Motilal Oswal Financial Services Ltd (“Motilal Oswal” or the “Company”) is a diversified financial services group focused on wealth creation through knowledge. The Company provides a whole host of products and services across retail broking & financial products distribution, institutional broking, private wealth management, investment banking, private equity (growth capital and real estate), asset management and home finance.

INVESTMENT RATIONALE

Integrated Financial Services Provider

| Category | Business | Primary products and services |

| Transaction-based businesses | Broking & Distribution | Equity (cash and derivatives), Commodity and Currency, Distribution of financial products, Depository services |

| Institutional Broking | Equity (cash and derivatives) broking, Advisory | |

| Investment Broking | Capital raising, M&A advisory, Domestic IPOs, Private equity placements, Corporate finance advisory, Restructuring, FCCBs and GDRs | |

| Asset-based businesses | Public Market Equities | Portfolio management services (PMS), Mutual funds |

| Private Equity | Private equity investment and advisory, Real estate investment and advisory | |

| Wealth Management | Professional money managers, Trading, Alternate assets, Credit solutions, Wealth transmission, Specialized advisory services | |

| Fund-based businesses | Aspire Home Finance | Affordable housing finance |

| Fund Based Activities | Loan against shares book, Sponsor commitments into its own mutual funds, private equity funds and housing finance entity |

Strong Financial Position

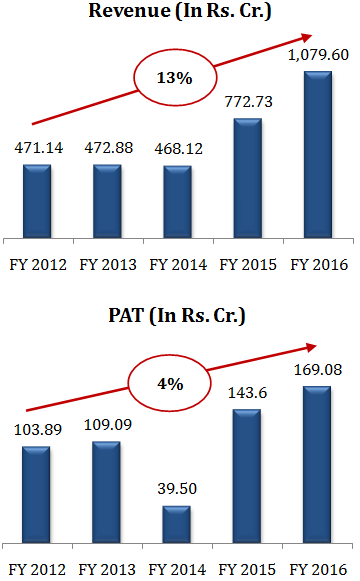

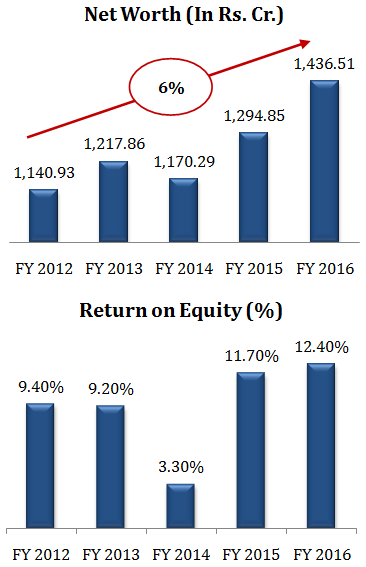

Motilal Oswal has shown consistent growth over the last five years (i.e. 2011-12 to 2015-16). It’s net revenue from operations over this period grew at an impressive CAGR of 13 %. For FY 2016, income from operations increased by 41 % to Rs. 10,927 Cr. from Rs. 7,750 Cr. and PAT increased by 18 % to Rs. 1,691 Cr. from Rs. 1,436 Cr. Motilal Oswal has net worth in excess of Rs. 14,365 Cr.

Financial Performance of Motilal Oswal Financial Services Limited

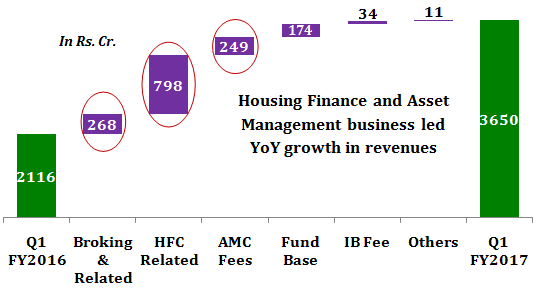

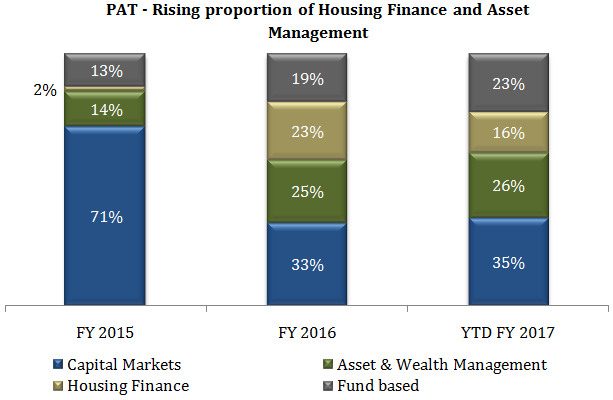

New Drivers for Revenue & Profit – Housing Finance and Asset Management

| Particulars (In Rs. Cr.) | Q1 FY16 | Q1 FY17 | Change | (%) |

| Housing finance related | 204 | 1,002 | 798 | 391% |

| Investment banking fees | 49 | 82 | 33 | 69% |

| Asset management fees | 403 | 652 | 249 | 62% |

| Fund based Income | 284 | 459 | 175 | 61% |

| Brokerage Income | 1,163 | 1,431 | 268 | 23% |

- Capital Markets includes retail broking, institutional equities & investment banking

- Asset Management includes asset management, private equity & wealth management

- Housing Finance includes Aspire Home Finance

- Fund based includes sponsor commitments to our AMC products and NBFC LAS book

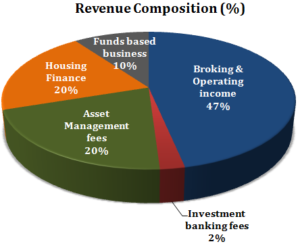

The Company’s housing finance and asset management business verticals together contribute 40 % in the total revenue.

Asset Management Business – Motilal Oswal operates Portfolio Management Service (PMS) and mutual funds which helps the Company to bring in a source of regular annuity-fee income. As of June 2016, the Company’s AUM stood at Rs123 billion up 68% YoY.

The Company is amongst the fastest growing AMCs in the equity space. The market share of net sales in the open-end equity mutual funds increased from 2.2% to 4% in the same period. Motilal Oswal PMS has gained flavor as an alternate product with several distributors. The Company’s flagship Value PMS delivered 25% CAGR in 13 years &Next Trillion Dollar Opportunity PMS delivered 17% CAGR since 2007.

Significant investments have been made in recent quarters in brand promotion to build a strong recall & positioning amongst the investor and distributor fraternity. The marketing campaign “Sirf Ek Sawaal: Why not Motilal Oswal” was launched across Digital, Print and TVC media channels.

Housing Finance Business – For Q1 FY 2017, the housing finance vertical has shown an impressive growth of 391 % as compared to Q1 FY 2016. Housing Finance contributed ~27% of consolidated revenues, as compared to ~10% in Q1FY 2016.As of Q1FY 2017, RoA was 3.5%, RoE was 16.6% & D/E was 5.7x.

As of June 2016, the loan book stood at Rs. 25 billion across ~25,000 families with an average ticket-size of Rs. 1 million. In terms of liability profile, Aspire has term-loan drawdown from 23 banks and 1 NBFC as of 30th June, 2016, up from 8a year ago. Approximately 54% of the borrowings are from the capital markets, in the form of NCDs.

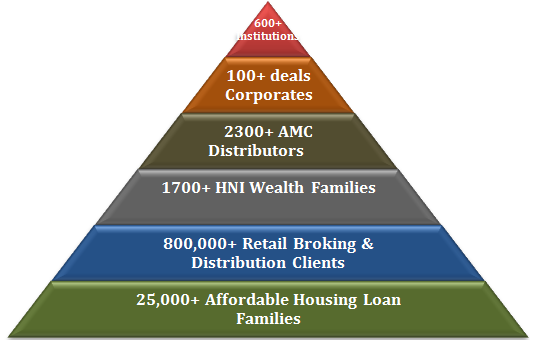

Extensive Distribution Network

Motilal Oswal financial products and services are distributed through a pan-India network. The business has grown from a single location to a nationwide network spread across 2,000+ business locations operated by business associates or directly through own branches in 511 cities. This extensive network provides opportunities to cross sell products and services, particularly as the company diversifies into new business streams. In addition to the geographical spread, the Company also offers an online channel to service customers.

Well-Positioned Across Client Pyramid

INVESTMENT CONCERNS

Intensifying competition from local and global players

The Company faces significant competition from Scheduled Commercial Banks who now offer 3 in 1 accounts giving flexibility to customers to have their brokerage accounts along with their savings bank account. Not only does this save the hassle of maintaining duplicate accounts but also makes it easier to transfer money between various accounts.

Further, the Company competes with other Indian and foreign brokerage houses and investment banks. Motilal Oswal faces competition in all its business lines; and the competition is not only from domestic but also from foreign institutions such as Franklin Templeton, JP Morgan, ABN Amro, and HSBC. The Company competes on the basis of a number of factors, including execution, product and service offerings, innovation, reputation and price which may limit the growth and affect the margins of the Company.

Businesses significantly correlated to capital markets

Motilal Oswal’s growth and profitability are, to a large part, dependent on the stable growth and functioning of the capital markets. The Company’s business verticals like the securities business, venture capital management and investment banking are directly leveraged to performance of the capital markets. The growth of financial services sector will allow the Company to grow businesses in each of the verticals. In the event of any further downturn in capital market, the Company’s profitability may adversely get impacted.