Motherson Sumi Systems Limited (“MSSL” or the “Company”) is one of the world’s leading specialized automotive component manufacturing companies for OEMs. MSSL is a focused, dynamic, and progressive company providing customers with innovative and value-added products, services, and solutions. With a diverse global customer base of nearly all leading automobile manufacturers globally, the Company has a presence in 41 countries across five continents.

DEMERGER

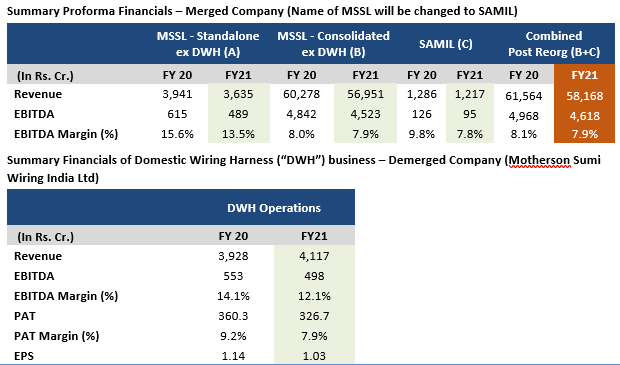

On July 02, 2020, board of directors of Motherson Sumi Systems Limited (MSSL) and Samvardhana Motherson International Limited (SAMIL) has approved the reorganization of business which entails demerger of the domestic wiring harness business from MSSL into a new company, with a similar shareholding structure as that of MSSL and subsequent merger of SAMIL into MSSL.

Step 1: Demerger of DWH business of the Company into New Co., which will eventually be listed, with mirror shareholding as that of the Company. For every 1 share held in MSSL, 1 share of New Co. would be allotted

Step 2: Merger of SAMIL, the principal holding company of Motherson Group and promoter of MSSL, into MSSL. MSSL will be renamed as Samvardhana Motherson International Limited

In the proposed reorganisation, two growth focused listed companies will emerge.

[1] Motherson Sumi Wiring India Ltd. (MSWIL) will be the largest listed automotive wiring harness player in India with a nationwide manufacturing footprint. MSWIL will benefit from the continued parentage of MSSL along with an increased focus from Sumitomo Wiring Systems, Japan (SWS) to cater to the fast-growing Indian automotive market. Also, MSWIL will bring in exciting new solutions for electric vehicle offerings from its customers.

[2] Motherson Sumi Systems Ltd. (MSSL) combined with the business of Samvardhana Motherson International Ltd (SAMIL) creates a solid platform to achieve its stated Vision 2025. The Company will fully own its international business Samvardhana Motherson Automotive Systems Group BV (SMRPBV); which not only results in a simplification of the group structure and enhanced cash flows; but also, further diversifies MSSL’s revenue and product mix by addition of products like automotive lighting, shock absorbers, sheet metal, HVAC etc in line with its 3CX10 strategy.

INVESTMENT RATIONALE

Leading Automotive Component Player

The Company is one of the leading automotive component companies globally and a tier-I supplier of wiring harness, rear-view vision systems, interior and exterior modules to large global auto OEMs such as the Volkswagen Group (VW Group) and Mercedes Benz/Daimler. The Company has a healthy market position in terms of global presence as well as share of business of its products. The Company’s polymer business (SMP) is a leading supplier of bumpers, cockpit assemblies and door trims in the premium segment with a sizeable global market share. Samvardhana Motherson Reflectec (SMR), the Company’s mirrors business, enjoys a dominant global market share for exterior mirrors.

Well-Diversified Business Profile

The Company has a diversified automotive product portfolio of automotive vision systems, wiring harnesses, polymer-based auto components, tooling, metal machining and elastomers spanning key automotive markets globally. Aided by the acquisition of PKC Group (in FY2017) and Samvardhana Motherson Reydel Company (SMRC; in FY2019), the Company’s revenue dependence on the European OEMs and the Volkswagen (VW) Group (~30% in FY2021) has moderated. The Company has a widespread geographical footprint, with plants located across geographies. Over the years, it has set up manufacturing facilities in close proximity to OEM plants, thereby integrating into an OEM’s supply chain, offering just-in-time (JIT) logistics. This has helped the Company to gain new businesses and maintain a healthy order book.

Strong in-house Product Development Capabilities

The competition in the automotive industry remains high; nevertheless, aided by its in-house product development capabilities and technical collaborations (Sumitomo Wiring Systems Ltd. for wiring harness), the Company has emerged as a preferred solution provider to its customers and has sustained a strong market position over the years. The Company’s product portfolio remains agnostic to internal combustion engines, hybrids and electric vehicles (EVs), thereby limiting any risk arising from a prospective transition towards electrical mobility, going forward. The Company is deriving a significant proportion of its order book from new EV orders, which offers comfort regarding its ability to keep up with evolving technological trends.

Standalone Business on Strong Footing

The India Wiring Harness business is likely to grow faster than the PV industry, led by an increase in content (due to ongoing premiumization). BS-6 has increased the complexity of wiring harnesses and increased the value by 10–20%. Also, it has opened 2W segment for the Company, as 2Ws shift to electronic fuel injection systems with more sensors. The Company is already market leader in 2W wiring harness in the EU.

Business Reorganization to Drive Better Value

The proposed structure would create two listed entities – a) India Wiring Harness business and b) Global businesses + other India businesses. This is likely to drive better value discovery of the global business and also give the minority shareholder the option of investing in either or both of the businesses.

| Segments | EBITDA (In Rs. Cr.) | EV/EBITDA | Enterprise Value (In Rs. Cr.) |

| DWH | 498.1 | 7.0 | 3,487 |

| Merged Company | 4,617.6 | 17.4 | 80,346 |

| Total Enterprise Value | 83,833 | ||

| Net Debt | 2,920 | ||

| Market Cap | 80,913 | ||

| Number of shares (In Cr.) | 315.79 | ||

| Price per share (Rs.) | 256.22 | ||

The Company’s management has a track record of pursuing an inorganic growth strategy, which is expected to continue and has been outlined by the management as per its Vision 2025. Most of its acquisitions are customer-backed, with the management being primarily successful in turning around these entities. Aided by its past acquisitions, the Company has been able to enhance its operational profile significantly over the years, as reflected by strong synergies within the Company, in terms of centralized procurement as well as a large product basket. This helped the Company remain cost-competitive and a preferred solution provider for its customers.

The Company is likely to witness significant improvement in financial performance as supply issues relating to semiconductor eases from Q4FY22 and this will also lead to operating leverage benefits Company’s green field capacities ramp up production. Further, strong order book coupled sizeable proportion of orders from EV and hybrid models indicates potential of healthy revenue stream. Under the ongoing business reorganisation exercise, the relatively higher margin DWH business will be demerged, and the various businesses housed under SAMIL offers significant revenue growth and diversification potential and are likely to contribute materially to the Company’s consolidated profile over a longer term.