When to use: Long Straddle Option Strategy is useful for investors who believe that the stock will be very volatile (i.e. move a lot in price) but are uncertain about the direction of the move. For example, suppose you believe an important court case that will make or break a company is about to be settled, and the market is not yet aware of the situation. You believe that the stock will either double in value if the case is settled favorably, or will drop by half if the settlement goes against the company. The long straddle strategy will do well for you in such a situation, regardless of the outcome.

Long straddle option is a bet on volatility. An investor who implements the long straddle option strategy must view the stock as more volatile than the market does.

How it works: In the long straddle option strategy you buy both a call option and a put option of the same underlying stock, each with the same strike price X, and the same expiration date, T.

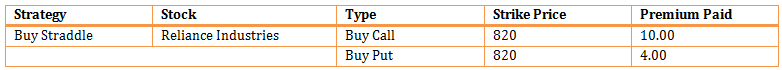

For example: On 16th August 2013, when the share of Reliance Industries was trading at Rs. 780.00, you decided to buy a call option at a premium of Rs. 10.00 and a put option at a premium of Rs. 4.00, expiring 26th September 2013 with a strike price of Rs. 820.00.

Risk/Reward: In long straddle option, the maximum risk is limited to the option premium paid on – both the call option and the put option while the reward/profit is unlimited.

For Call Option – If the price of Reliance share rises above Rs. 820.00 (i.e. the strike price of the call option), you can exercise your option, but the price of the stock must rise above Rs. 830.00 (i.e. strike price + the amount of premium) for you to exercise your option and make a profit.

For Put Option – If the price of the share falls below Rs. 820.00 (i.e. the strike price of the put option), you can exercise your option, but the price of the stock must fall below Rs. 816.00 (i.e. the strike price minus the premium), for you to exercise your option and make a profit.

Breakeven Points:

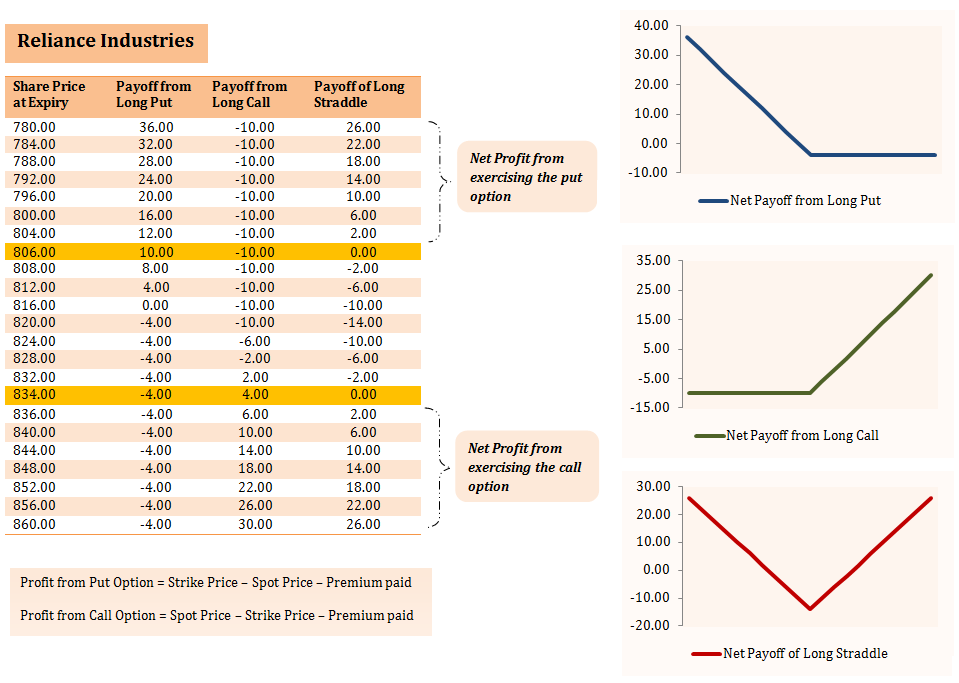

Upper Breakeven = Strike price + net premium paid = Rs. 834.00 (820 + 14)

Lower Breakeven = Strike price – net premium paid = Rs. 806.00 (820 – 14)

The table below show the net payoff of long straddle option strategy at different spot prices upon expiry:

(click to enlarge)

How to use the Long Straddle Option Excel calculator

Just enter your expected spot price on expiry, option strike price and the amount of premium, to estimate your net pay-off from the long straddle option Strategy.

Note: The example and calculations are based assuming a single share though in reality options are based on lots of many shares. For example Reliance option contract is for 250 shares. Accordingly the premium you pay will be Rs. 3,500 for 2 lots (i.e. 10.00*250 + 4.00*250) in our example.

Would ATM strike price be appropriate while implementing long straddle strategy ? Thanks!!!

Yes.

Very nice article. I certainly appreciate this topic.