Now that the whole world knows that markets are overvalued and that we are somewhere at the start, middle, or end of a bull market, the question for most investors is – should you still buy stocks and which ones?

Of course you should buy stocks at all times. While the markets are overvalued, we are nowhere close to euphoria. Certainly markets will correct at some point (my guess is towards the first half of 2018). I doubt however that there will be recession. Unlike the 50% correction of 2008, we may see smaller corrections of 5-10% from time to time. At some point in the next few quarters, earnings will pick momentum. Valuations however may not cool off anytime soon. Euphoria is never built on so much worry as we have in the current market. The environment if at all is ripe for smaller periodic corrections with continued earnings improvement.

In this environment of constant rise and fall, what stocks should you be betting on? In large part this will depend upon the type of investor you are.

If you are looking to benefit from the market in the short term, you should be prepared to take some loss. Buy high beta and over-owned stocks in financial services, telecom, housing finance, metals and everything else that is moving. Make sure to sell it all if it falls over 5%.

If you are someone who wants to start on the investment ladder and are happy to put away cash for a few years, you should choose beaten down sectors like IT, Pharma, power, infrastructure and even metals which is still beaten down.

Extreme Overvaluation Vs. Extreme Revival Hope

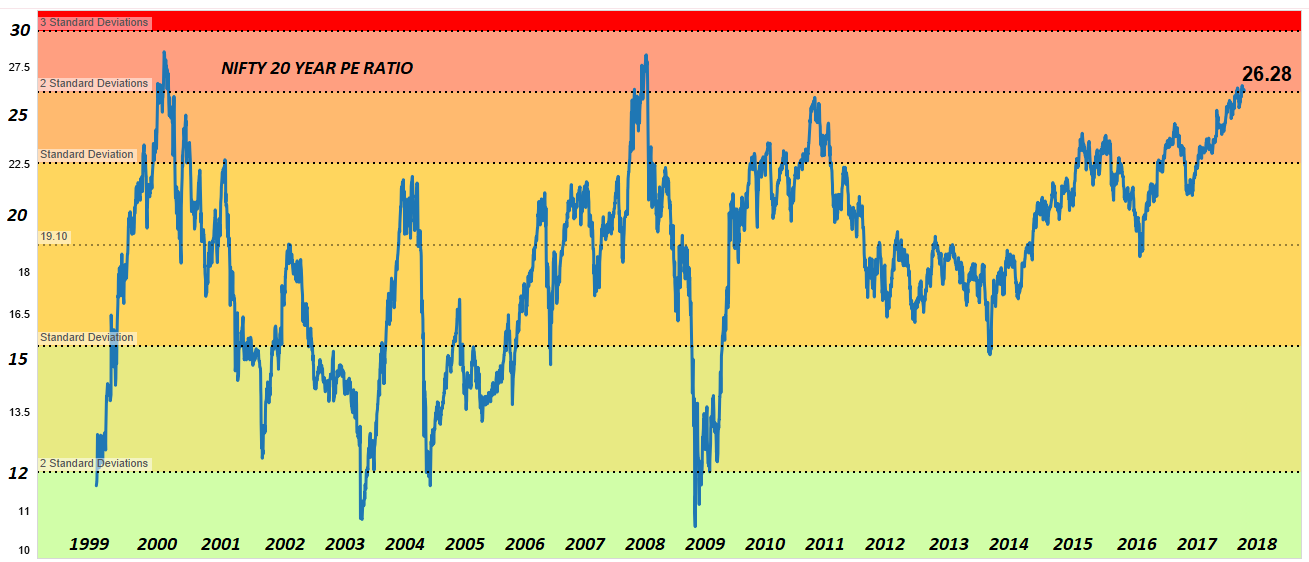

By now, everyone is aware that markets are extremely overvalued and should correct. Historically, markets have not sustained over trailing PE of 26 (as they are now). Unlike previous crashes however, they may not correct aggressively if one were to go by the kind of hope on revival of corporate earnings. In my view, no matter how much earnings improve over the next few quarters, these markets will remain over-valued and will see periodic corrections. In all of this, investors will see undervalued stocks run up with each small cycle.

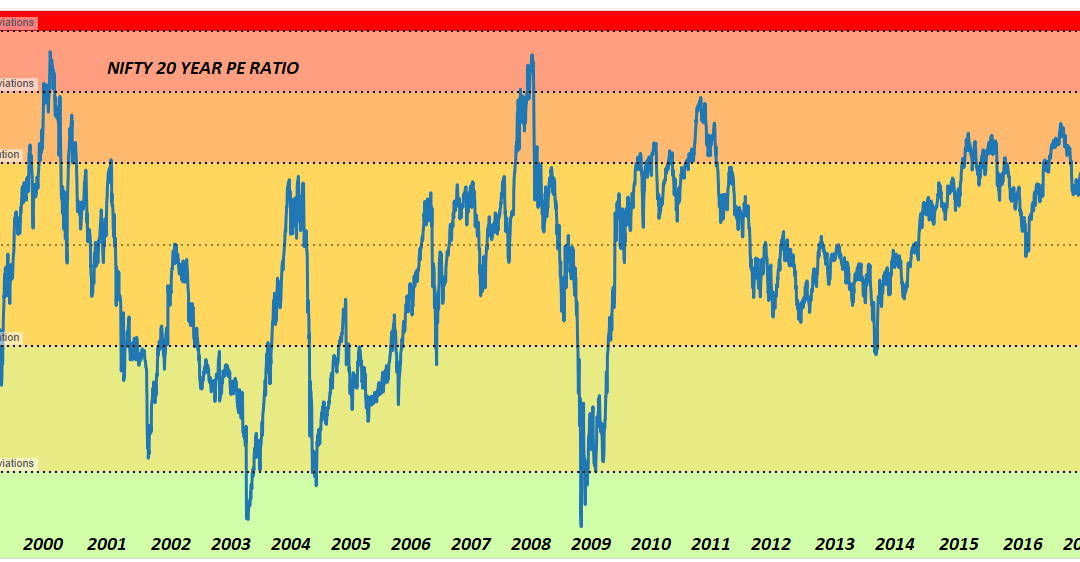

Here’s a graphical representation of this extreme overvaluation. Note that in past 20 years, we have crossed the 26 PE mark only twice and in each case there was a massive correction after that.

Over the last 3 years, much has been done by the government which should boost infrastructure and economic activity. Starting from Smart cities, to Make in India, to Demonetization and passage of GST, to PSU Recapitalization and Bharatmala project. The trouble is that so far nothing is visible on the books of accounts for infrastructure companies. That said, there is still extreme undervaluation in this sector and going forward, top money makers will come from this sector, is something I do not doubt a bit.

A word of Caution on Fixed Income and Debt Mutual Funds

Instead of being worried about the broader stock market outlook, investors will be well advised to stay particularly careful when selecting fixed income / debt mutual fund schemes which seem to be becoming extremely popular off late. I guess the reason for this popularity is this extreme overvaluation in stock prices.

Fixed income funds is where I believe investors should be particularly careful and seek the help of an investment advisor, more than at any other time.

With the kind of paper quality that is in some of these fixed income schemes, there are very few which will beat the performance of a basic fixed deposit. Further, while they get the benefit of indexation, index itself may not grow as fast as it did in past. For this reason, stocks may actually be a far safer investment class than some of these fixed income schemes if chosen wisely. When selecting debt / fixed income mutual fund schemes, investors must be twice as careful as when selecting equity schemes or stocks.

The key to deal with the current market is asset class diversification. There are 2 times when this is more true than all other times – First, in bull markets. Second, in bear markets.