimited risk as the stock price may rise to any level. In case the price rises sharply above the strike price, the exchange utilises the margin amount to make good the profit which the option buyer makes. The amount of margin is decided by the exchange and it typically ranges from 15 % to 60 % based on the volatility in the underlying stock and market conditions. In the above example, as a seller of call option, you will have to deposit a margin of Rs. 57,031.25 (i.e. Strike price * Lot size * 12.50%) for selling/writing 2 lots of Bajaj Auto’s call option. Note that the total value of your outstanding position in this case will be Rs. 4,56,250 (i.e. strike price * lot size).

Very useful for investors, I go through it and also suggest this post to my friends.

pl give option strategy adjustments