The most basic and commonly implemented option strategy is the Long Call Option Strategy.

When to use: When you are Bullish and anticipate the stock / index to rise.

How it works: Suppose, you are bullish on Tata Motors stock on 16th August 2013, when the share trades at Rs. 319. You buy a call option at a premium of Rs. 18, expiring 26th September 2013 with a Strike Price of Rs. 320.

Risk / Reward: If the price of Tata Motors stock rises above Rs. 320 (i.e. the strike price), you can exercise your option, but the price of the stock must rise above Rs. 337 (i.e. the strike price + the amount of premium you paid) for you to exercise your option and make a profit. In other words, your break even or the price above which you will make any profit in this scenario will be Rs. 337 (i.e. Strike Price + Option Premium).

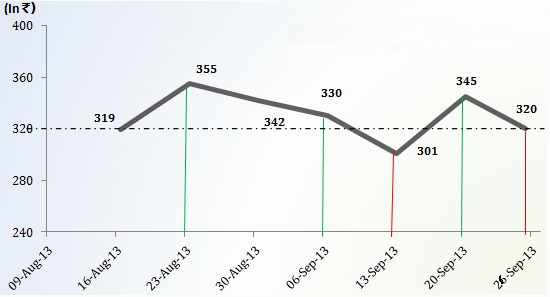

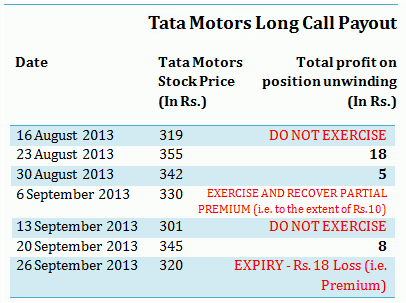

If however, the stock price does not go above Rs. 320 until the date of the expiry, you will not be able to exercise the option and the option will lapse worthless in which case you will lose the option premium of Rs. 18. The Chart illustrates your payout assuming that you unwind your position on these dates and prices:

* Position unwinding in the table above refers to “Exercising the Option” and not “squaring off” – Look Below.

Accordingly, your risk is limited to the option premium of Rs. 18 (i.e. Rs. 18 is the maximum loss you can suffer on this contract). Your reward is unlimited and will depend on how much the price rises above Rs.337 at the time you unwind your position.

Note: The example and calculations are based assuming a single share though in reality options are based on lots of many shares. For example Tata Motors call option contract is for 1000 shares. Accordingly the premium will be Rs. 18,000 for a single lot (i.e. 18 *1000).

In Practice: In practice, traders do not wait until expiry to unwind their position. You (can) square off your position before the expiry of the contract. This is done by selling the same number of call options which you purchased of the same underlying stock and same expiry date. So for example if you purchase 1 call option contract of Tata Motors (lot size 1000 shares) at a strike price of Rs. 320 @ a premium of Rs. 20 (i.e. Rs. 20,000 for the whole contract) expiring 26th September 2013; you can square off your position by selling the same call option contract (i.e. strike price Rs. 320, expiring 26th September 2013). The difference between the premium at which you bought the Options and the premium at which you sold it, will be your profit or loss.

In addition to squaring off, you can also exercise your Option on or before the expiration date, in which case your profit/loss will be calculated based on the difference between the closing market price on the day you exercise the Option and the strike price. If you do nothing until expiry, your position will be settled by the stock exchange on expiry.

How to use the Long Call Option Strategy Excel calculator

Just enter your expected spot price on expiry, option strike price and the amount of premium, to estimate your net pay-off from the Long Call Option Strategy.

SIR I WANT TO LEARN OPTION

Sorry Anveera – I no longer do lectures…:-)

Sir,

In the above example, you have said you can exercise the option OR square it off. Can we square off the option? I suppose in India we are working with European options which can be exercised only at the expiry.

So I think we can not exercise this option during the term of the contract.

Am I right or I am wrong somewhere?

Please elaborate.

You will be squaring off the option whether its during the term or at expiry, that’s how the system will work.

Dear Rajat Sharmaji,

You are excellent. You have made it in thesimple language understood by small retailer also.

Thanks.

Yours truly,

Anantray R Trivedi

Retired Senior A.O.

Ahmedabad 380004

Thank you Sir.

Sir, Can you please explain how trading account will be accounted from the date of buying to the date square off? Only to the extant of premium, limit is blocked or full value of security? Whether daily up and downs(profit or loss) will be reflected in our account?

I have been watching and reading but always got into more confusion It was so confusing to distinguish the difference between the various options . But after reading this I’m able to do real time calculation with a pen and paper in hand. I guess now I’m completely clear about the concept and calculations. Now i will try working out virtually. Ones i get a hang on the various strategies i will start doing these investments. Thank you making it understandable.

If current price is 319 and strike price is 320 and premium is 18 rs.stock price must rise above strike price of rs 18 i.e 338 to book profit,but you have mentioned 337 can i know how?