When to use: Long Strangle Option Strategy is used when the investors believe that the stock will experience very high volatility but uncertain about the direction of its movement.

How it works: In the long strangle option strategy you buy an out-of-the-money call option and an out-of-the-money put option of the same stock with the same expiration date, T.

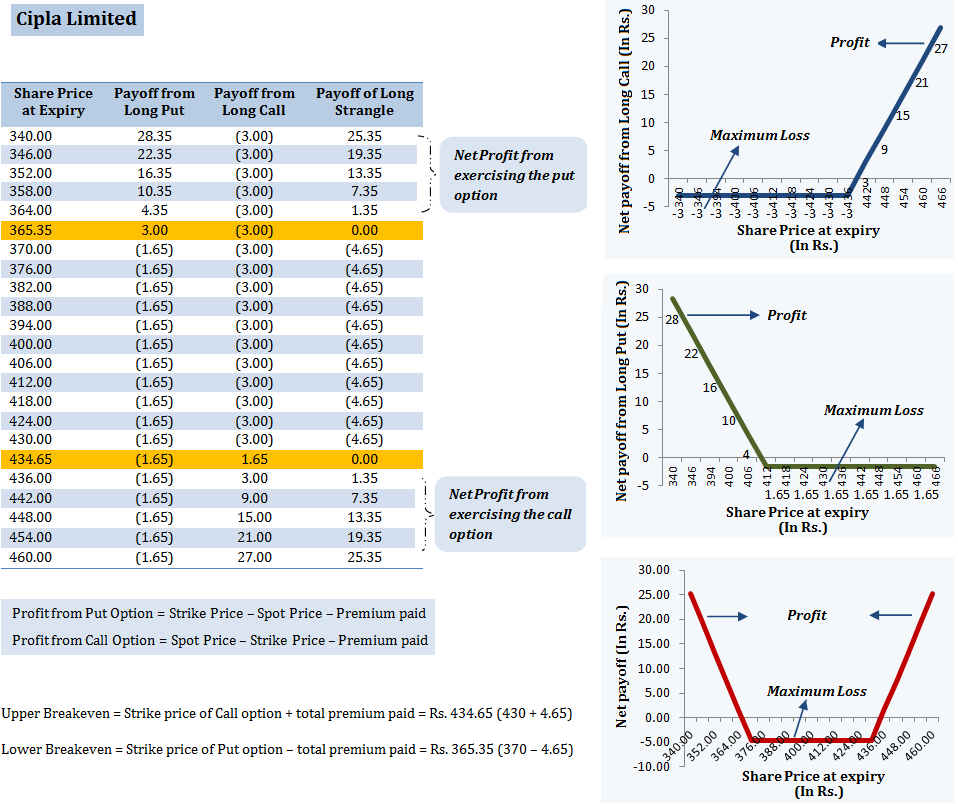

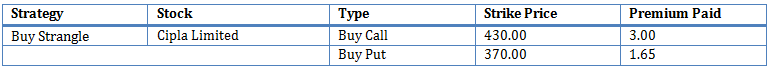

For example: On 16th August 2013, when the share of Cipla Limited was trading at Rs. 414.30, you decided to buy an out-of-the-money call option at a premium of Rs. 3.00 with a strike price of Rs. 430.00 and an out-of-the-money put option at a premium of Rs. 1.65 with a strike price of Rs. 370.00, expiring 26th September 2013.

(click to enlarge)

For Call Option: If the price of Cipla Limited rises above Rs. 430.00 (i.e. the strike price), you can exercise your option, but the price of the stock must rise above Rs. 433.00 (i.e. the strike price + the amount of premium you paid) for you to exercise your option and make a profit.

For Put Option: If the price of the share falls below Rs. 370.00 (i.e. the strike price of put option), you can exercise your option, but the price of the stock must fall below Rs. 368.35 (i.e. the strike price minus the premium), for you to exercise your option and make a profit.

Thus, in order for this trade to realise profit at expiry, the stock must be above Rs. 434.65 or below Rs. 365.35. The table below show the net payoff of long strangle at different spot prices on expiry:

(click to enlarge)

The table above allow you to easily see the break-even points, maximum profit and the loss potential on expiry in rupee terms.

The two break-even points occur when the price of the underlying share equals Rs. 434.65 and Rs. 365.35.

The profit can be made if the share price upon expiry must be above Rs. 434.65 or below Rs. 365.35 and the maximum loss which the investor may suffer is equal to the total premium paid on both the options i.e. Rs. 4.65.

How to use the Long Strangle Option Strategy Excel calculator

Just enter your expected spot price on expiry, option strike price and the amount of premium, to estimate your net pay-off from the Long Strangle Option Strategy.

Note: The example and calculations are based assuming a single share though in reality options are based on lots of many shares. For example Cipla option contract is for 1000 shares. Accordingly the premium you pay will be Rs. 4,650 for 2 lots (i.e. 3.00 *1000 + 1.65*1000) in our example.