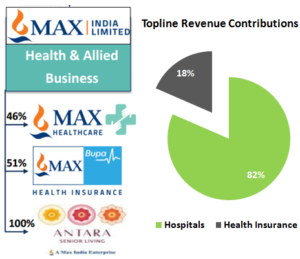

Max India Limited (“Max India” or “Company“) is engaged in healthcare business. The Company operates in 3 businesses:

► Healthcare: Max Healthcare, a subsidiary of Max India, in partnership with Life Healthcare of South Africa.

► Health Insurance: Max Bupa Health Insurance, a JV between Max India and Bupa Finance Plc, UK.

► Senior Living: Antara, 100 % owned retirement community in Dehradun

Also See: Pre – Demerger Analysis of Max India

WHAT’S DRIVING THE STOCK

India: A Story of Increasing Disease and Grossly Underserved by Hospitals

Indian Healthcare Industry is still at a nascent stage compared to its counterparts in developed countries. However, we derive our confidence on the industry, based on shift in demographics, rise in per capita income and pick-up in health insurance and medical tourism.

India spends ~4% of its GDP on healthcare, significantly lower than the U.S. (15%), Australia (9%) and Brazil (8%). Also, the per capita healthcare expenditure at $196 is the lowest in the world when compared to $8,845 in the U.S., $3,235 in the U.K. and $578 in China.

According to WHO Health Statistics (WHO) 2016, India faces acute shortage in desired healthcare infrastructure with only 9 beds per 10,000 people against the global average of 30 beds. In order to meet international benchmarks set by WHO for healthcare infrastructure, India will require an investment of over Rs. 14 lakhs Cr. over the next five years (According to Crisil Research).

India’s Demographic Profile – India’s growing population would translate into an incremental demand for healthcare services in the coming years. Analyzing the demographic profile of India, around 65% of the Indian population is below 35 years of age. Further, the proportion of old population (60 years and above) is increasing at a faster rate than the rest of the population. The increasing old population is expected to boost demand for the healthcare and related services significantly.

Rise in Life Style Related Diseases – Due to sedentary urban lifestyle, increased alcohol consumption and smoking, the urban youth are prone to the lifestyle diseases like stress, diabetes, high blood pressure. Growing health awareness and precautionary treatments coupled with improved diagnostics will result in an increase in hospitalization in the coming years.

Key Drivers for growth of Hospital Business in India:

- 500 Million Additional middle class by 2025.

- Less than 25% of population is currently covered by insurance. At the current rate of growth of insurance business the Insurance penetration is likely to reach up to ~ 45% of population by 2020. (Max Bupa has 4.3% share of private market v/s 4.1% over the previous year – FY 2015)

- Growth in insurance business is most positive for private sector hospitals like Max India. Health insurance provides affordability to high end medical treatment.

- Medical Tourism (which is where Max specialises, will be an added boost) given the cost of high quality medical treatment which Max India provides.

Max India: Turning Profitable and Growing Size

Max India’s business is split across (i) hospitals; (ii) health insurance and (iii) senior living facility (yet to start operations).

For FY 2016, Max Hospital Network turned profitable (for the first time) and reported an EBITDA growth of 26% (Reported EBITDA = Rs. 215 Cr.). Max Bupa is not yet profitable largely on account of large expenditure being incurred in marketing expenditure. The Company expects Max Bupa’s operations to turn profitable by FY 2020.

Antara senior living business will be starting its business operations from Dehradun this year (FY 2017).

Integration of – Health Insurance, Hospitals and Pathology

Max India is vertically integrated healthcare system, offering healthcare service under one umbrella. The Company has in house health insurance Max Bupa healthcare which gives Max India an added advantage.

WHAT’S DRAGGING THE STOCK

Intense Competition

Max Hospitals: Entry of new players in the industry and increasing dependence of hospitals on technology and skilled manpower make healthcare business as an extremely capital intensive business.

Health Insurance: The Company’s health insurance business (Max Bupa) is still a relatively smaller player in this segment. Some of the larger players, especially the public sectors players, have large insurance books and command over half the market share. Competition has increased further with the entry of new players. As such, considerable effort will be required to compete in this market.

Highly Capital Intensive Business

The healthcare sector is capital intensive with long gestation and payback periods for new projects. Land and infrastructure costs account for 60-70% of the capital expenditure in case of hospitals. Further, the business also requires capital for upgradation/ maintenance / replacement of equipment and expansion. Max India is in its expansion phase, therefore, availability of capital at a reasonable cost remains a key challenge for the Company. Also, in the insurance business, marketing of healthcare insurance products in the tier 2 and tier 3 cities involves huge expenditure.

Benefits Of Subscribing To A Stock Advisory Firm:

Investment is one of the most critical aspects of your life. One has to plan investments for different stages of life like retirement, child education, marriage, vacations, etc. It’s a work of utmost patience and diligence to chalk out an investment plan which not only gives great value to your capital but at the same time perfectly meets all your financial targets. To be honest, it is a job of an expert to draw an investment plan tailor-made to suit all the requirements of an individual. We regularly follow your site to train our employees and advise our clients.