UPDATE: STOCK SPLIT 1:5 – 8 Marh 2024

If you have eaten a Ferrero Rocher chocolate or used the Mango Body Butter from The Body Shop, chances are you have consumed butter made at a factory in Raipur, Chhattisgarh, owned by Manorama Industries.

ABOUT THE COMPANY

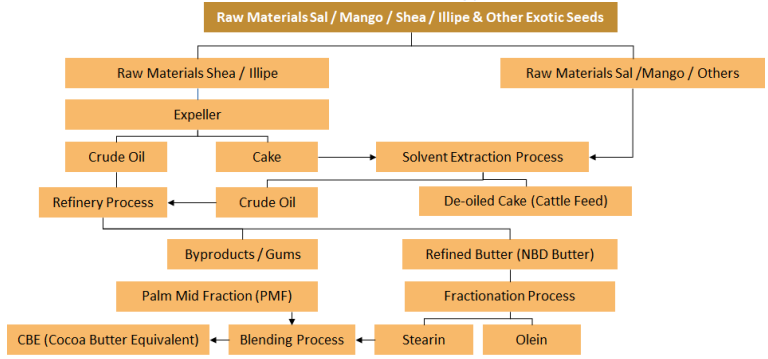

- Manorama Industries Ltd. (Manorama) is a leading global producer of specialty fats and butter from tree-borne and plant-based seeds.

- It is a major producer of cocoa butter equivalent (CBE) extracted from Sal seeds, Mango kernels, Shea nuts, Kokum kernels, and other naturally procured raw materials collected by the forest tribal community (~18,000 collection centers operated across India by Manorama).

- The company operates on a unique business model of converting waste to wealth by collecting seeds from the forest bed as raw material from the tribal community and by converting these seeds into products used in premium chocolates, confectionary and cosmetic products.

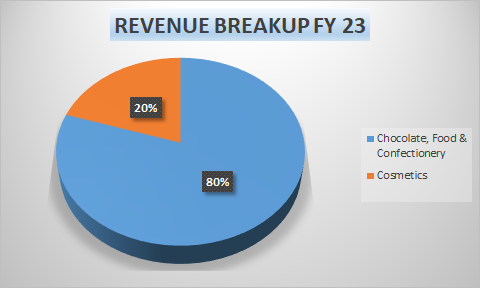

- Chocolate, Food & Confectionery

- Cosmetics

Approximately, 80% of revenues for Manorama Industries are derived from the chocolate industry and the remaining 20% from cosmetic and other industries. Out of total revenue of Rs 351 Crore for FY23

- Chocolate, Food & Confectionery – Rs 281 Crore

- Cosmetics – Rs 70 Crore

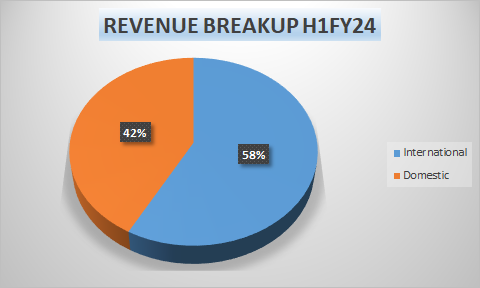

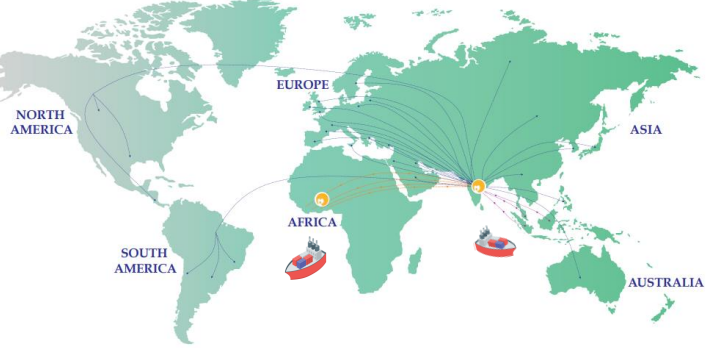

Geographical Breakup

Geographical Footprint

Manorama Industries is a global player catering to most of the world’s markets providing customized solutions for the application of specialty fats and butter. The company exports to various countries globally and sources various seeds and nuts from West African countries

Manorama Industries – Client Book

The company has a long list of marquee clients such as Ferrero Rocher, Mondelez, and Barry Callebaut in the chocolate and confectionary space, and The Body Shop, Lush, and L’Oréal in the cosmetics segment.

Manorama Industries recently entered into a supply agreement with The Body Shop for supply of mango butter.

Brownfield expansion to boost sales and profitability

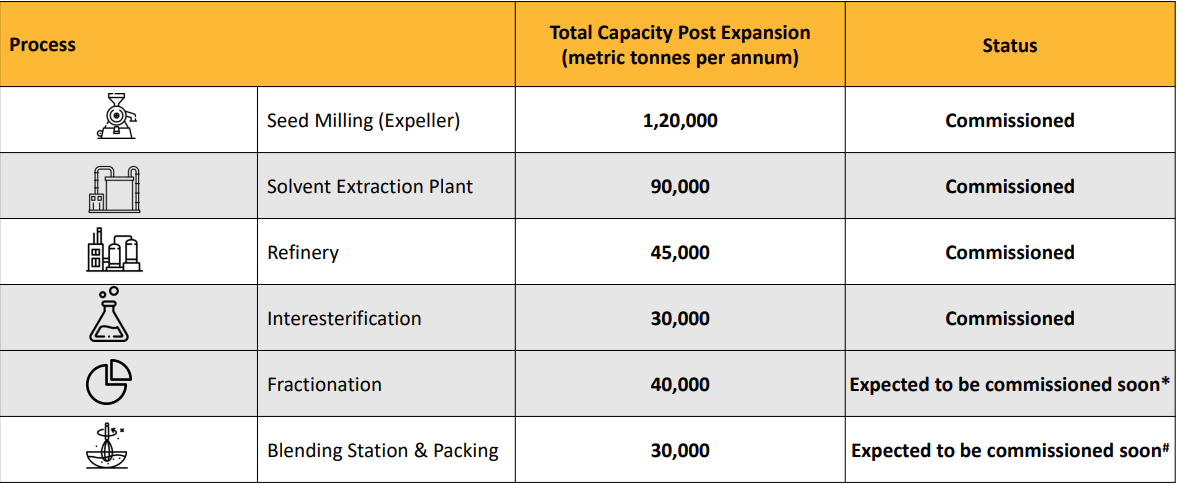

- To meet the huge surge in specialty tailor-made fats and CBE demand, the company has set up an integrated state of the art manufacturing plant at Birkoni, near Raipur, Chhattisgarh. This includes all processes viz Crushing, Extraction, Refining, Fractionation etc.(Explained Below)

- The commissioning of additional 30,000 tonnes of Refinery and 25,000 Fractionation plant will make Manorama a leading Indian manufacturer in the global CBE and specialty butter & fats market and will enable the Company to further ramp up its output for the global demand supply gap.

- The Company has a distinct sourcing advantage due to its strategic location in the heart of India’s forest-region and its strong relationship and network with the local tribal communities, who are well-versed with the forest topography

- Upcoming Raipur Visakhapatnam Expressway will reduce the current transportation & logistics time subsequently to just 6-7 Hours and this will ultimately save the fuel & freight cost.

Capacity Expansion

- Manorama Industries was operating at a fractionation and refinery capacity of 15,000 MT, which is running at 65-70% utilisations after COVID-related disruptions. To further enhance the manufacturing capability, Manorama announced a capex plan.

- The cost of this capex was originally envisaged to be Rs. 65 Crore. As of 30th September 2023, the company has incurred Rs.114 Crore towards this Capital Expansion. This cost increase was largely due to the addition of certain enhanced equipment and technologies along with the setting up of an additional 5,000 tonnes of refinery capacity, powerhouse, Boiler, and Factory Infrastructure in the plant.

-

Full utilization of the new brownfield expansion would lead to an increase in sales assuming similar asset turnover. Moreover, considering the current expansion is a brownfield, operating leverage should kick–in and lead to further improvement in EBITDA margins.

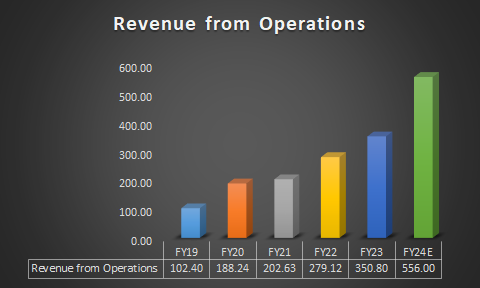

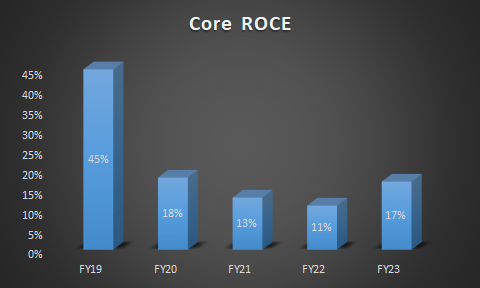

Financial Analysis & Projections

(In Rs. Crores)

- Sales are expected to inch higher on full utilization of existing capacity and with additional capex in place to increase the capacity.

- With current capex of Rs. 114 Crore of which Rs. 65 Crore is used for the capacity expansion and assuming previous turnover of ~3.15. We estimate the incremental revenue to be Rs. 205 Crore. Projected revenue for FY24~ 350.80+205 = 556 cr

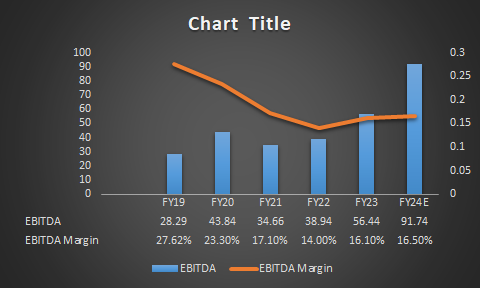

EBITDA margins to expand by 30–40 bps*

In recent years, Manorama Industries has experienced a decline in EBITDA margins due to factors such as inflation and supply side constraints. However, we anticipate that these margins will improve with the normalization of inflation, better utilization of capacity, and the significant operating leverage that is expected to kick in.

MANORAMA INDUSTRIES INVESTMENT RATIONALE

- Cocoa Butter Equivalent(CBE) increase in demand: The cocoa butter equivalent, a key product of Manorma Industries, lowers the cost of chocolate production because it is less expensive than cocoa butter. The Cocoa Butter Equivalent (CBE) Market is primarily driven by the increase in demand for chocolates and the high price of cocoa butter

- Significant scope for business growth – FSSAI increased the CBE limit in chocolates from 2.5% to 5.0% in 2018. However, in developed markets, the permissible limit is 10% and if the same is allowed in India, it will open up significant scope for growth to MIL. We expet this to happen in days ahead.

- Raw material availability is plentiful – Manorama Industries sources Saal and Mango seeds from tribals of the nearby forest, while importing Shea seeds from western African countries. Availability of Saal and Mango seeds is abundant in the Chhattisgarh Forest area and currently, the company sources only 5% of the available supply. The abundant

availability of raw materials and scope for expansion citing the demand potential should enable the company to plan future capacity expansion. - Niche Strength- Manorama is the only player in India with ability to manufacture CBE from Sal seeds given its procurement strength. Hence, global players will find it difficult to compete with Manorama Industries in the Indian context.

- Barriers to entry – As per Indian regulations, CBE manufacturing is permitted only from Indian Sal, Mango, and Kokum, with a high import duty for Shea-based fats. Any new player coming in the market has to go through at least 3-4 years waiting period for obtaining all customer and regulatory approvals to supply the material

- Long-term growth plans- In the long term, the management plans to enter the Indian B2C segment and are currently developing a range of new products for this. Overall, the company aims to become a leading player in the CBE, Specialty fats and butter market globally.

- Catering to cattle feed industry: Deoiled cake is a byproduct sold as cattle feed produced from the processing of Sal / Mango / Kokum. Cattle feed is a huge market in India which improves realisation far better compared to any manufacturer in other developed countries thereby giving Manorama Industries price competitive in the international market compared to other producers.

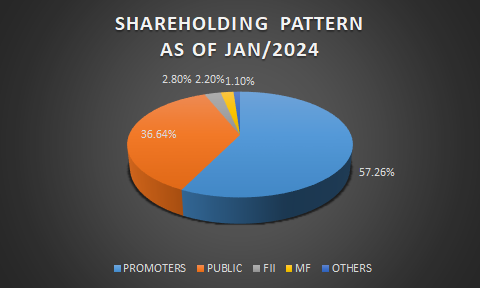

- Corporate Transparency and Promoter-Led Excellence: Manorama Industries operates as a promoter-driven enterprise, with a management team that consistently upholds high standards of transparency in its operations.

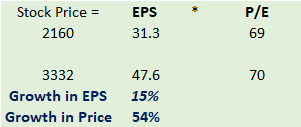

VALUATION

Stock price Mental Model-

3-Year Horizon

- Given the significant capital expenditures already made and the management’s ability to efficiently utilize those investments, we anticipate that the company’s earnings per share (EPS) will register a CAGR of 15% over the next three years. This growth has the potential to lead to a significant increase in the stock price.

- Although the company may seem expensive based on its PE multiple, we believe that the waste-to-revenue business model, coupled with significant capex, can lead to multifold growth.

- Also, MIL’s waste-to-revenue business model ensures a high ESG score which is a precursor for a re-rating of its valuation multiple.

Manufacturing Process

KEY RISKS

- Long working capital days- Seed picking is seasonal in nature, and the company has to collect and keep the inventory for the entire year of sales in those three months. This leads to inventory days of over 300 days and hence a very long working capital cycle.

- Reduced demand: The company supplies its products to only two industries – confectionaries and cosmetics. Any slowdown in these two industries could significantly reduce the demand for products.

DISCLAIMER: Some of our clients are invested in this stock.

(In Rs. Crores)

(In Rs. Crores)

Good one

Thanks