Product: Motilal Oswal India Opportunities Fund (IOPV2) Strategy

Focus: deliver higher returns by making investments in stocks and sectors that can benefit from India’s emerging businesses.

Concentration: The portfolio typically consists of 15-20 mid cap stocks.

Ideal for: Ideal for investors looking to invest in small and mid cap stocks for higher than average growth.

Note: Not more than 10-12% of portfolio is invested in a single stock

PMS Allocation (as of end March 2018):

- Mid Caps: 92.35%

- Small Caps: 6.51%

- Weighted Average Market Cap – Rs. 9,354.22 Cr.

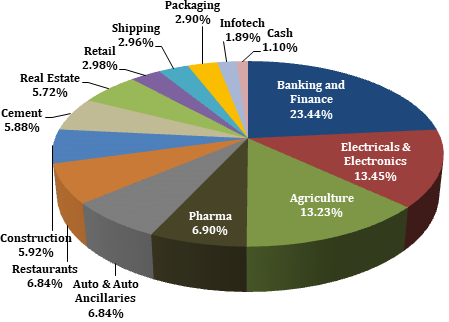

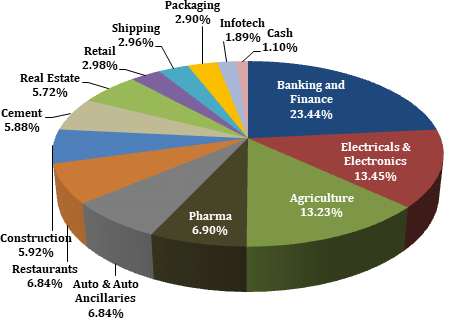

Motilal Oswal IOP V2 – Top Sectoral Allocation

Current Holdings as of March 2018

Below allocations were created at the end of the first week in February:

| Company | % Holdings |

| Cholamandalam Investment And Finance | 7.11% |

| Coffee Day Enterprises | 6.84% |

| Sundaram Fasteners | 6.84% |

| Avanti Feeds | 6.64% |

| Godrej Agrovet | 6.59% |

| Gruh Finance | 6.03% |

| Century PlyboardsIndia | 5.92% |

| JK Lakshmi Cement | 5.86% |

| Sobha | 5.72% |

| J M Financial | 5.54% |

| HEG | 5.34% |

| Bajaj Electricals | 5.32% |

| Ipca Lab | 5.02% |

| CDSL | 4.76% |

| Bata India | 2.96% |

| Cochin Shipyard | 2.96% |

| Essel Propac | 2.90% |

| Kei Industries | 2.79% |

| Accelya Kale Solutions | 1.86% |

| Shalby | 1.86% |

Motilal Oswal India Opportunities Fund V2 Strategy – Buy and Hold Approach

In IOPV2, the investment strategy is to buy growth stocks across market capitalization which has the potential to grow at 1.5 times the nominal GDP for next 5-7 years. PMS – BUY & HOLD strategy will lead to less churning of portfolio thereby lowering costs and enhancing post-tax returns for investors.

Previous Price Performance of Stocks Currently Held in Motilal Oswal India Opportunities Fund V2

| Company | CMP | 1 year return | 3 year return |

| Cholamandalam Investment And Finance | 1496.8 | 51% | 174% |

| Coffee Day Enterprises | 306.05 | 31% | – |

| Sundaram Fasteners | 565.2 | 50% | 233% |

| Avanti Feeds | 2207.2 | 215% | 618% |

| Godrej Agrovet | 645.5 | 8% | – |

| Gruh Finance | 558 | 50% | 128% |

| Century PlyboardsIndia | 322.7 | 33% | 42% |

| JK Lakshmi Cement | 463 | 6% | 30% |

| Sobha | 506 | 40% | 32% |

| J M Financial | 131.3 | 63% | 194% |

| HEG | 3189.5 | 1361% | 1434% |

| Bajaj Electricals | 574.5 | 84% | 170% |

| Ipca Lab | 665.8 | 15% | 3% |

| CDSL | 286.25 | 9% | – |

| Bata India | 744.4 | 37% | 29% |

| Cochin Shipyard | 491.2 | -6% | – |

| Essel Propac | 239.15 | 1% | 101% |

| Kei Industries | 381 | 117% | 570% |

| Accelya Kale Solutions | 1315.95 | -8% | 45% |

| Shalby | 204.8 | -14% | – |

FOR BENEFITS OF INVESTING IN PMS SCHEMES CALL – +91 8368931743.

In general, It is Impossible to save on the management fee (of~ 2.5%) by purchasing disclosed portfolio stocks on your own. Typically, by the time the fund makes a disclosure of the stocks they are holding, these stocks have already run up by well over 5-10%. Naturally, the fund manager wants you buy it on your own to take the prices higher after he purchases.

LOOKING TO INVEST IN THIS SCHEME?

Here’s 3 benefits of investing in this scheme through us:

[2] We don’t charge a 2.00% upfront fee for this scheme (or for any other PMS scheme) which helps the investors get maximum upside.

[3] Your Commission Structure/Management fee and all other expenses will remain same or will be lower – CALL US TO CHECK!

[4] We will also give in a free subscription to our website.

You yourself are into stock recommendation, then why recommend other PMS?

Just in case you don’t like me, you can choose this. Hence!

Just call me and I can get you started with the above, at better commission structure than Motilal will give you.

Dear Rajat

I have invested in Value Strategy PMS for past 18 months. Its performance is not good. Do you recommend to switch to IOP V2?

Enjoyed studying this, very good stuff, regards . A man may learn wisdom even from a foe. by Aristophanes.

I have taken Motilal oswal PMS and highly disappointed and will never suggest anyone to go for it, It is always better to go for mutual fund. They just keep on charging every month and you keep on loosing your money and their fund managers are not efficient enough to give you any profit.

I have lost almost 15% in last one year in Motilal PMS while in mutual fund in the same market has earned more then 10%.

So please beware and don’t get in to this PMS trick which is just money making trick of Ramdev Agarwal.

That doesn’t sound good. How long have you been invested for? I can assure you that I have seen very good returns over time, for all clients in fact far ahead of Mutual Funds. Ideally, stop looking at what they charge you every month.

I was thinking to go for PMS IOP , as per data they are showing excellent return ? may be due to fall in market specially in mid caps and small caps, how long you have been doing this ?

14 Years.

Rajat – proof of pudding in its eating. When the market is not doing so bad and you loose 25% it is beyond the understanding of investors who have put in their hard earned money. We go to experts to do better than market or at least what the market does and certainly not loose our capital. The fund managers can give all kind of logical explanations which i think anyone can give after the fact. Expertise lies when you can predict and grow the money and at least protect the capital

I agree absolutely. Have you lost money in this fund?

I am invested in IOP and am -25% as on date. Extremely disappointed with IOP performance. Invested from Jan 2018.

This seems correct. The portfolio has been down ~20% since beginning of the year. But that is true for most small/ midcap funds. Even then, I agree this has underperformed and not the top reccommendation.

I have invested in IOM from 2017 and I am at -26% of my portfolio.

Do not trust thir sales pitch, i am looking to withdraw but its on continuous dowanfall, no time to exit. Please keep away from Motilal.

Same here. Capital eroded big time. Invested in motilal since jan 2018.Stay away from motilal.

You should have switched at the right time. That was around February 2018.

Is it a good idea to exit MOSL IOP PMS now after having invested 30L in Sept 2017 with almost a loss of around 13L?

No, it may be a good time to work with a financial advisor – try it, it does work 🙂

Many retail investors have burnt fingurs and ruined capital in IOPV2 PMS scheme.Reasons being there is no bottom up approach, lack of systematic investment at various entry levels of stock price and investment in one go without keeping any cash aside have hit hard the returns.In case of severe market conditions, when small & mid caps have seen carnage you can’t go with your QGLP strategy specially in small caps. Timely exit from stock is also necessary. It is very miserable to see the performance of this scheme lagging behind the top small cap MF schemes due to inactive fund management. Investors can always find good returns in equities with prudent Asset Allocation through Multicap or Focused MF instead of chasing past returns in these kind of PMS schemes.

Retail burns money when they invest without any advisory, mostly on the recommendation of service provider.

Top advice: Call us, or any other good SEBI Registered investment advisor before getting started.