Motilal Oswal Financial Services Limited (“Motilal Oswal” or the “Company”) is a well-diversified, financial services company focused on wealth creation for all its customers, such as institutional, corporate, HNI and retail. The Company’s services and product offerings include wealth management, retail broking and distribution, institutional broking, asset management, investment banking, private equity, commodity broking and principal strategies. Motilal Oswal distributes these products through 1,534 business locations spread across 507 cities and via online channel to over 8, 00,385 registered customers.

WHATS DRIVING THE STOCK

Huge Opportunity in the Brokerage Business

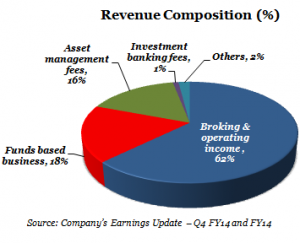

Revival in the economy, has increased trading volumes and hence commission revenue for the Company. Currently, the broking and related revenue contributes ~60 % of the total group revenue.

Over the next 5-6 years, India’s equity broking market size in terms of revenue pool is expected to grow 6 times. The current size of broking revenue pool estimated at Rs. 112 billion and is expected to reach approx Rs. 697 billion by FY 2020, comprising Rs. 243 billion in institutional and Rs. 454 billion in retail segment. **

** (Source: Company’s Corporate Presentation)

Factors to lead to this growth:

- Sustained economic, savings and income growth

- Increase in retail participation

- Increased ability of DIIs to mobilize savings

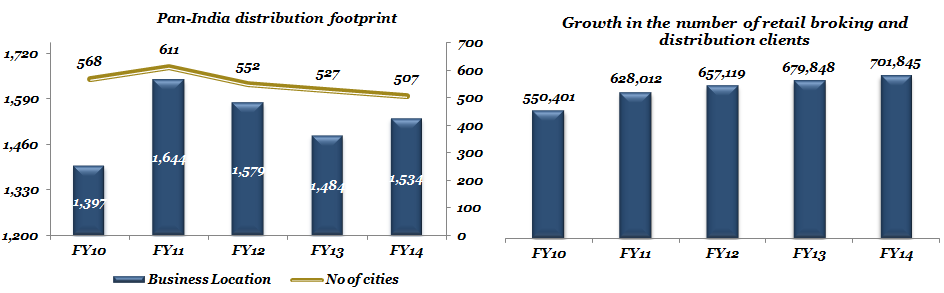

Motilal Oswal is one of the leading stock broking firms in India with a rapidly growing client base and wide distribution network. As of March 2014, Motilal Oswal operated from 1,534 business locations across 507 cities with a total client base of 8,00,385 which includes 701,845 retail broking and distribution clients.

Diversification Efforts to Yield Results in an Improved Economy

Recently the Company has invested in a new housing finance company – Aspire Home Finance Corporation Limited and is at an advanced stage in the process of commencing the business. Application for necessary approvals/license have been made to National Housing Bank, the sector regulator. Post grant of license, the Company plans to infuse Rs. 100 Cr in this new vertical.

Widespread Distribution Network

The Company’s financial products and services are distributed through a pan-India network. The business has grown from a single location to a nationwide network spread across 1,534 business locations operated by business associates or directly through own branches in 507 cities. This extensive network provides opportunities to cross-sell products and services, particularly as the company diversifies into new business streams. In addition to this vast geographical spread, the Company also offers an online channel to service customers based outside these geographies.

Intensifying competition from local and global players

The Company faces significant competition from Scheduled Commercial Banks who now offer 3 in 1 accounts giving flexibility to customers to have their brokerage accounts along with their savings account. Not only does this save the hassle of maintaining duplicate accounts but also makes it easier to transfer money between various accounts.

Further, the Company competes with other Indian and foreign brokerage houses and investment banks. Motilal Oswal faces competition in all its business lines; and the competition is not only from domestic but also from foreign institutions such as Franklin Templeton, JP Morgan, ABN Amro, and HSBC. The Company competes on the basis of a number of factors, including execution, product and service offerings, innovation, reputation and price which may limit the growth and affect the margins of the Company.

Businesses significantly correlated to capital markets

Motilal Oswal’s growth and profitability are, to a large part, dependent on the stable growth and functioning of the Capital markets. The Company’s business verticals like the securities business, venture capital management and investment banking are directly leveraged to performance of the capital markets. The growth of financial services sector will allow the Company to grow businesses in each of the verticals. In the event of any further downturn in capital market, the Company’s profitability may adversely get impacted.

** This stock analysis of Motilal Oswal is for information purpose only. This report should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis.