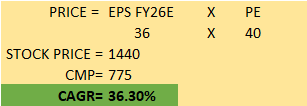

VALUATIONS

We maintain a positive view on Mold-Tek Packaging.

Our Call – Buy

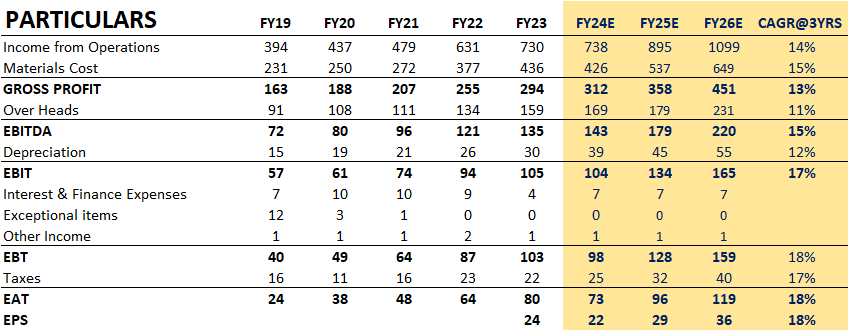

We expect a 36% upside due to the company’s earnings being at an inflection point. Mold-Tek Packaging is expected to show superior volume growth and margin improvement, supported by capacity expansion and an improved revenue mix. We anticipate a robust PAT CAGR of 18% throughout FY23-25E, with a steady improvement in RoE/RoCE to 19%/24% by FY25 compared to 19%/16% in FY23. We remain positive about Mold-Tek Packaging and expect a 36% upside. Currently, the stock trades at 36x its earnings, but we anticipate a rerating in PE towards its median of 40.

INVESTMENT RATIONAL

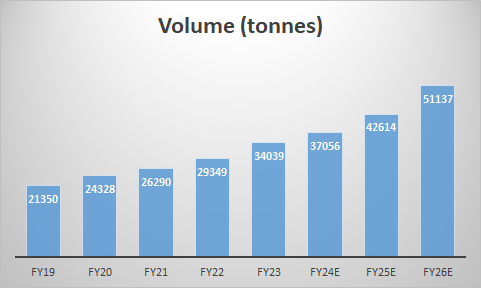

Mold-Tek Packaging can launch new products by adopting advanced technologies. Higher order inflow in the paints and lubes segment and recovery in demand in the food and FMCG segment will support volume growth over FY23-FY25. To tap healthy demand from end-user industries, the company plans to expand its capacity by 60000 MT over the next couple of years. The stable growth in existing segments and foray into pharma OTC would drive sustained higher volume growth. The share of the high-margin F&F/Pharma segment is expected to increase in the company years and drive strong improvement in margin. The company’s balance sheet is also lean with low net debt/equity of just 0.1x and generates decent cash flows from operations.

COMPANY BACKGROUND

- Mold-Tek Packaging is engaged in the manufacturing of injection-molded containers for lubes, paints, food, and other products.- Their portfolio encompasses containers commonly utilized by prominent brands such as Asian Paints, packaging solutions for FMCG products like peanut butter, as well as specialized containers for pharmaceutical applications such as Idoex.

- Mold tek is one of the few companies with integrated facilities from Mould Design & Manufacturing, Robot & IML label manufacturing, hence offering cost-effective IML solutions in India which leads to superior margins compared to its peers.

- Commands strong presence across all major customers like Asian Paints, Castrol, Shell, Mondelez, Hindustan Unilever, etc

- Established in 1986, Mold-Tek Packaging is one of the leading players in Rigid plastic packaging in India.

-

- Rigid plastic packaging – The traditional forms of packaging such as glass bottles, jars, cartoons, and metal cans have been largely replaced by the rigid plastic packaging industry for reasons like premium feel, lighter weight, lower cost, design flexibility, and ease of recycling. Packaging made of rigid plastic is durable, affordable, and environmentally friendly.

- The end-user industry, including food & FMCG, cosmetics, and healthcare, is expected to drive significant growth in the industry.

- In the Food and beverage industry rigid plastic packaging is in high demand to ensure food safety and shelf life.

- Rigid plastic packaging – The traditional forms of packaging such as glass bottles, jars, cartoons, and metal cans have been largely replaced by the rigid plastic packaging industry for reasons like premium feel, lighter weight, lower cost, design flexibility, and ease of recycling. Packaging made of rigid plastic is durable, affordable, and environmentally friendly.

-

- Pioneers in In-Mold Labelling (IML) in India, HD photographic labels & IMLed products. These are 100% recyclable & produced hands-free.

- IML has a huge market potential where Mold-Tek has a significant first-mover advantage.

- Significant cost optimization in IML driving higher margins & profitability.

- As of Q3FY24, 63.63% of their revenue is derived from in-mold labeling (IML).

IN-MOULD LABELLING USES

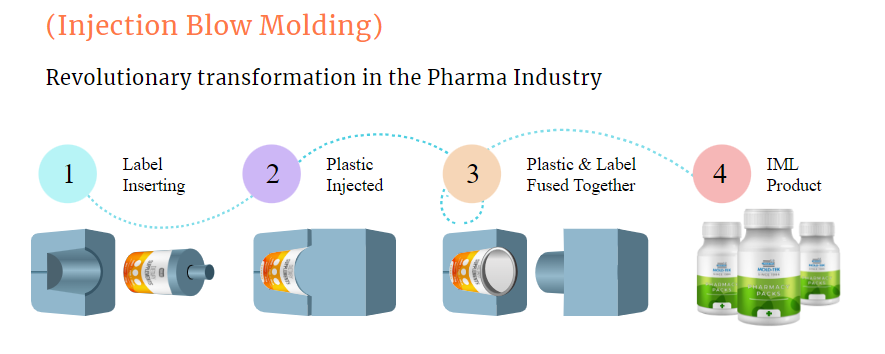

- Mold-Tek Packaging has expanded its product line to include Injection Blow Moulding (IBM) with In-Mold Labelling (IML) for pharma, cosmetics, and FMCG industries. IBM packaging market size is more than Rs. 5000 Crore, growing at a rate of 8-9% per annum – Mold-Tek plans to achieve around 5-6% market share in IBM.

- Management has projected an incremental revenue of approximately 40cr from the Pharma business over the next three years.

- Applications IBM Containers

1) Pharma – HDPE tablet containers & CRC Caps

2) Containers for the FMCG& Cosmetics sector

- Applications IBM Containers

PRODUCTS MANUFACTURED BY MOLD-TEK PACKAGING

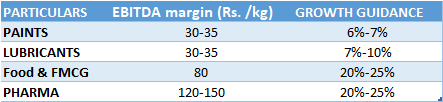

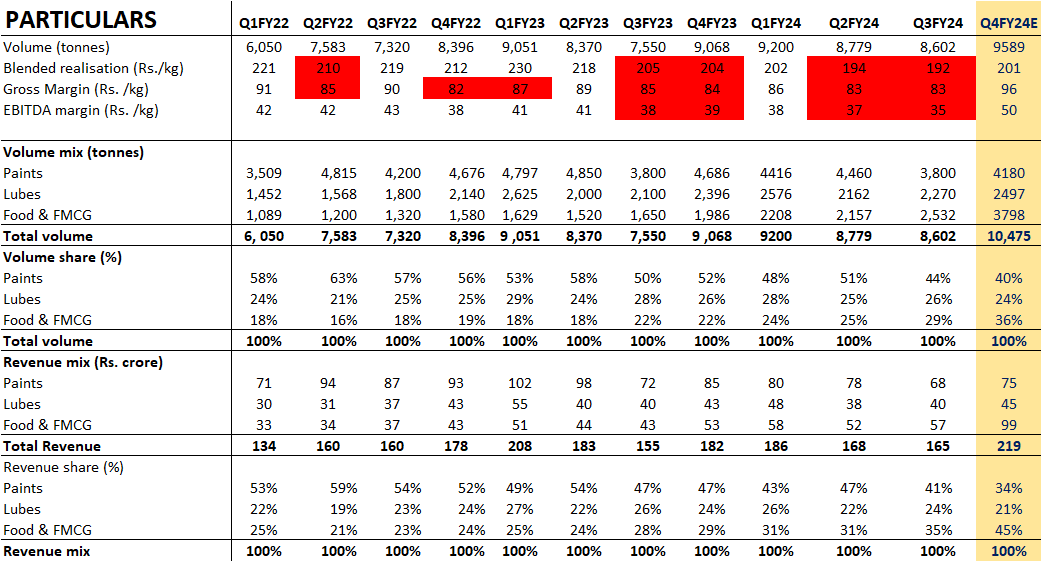

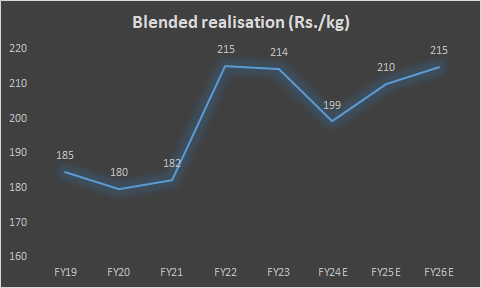

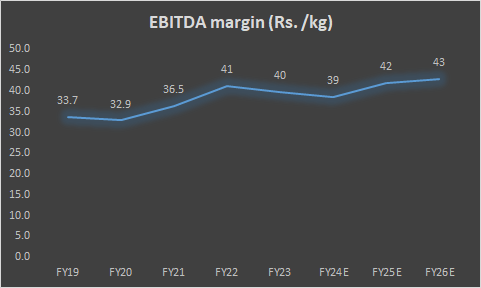

UNIT ECONOMICS AND PRODUCT MIX

Management anticipates a growth of 15% to 20% in terms of volume.

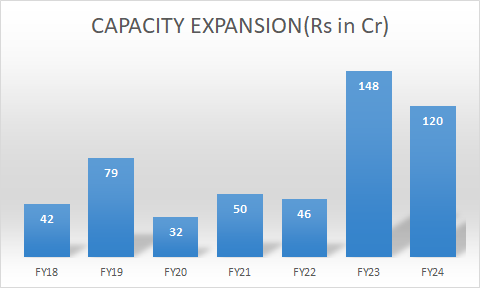

Capacity Expansion Of Mold-Tek Packaging

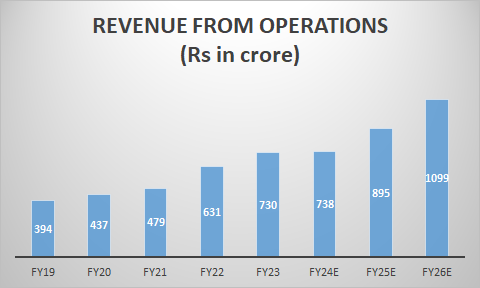

Mold Tek has announced a significant increase in capital expenditure for the financial years 2023 and 2024, intending to expand their manufacturing capacity. Currently, the manufacturing capacity stands at 45000 MT, but the management plans to increase it to 60000 MT in the next 2-3 years. This expansion is expected to lead to significant growth in revenue for the company.

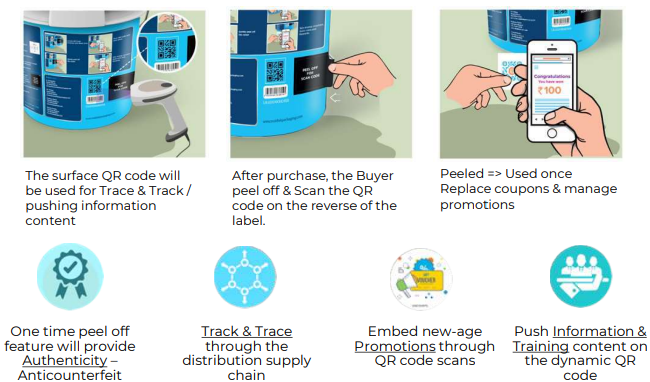

Digital Packaging – First time in India through Dynamic QR-coded IML Containers

To improve its product mix Mold Tek also started QR-IML packaging to Shell and expects this feature to be adopted by other customers in paints, lubes, ice cream, and FMCG. –

- Unique QR-coded IML with a partially peel-able feature gives tremendous scope to customers

- Enables better transparency & improves Supply chain efficiency of customers and prevents duplicate markets

Commands higher margin than non-IML products. Big clients in Lubes & paints showing interest in adopting this technology

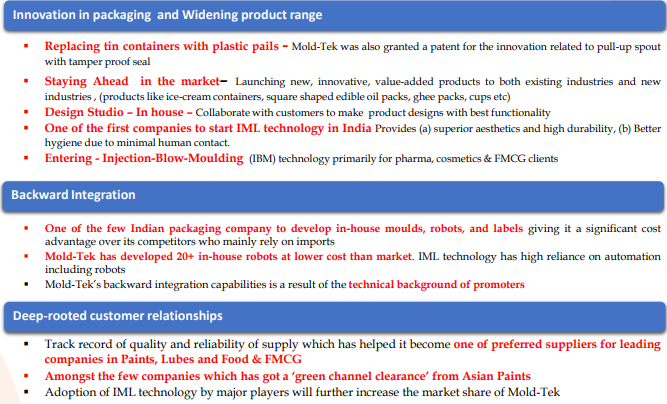

KEY USP STATED BY THE MANAGEMENT WHICH GIVES Mold-Tek Packaging EDGE OF THEIR COMPETITORS –

STRONG MOAT- The company can pass on raw material costs to consumers and maintain stable margins.

MOLD- TEK DECORATION TECHNOLOGIES

- Screen Printing −Labour intensive & low quality print compared to other technologies

- HTL – Heal Transfer Label ling- Better quality but is not completely hands-free operation & not 100% recyclable

- IML – In Mould Labelling – HD Photographic label with provisions of giving glossy finish – High Margins

- Injection Blow Moulding – Pharma Regulated – Lightweight High Utility and High Margins

FINACIAL SNAPSHOTS