On 1st of February 2018, in his budget speech, The Finance Minister introduced Long Term Capital Gain (LTCG) Tax at the rate of 10% on stock investments and investments in equity oriented mutual funds.

For starters, I dont think the markets are falling because of this. No doubt this has had an impact but to say that markets will keep falling until 31 March as investors will try to book capital gains is completely wrong.

If at all, those who invested in stocks (or equity mutual funds) prior to 31 January should actually be the last ones to sell what they are holding because of the Grandfathering clause.

What is Grandfathering?

I have been approached by no less than relationship managers at banks with confusion on this seemingly easy concept.

The acquisition cost of an asset for the purpose of computing capital gains will be higher of (i) actual purchase price or (ii) maximum traded price on Jan 31 2018

To explain this with a simple example:

Rajat purchased 1000 mutual fund units at NAV of Rs. 30 on February 24th, 2017 for a total consideration price of Rs. 30,000. On January 31, 2018, the NAV of each unit was Rs. 42. On April 21st 2018, Rajat sold all his mutual fund units at NAV of Rs. 40. For the purpose of calculating capital gains:

Rajat’s purchase price = Rs. 42 (being higher of his actual purchase price and the price prevailing on 31 January 2018)

Rajat’s sale price = Rs. 40.

Rajat sold at a loss of Rs. 2 per unit and will pay no capital gains. While technically there is a loss on this transaction, for the purpose of computing capital gains; if the difference between purchase price and sale price is negative, capital gain will be considered NIL (and not as capital loss).

So while the LTCG of 10% becomes effective from 1 April 2018, those who acquired stocks or mutual funds prior to 31 January 2018 will get the benefit of choosing the higher price when calculating their capital gains in later years.

Market View: I do not find any merit in the argument that stock market fall was triggered by those who sold to book capital gains on the view that they may not get higher prices before 31 March 2018. Actually, they need not. There purchase price will be as it prevailed on 31 January 2018, even if they purchased their holdings in the year 1985, or at anytime prior to 31 January 2018.

The sharp correction may well have something to do with the confusion around how grandfathering will work. Think about how different people might want to work around their taxes? The possibilities are endless. You can always call me for brainstorming on this.

What Should Investors Do Now?

The other day I was telling a client that in a recent study at a large bank it was found that maximum money in percentage terms was made in portfolios of clients who had died. Why? Because they stopped timing the market.

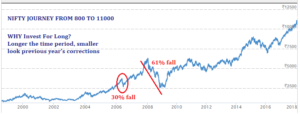

This is something I have written many times before – don’t try to time the market and invest regularly. Having said that, this policy will work best for people who can invest at all levels of the market. These days, there are stories apleanty of investors who sold their stocks when markets hit 8,000 – 9,000 – 10,000 – 11,000, because markets looked overvalued. Even if markets fall another 10%, many of these investors would have missed out.

Today’s 10-15% corrections look no more than a tiny blip on the long term chart of a stock or the overall market. Case in point – This 20 year chart of Nifty:

Investing right is more important than timing the market. If you find the right stocks and sectors to invest in, then it is futile to worry about short term market movements. With right selection, even in shorter terms (2-5 years) you are more likely to do well in stocks than in any other asset class even if the market crashes by an average 15-20% sometime in between. Of course,

Hi Rajat,

Thanks for this sensible article and the explanation about grandfathering.

“Don’t try to time the market and invest regularly.” Great advice, which we need to keep in mind irrespective of whether the market is rising or falling or crashing. 🙂

You are welcome my friend Rohi.

A slight correction in your illustration for “Grandfathering clause”..

In your eg: case as per illustration in CBDT you cannot book capital loss but NIL capital gains.

i.e this grandfathering aims to minimise the capital gains for all those who invested before Jan31 2018 as much as possible so that only gains post market price Jan31 will be considered for 10% tax on it.

Prior Jan31 2018(actual cost)-30

At Jan31 2018(Fair price) – 42

Sale price – 40

Here purchase price or cost price should be taken as 40 only and so net capital gain/loss is 40-40 = NIL.

Having said above,it also attempts to minimise booking capital loss as well.

thanks for your post.

Yes. You are absolutely right. I hope not everyone is reading it that way, I should re-do the wording because now it does look like im suggesting taking a loss on that,….

As you said, that would be NIL indeed; though capital loss on other transactions can be set off. Thanks for that.