Caveat: Major concerns around pledged shares and continuous fall of stock price.

MBL Infrastructure Limited (“MBL Infra” or the “Company”) provides integrated Engineering, Procurement and Construction (EPC) services for civil construction and infrastructure sector projects, which can be categorized in the following major segments:

- Highway Construction: This is the primary area of operations of the Company having NHAI, MoRTH and State PWDs as its major clients.

- Road Operations & Maintenance: Constructed roads and highways require continuous operations and maintenance. The Company has an early mover advantage in this segment.

- Highway – BOT Projects: MBL Infra has successfully completed two projects under BOT which are fully operational and three projects are under various stages of construction. The Company has also been awarded two prestigious projects on DBFOT Hybrid Annuity basis by NHAI.

- Industrial Infrastructure: The Company has successfully executed some major projects in Industrial Infrastructure Development space across India and continuously seeks to have its presence in this segment.

- Housing Infrastructure: MBL Infra also ventured in the construction of various housing projects and has successfully completed some of the projects awarded by various Government agencies. More projects are under various stages of completion.

- Railway Infrastructure: The Company has already executed Road Over Bridges projects and is also executing a project for Delhi Metro Rail Corporation.

- Water Infrastructure MBL Infra has aggressively started undertaking civil engineering projects of water infrastructure which includes construction of ports, harbor / marine structure, water supply / sanitation, bridges, viaducts and elevated structures.

- Other Infrastructure Projects this includes urban infrastructure development, construction of flyovers, mining, stone crushing, ready-mix concrete, etc.

WHAT’S DRIVING THE STOCK

Proxy play on India infrastructure story

Government Initiative – The Indian Infrastructure sector is likely to get major boost from Government’s focus on development of infrastructure in India. In the Union Budget for 2016-17, total investment in infrastructure is Rs. 2, 21,246 Cr.

The recent Demonetization move will have a very strong impact on infrastructure sector as the government will have new money to spend without borrowing from the market by way of increased tax collections. Infrastructure projects like roads, bridges and power would kick-start capex cycle and push economic growth higher.

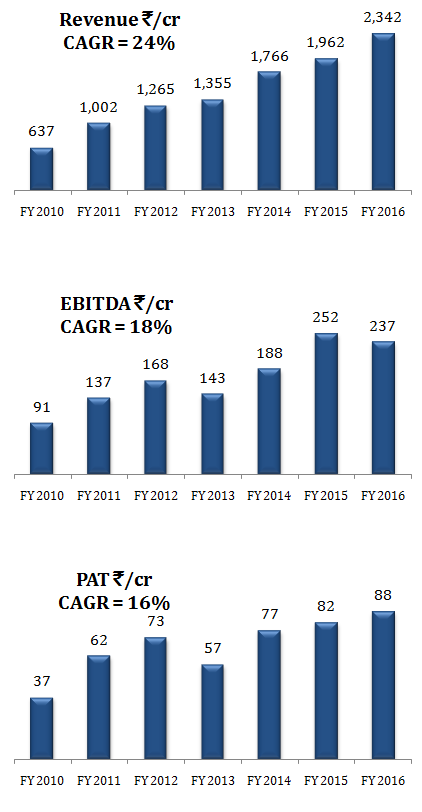

Strong Growth Over Time

MBL Infra has shown consistent growth over the last five years (i.e. 2011-12 to 2015-16). It’s net revenue from operations over this period grew at an impressive CAGR of 13.13 %. For FY 2016, income from operations increased by 19.53 % to Rs. 2,348.62 Cr. from Rs. 1,964.93 Cr. and PAT increased by 8.22 % to Rs. 88.30 Cr. from Rs. 81.59 Cr.

It operates with little debt (0.19:1 debt to equity) on its books. The Company has been consistently paying dividends since listing and has maintained a dividend payout ratio of 8 %.

AT THE CURRENT PRICE OF Rs. 75.05, MBL INFRA’s DIVIDEND YIELD IS 2.00%.

THE COMPANY’S TRAILING 12-MONTH (TTM) EPS STOOD AT RS 22.00 PER SHARE. AT CURRENT CMP OF 75.15, THE STOCK IS TRADING AT A PRICE-TO-EARNINGS (P/E) MULTIPLE OF 3.42.

In 2015, the Company rewarded its shareholders with bonus shares in the ratio of 1:1 which further instills confidence in the Company and the management.

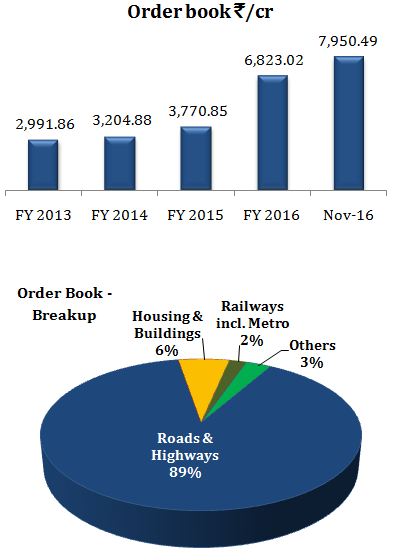

Increasing and Diversified Order Book

MBL Infra continues to do well across various segments of business during the year and has been able to bag prestigious orders. MBL Infra order book has shown consistent growth over the last 5 years (i.e. 2012-13 to 2016-17). Over this period, order book grew at an impressive CAGR of 21.59 %. For FY 2016, order book increased by 81 % to Rs. 6,823.02 Cr. from Rs. 3,770.85 Cr. s of November 2016, the Company’s order book stood at Rs. 7,950.49 Cr. of which 89% is roads and highway construction, 6% from housing & building and rest from others.

Geography Wise – Order Book

| North & West | · New Delhi / Haryana/ UP/Uttarakhand

· Rajasthan |

58% |

| Central | · Madhya Pradesh | 29% |

| East (incl. others) | · Bihar/Assam/Chhattisgarh

· West Bengal / Others |

13% |

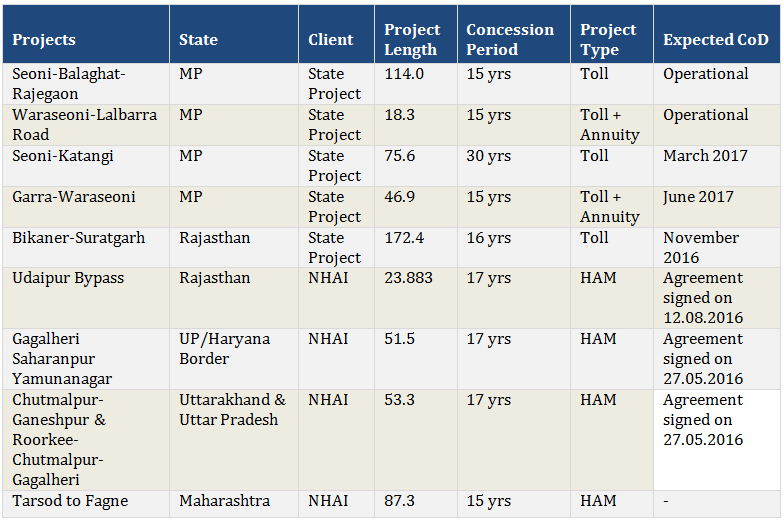

Key Current Project

- Four laning of NSEW corridor of Agra Dholpur section of NH-3

- Maintenance contract of New Delhi Ring Road from PWD

- Widening and maintenance of Seoni-Balaghat road (MP)

- Widening & strengthening of existing National Highway NH-37 from Guwahati to Sonapur

- Hybrid Annuity Model (HAM): Four Laning of Chutmalpur-Ganeshpur section of NH-72A & Roorkee- Chutmalpur-Gagalheri section on NH-73 in the State of Uttarakhand and Uttar Pradesh – Rs. 1184 Cr.

- HAM: Four Laning of Gagalheri-Saharanpur- Yamunanagar (UP/Haryana Border) section of NH-73 – Rs. 942 Cr.

- HAM: Six Laning of Greenfield proposed Udaipur Bypass (connection between NH-76 at existing Km 118+500 at Debari to NH-8 km 287+400 at kaya village (Udaipur Bypass – length 23.883) – Rs. 779 Cr.

- HAM: Four laning of Tarsod to Fagne (Package –II B) Section of NH-6 from km 422.700 to km 510.00 (design length 87.30 km) in the State of Maharashtra – Rs. 520.7 Cr.

* Hybrid Annuity Model (HAM): The HAM is a mix of engineering, procurement and construction (EPC) and build operate-transfer (BOT) formats. The Government and private companies share the total project cost in the ratio of 40:60 respectively. The Government shoulders the risk and responsibility of revenue collection.

Summary of BOT Projects

Strong Client Base

MBL Infra has a strong client base comprising: NHAI, The Ministry of Road Transport and Highways, Madhya Pradesh Road Development Corporation, SAIL, Central Public Works Department, Delhi Metro Rail Corporation, PWD (NCT New Delhi, Haryana, Rajasthan, Assam, Uttar Pradesh, Uttarakhand, West Bengal), HUDA, M.P. Housing Board, NBCC, RITES, Hooghly River Bridge Commissioner (HRBC), Water Resource Department (Bihar) etc.

NHAI & Ministry of Road Transport and Highways together contribute 75% in the total order book.

WHAT’S DRAGGING THE STOCK

While infrastructure theme is likely to do well for many years given the need for infrastructure projects in India, this is one sector where investors have to be extremely careful in making stock selection on account of delay in execution and commissioning of projects as also high debt position.

Also see: Best Infrastructure Stocks in India

Pledged Promoter Holding

82.69% OF PROMOTER HOLDING IS PLEDGED.

Over the last two years, the MBL Infra promoter group has pledged excessively high quantity of shares. The share of pledged promoter holding has increased from 24.68% in Sep-2015 to 82.69% in Sep-2016. With 37.45% promoter stake in the company at September-16, this amounted to 30.97% of total share capital being pledged – a highly precarious state. Currently, 83% of the promoter holding is pledged – a highly alarming situation for the minority shareholders.

Note: Higher the pledging of promoter’s share, greater could be the risk of volatility in the company’s share price. This is because, as share prices fall, the overall value of the pledged shares falls. This would put pressure on the promoter to produce more shares as collateral. Sometimes, the lender may also be forced to sell some of the shares to ensure that the loan does not turn into a bad loan. If the promoter is unable to meet obligations of borrowing, the ownership of shares is transferred to the lender, who may then sell it to recover loans.

Working Capital Worries

A major increase in order book size in the current fiscal will require increased pressure on working capital requirement. The Company could struggle on account of this in the short term. Further with a majority promoter shareholding pledged working capital situation becomes even more alarming for the Company.

Over Dependence on EPC Projects

The top 5 projects currently constitute around 76% of the order backlog. Out of these the Orissa BOT project alone accounts for 40% of the total projects.

Risks Relating to Infrastructure Projects

Infra and Engineering Sector is a highly capital-intensive industry with long gestation periods. Revenue generation could take many years after the initial conceptualization of a project. Since most of the projects have a long gestation period (4-5 years of construction period), the uncertainties and risks involved are high.

Delay in commissioning of projects is also a concern as it leads to delay in inflow of revenues. At the same time, companies have to incur costs on the delayed projects, thus affecting margins and overall profitability which could have a negative impact on the share price.

Intense Competition

Competition for MBL Infra has increased over the past few years. The Company operates in a highly competitive business, especially when it comes to low to medium engineering and construction projects. Further, competitors are also trying to catch up the Company’s quality and size, which will put pressure on L&T profit margins in the coming years.

Highly% Pledged shares is a matter of Concern.

I agree.

Isko laga daala to life Jhinglala

Hahaha.

The current crisis – do you think it’ll hamper the company?

Rajat,

What do you think of this stock now?

Is it a good buy at 28?

Why not ?

Friends, don’t be upset. Hold the stock whatever you have,and the

stock will run from Q2 and onward. thanks

Rajat, Really Good analysis, but quite unfortunate that pledging lead to such huge mess. Although i feel that the current Resolution process under IBC can turn out to be a blessing in disguise for the promoters, provided they are able to infuse additional equity in the business and raise their stake at these prices.

MBL does have a proven project execution capability & a decent track record in roads & highways. Hopefully they get a new lease of life for 2nd innings 🙂