Meghmani Organics Limited (“Meghmani” or the “Company”) is engaged in the manufacture and sale of Pigments and Agrochemicals.

The Company manufacture 2 Pigment products:

- Pigment Green – Pigment Green 7;

- Pigment Blue – CPC Blue, Alpha Blue and Beta Blue.

The Company’s Pigment Green and Pigment Blue products are sold and used in multiple applications, including printing inks, plastics, rubber, paints (for exterior and interior surfaces), textiles, leather and paper.

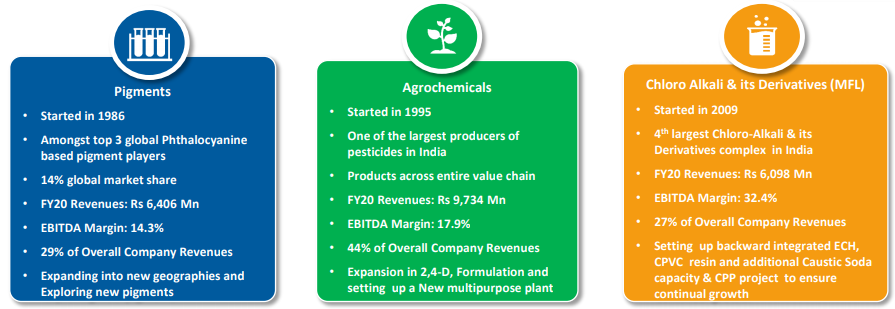

Agrochemical Products – The Company manufactures Agrochemical products which are Pesticides mainly used for basic crop protection and public health, as well as Pesticide Intermediates.

Chlor Alkali and its Derivatives – Meghmani Finechem Limited (MFL) is a subsidiary of Meghmani Organics Limited. MFL is well recognized in the global market as one of the leading producers of Chlor-Alkali and its Derivatives with backward and forward integration facilities. MFL has state of art fully automated production facility well equipped to meet international standards in manufacturing of Caustic Soda, Caustic Potash, Chlorine, Hydrogen, Chloromethanes, and Hydrogen Peroxide.

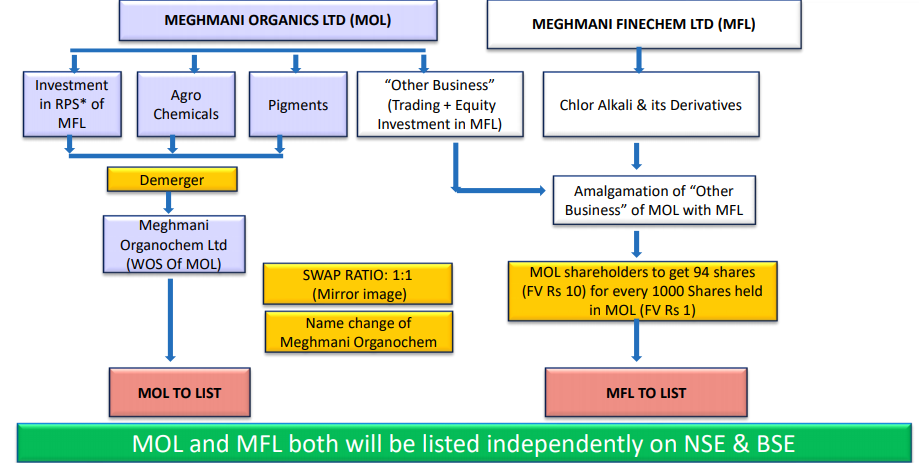

Composite Scheme of Arrangement

On 4th May 2021, the Company announced that the National Company Law Tribunal (NCLT), has approved the composite scheme of arrangement between Meghmani Organics (demerged company) and Meghmani Organochem (resulting company) and Meghmani Finechem (transferee company) on 03 May 2021.

Meghmani Organics has fixed 19 May 2021 as record date for purpose of composite scheme of arrangement to determine eligibility of shareholders of Meghmani Organics (Company), who will be entitled to receive –

- Fully paid equity shares of Re. 1/- each of Meghmani Organochem (Resulting Company), in the ratio of 1:1 as mentioned in the Scheme approved by NCLT; and

- Fully paid equity shares of Rs. 10/- each of Meghmani Finechem (Transferee Company), in the ratio of 94:1000 as mentioned in the Scheme approved by Hon’ble NCLT

Rationale:

The Company aims to position ‘Chloro Alkali and its Derivatives’ as independent and sustainable businesses. The Company believes that the business dynamics and growth trajectories deserve a status of an independent company. This will strengthen and further improve operational efficiencies of both the companies.

The Demerged Company viz. MOL is a well-established Listed Public Limited Company engaged in manufacturing variety of Agrochemical products as well as Pigments. The Transferee Company viz. MFL is engaged in manufacturing and Selling ofChloro-Alkali and its Derivatives.

Benefits:

- The proposed re-structuring would create enhanced value for the shareholders through potential unlocking of value through listing of both the businesses on the NSE and BSE (i.e. “Agrochemicals & Pigment” and “Chloro-Alkali and its Derivatives”);

- The restructuring would allow a focused strategy and specialization for sustained growth, which would be in the best interest of all the stakeholders and the persons connected with the aforesaid companies;

- Since both the business are having separate growth trajectories, the proposed restructuring would enable both the businesses to pursue their growth opportunities and offer investment opportunities to potential investors.

- The proposed re-structuring would enable investors to hold investments in the businesses with different investment characteristics, which best suit their investment strategies and risk profiles

Rationale/Concerns

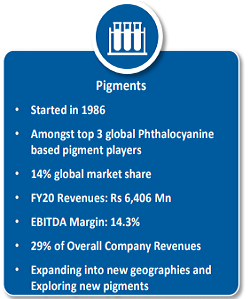

Strong Position in Pigments and Agrochemical Industries

The Company has an established market position in its principal business segments: pigments and agrochemicals. It is the largest producer of copper phthalocyanine (CPC) blue and is among the top 3 pigment blue players globally, and enjoys long-standing relationship with key customers. In agrochemicals also, the Company is among the largest manufacturer of pesticides in India having presence across the value chain in both technical and formulations. The Company has more than 30 brands of various pesticides formulations in India.

Diversified Revenue Profile

The Company has diversified revenue streams with an estimated 44% of its revenue came from agrochemicals, 29% from pigments, and 27% from basic chemicals in FY 2020. Revenue diversity is further augmented by presence in both domestic (43%) and international markets (57%). Besides, new products in base chemicals, agrochemicals and pigments will add to further diversity in revenue streams.

Integrated Operations, Leading to Cost Advantages

The Company has integrated backwards into manufacturing CPC blue, resulting in considerable savings. In its agrochemicals business, the Company has facilities for manufacturing cypermethric acid chloride, meta phenoxy benzaldehyde and meta phenoxy benzyl alcohol, which are key intermediates in crop-protection products, thus reducing reliance on import. In the base chemicals segment too, the Company has announced projects for manufacturing value-added products such as hydrogen peroxide, methylene dichloride, ECH, chloroform and carbon tetra chloride from hydrogen and chlorine, which are by-products of existing manufacturing processes.

Capex Plan

The Company has planned a capex of around Rs 700 Cr between FY 2021 and 2023, largely towards expansion of ECH in MFL, besides setting up capacity for new products in the agrochemical division. The Company has successfully commissioned multiple large projects in FY 2021 already i.e caustic soda and hydrogen peroxide expansions. The new caustic soda capacity was commissioned in June 2020 and the hydrogen peroxide capacity was commissioned in July 2020. The chloromethane sulphonate (CMS) capacity commissioned (commissioned in July 2019) has also scaled up to around 70-80% capacity utilization levels by September 2020.

The Company has tied up long term loans for funding the incremental capex in the Chlor Alkali & its Derivatives business over FY 2020 to 2022. The Company also has headroom in its fund based working capital limits which have been utilised at an average of 46% over the past twelve months.

The Company has sustainable business model and well-integrated manufacturing base. The Company has fairly well-balanced plant capacities and layouts with multiple locations that support the economy of scale. The product reach and distribution too, are well diversified geographically with presence in almost every continent, empowering consistency in products off take all throughout the year. The Company has a very low leveraged debt-equity as well as low interest cost due to hedging possibilities always available against underlying exports. This helps the balance sheet to become stronger and healthier.

The management believes that the Company’s business performance will remain healthy over the medium term marked by improving product mix, diversified revenue profile and healthy margins leading to strong cash accruals.

No mention of threats or weaknesses like in SWOT analysis type.

Eg, i read somewhere that biopesticides might be growing trend going forward this decade.