Product: Motilal Oswal Value Strategy PMS “Value PMS”

Focus: deliver higher returns by making investments in successful businesses managed by efficient management.

Concentration: The portfolio typically consists of 15-20 large cap stocks.

Ideal for: Ideal for investors looking to invest in large cap companies for long term wealth creation view. Note: Not more than 10-12% of portfolio is invested in a single stock

PMS Allocation:

- Large Caps: 65% – 100%

- Mid Caps: 0% – 35%

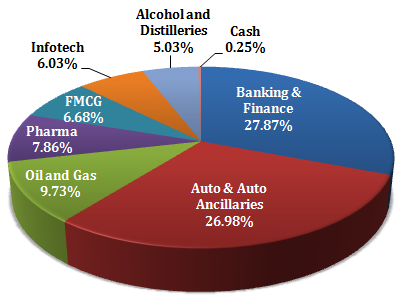

Top Sectoral Allocation

Current Top 10 Holdings as of December 31st 2016

| Company | % Holdings |

| BPCL | 9.73 % |

| Bosch | 9.09% |

| HDFC Bank | 8.66% |

| Sun Pharmaceuticals | 7.86% |

| Kotak Mahindra Bank | 7.77 % |

| Eicher Motors | 7.70 % |

| Asian Paints | 6.68% |

| State Bank Of India | 6.33% |

| TCS | 6.03% |

| Hero Motocorp | 5.14% |

Motilal Oswal Value Strategy – Buy and Hold Approach

In Value PMS stock selection is based on a thorough study of underlying long term potential of the company and with a view to hold those stocks for a long term so investors can benefit from the entire growth cycle of the business. Value PMS – BUY & HOLD strategy will lead to less churning of portfolio thereby lowering costs and enhancing returns for investors.

| Stocks | Purchase Date | Adjusted Purchase Price | Current Market Price | % Growth |

| Bosch Limited | Jun-03 | 497.00 | 22,834.85 | 4495% |

| Hero MotoCorp | Jun-03 | 253.65 | 3,240.35 | 1177% |

| Eicher Motors | Apr-12 | 2054.80 | 23,011.85 | 1020% |

| State Bank Of India | Jun-03 | 36.00 | 259.3 | 620% |

| HDFC Bank | Jul-08 | 201.00 | 1,287.55 | 541% |

| HDFC | Jan-06 | 241.80 | 1,336 | 453% |

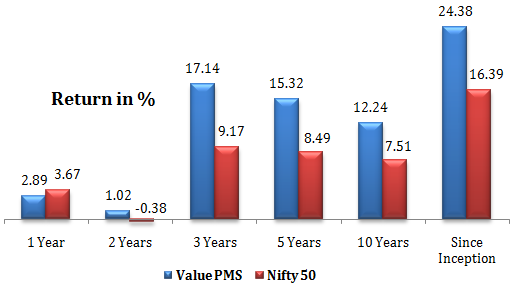

Performance Snapshot

Since Inception (2003), Value PMS has delivered annualized returns of 24.38% vs. Nifty 50 returns of 16.39%.

Note – Returns of individual clients may differ depending on time of entry in the PMS.

FOR BENEFITS OF INVESTING IN PMS SCHEMES CALL – +91 8368931743.

In general, It is Impossible to save on the management fee (of~ 2.5%) by purchasing disclosed portfolio stocks on your own. Typically, by the time the fund makes a disclosure of the stocks they are holding, these stocks have already run up by well over 5-10%. Naturally, the fund manager wants you buy it on your own to take the prices higher after he purchases.

LOOKING TO INVEST IN THIS SCHEME?

Here’s 3 benefits of investing in this scheme through a financial advisor like Sana Securities

[1] We don’t charge 2.00% upfront fees for this scheme (or for any other PMS scheme) which helps the investors get maximum upside.

[2] Your Commission Structure/Management fee and all other expenses will remain same or will be lower – CALL US TO CHECK! Its real.

[3] We will also throw in a free subscription to our website.

Hi Rajat,

3 queries – (1) does 2% fee go to the pocket of wealth manager OR Motilal Oswal? I have been advised to invest in this scheme by my bank otherwise and they offered a 1% reduction…

(2) what is the ideal holding period, also what is the annual fee.

(3) what is the kind of return to be expected if i invest twice its min. ticket size (investing period April17-Mar-20)

I have sent you a mail on this.

I have a 23 lakhs amount in PMS with HDFC.I will like to switch over to Motilal oswal PMS.

Pl let me what I lose when I exit and what I have to pay at entry.-all hidden charges.

and also why Motilal oswal PMS is better ?

1. Bajaz financial services asking me to invest in this fund. Will Bajaz will deduct 2% ?

2. is it better than lump sum investment in different mutual fund ?

3. Is it the right time to enter or wait ?

4. Since 2019 is election year, can we get maximum value by 2020/2021 ?

What is the current fee structure for Motilal Oswal PMS? What is the minimum amount to invest? Whom to contact for opening PMS?

Hi,

As a family we have a portfolio of more than 2CR. We are interested in investing in Value strategy. Are the management fee and other fees fixed or is there a possibility of lowering the rates?

regards,

Kiran

Management fee is fixed (even the stamp paper is pre-printed). The upfront fee varies based on your financial advisor. If you give our reference, we will get the entire 2% upfront fee waived off for you. In , I will be happy to do an analysis of your portfolio and give you my views / feedback on the same.

Let me know if you would like to speak over a call. You can drop me a WhatsApp message to schedule. My number is – 9833905054.

Dear Mr. Bindra .Even Motilal Oswal PMS is useless. I have lost 17 % in TEN months and they still keep deducting charges. They even exit from my loss making portfolio partially to cater to their charges. They never thought of exiting any stock and they are still holding on even if losses are more than 20%. Their Buy Wrong and Sit tight Policy will finally get me nowehere. I cant even exit completely, I will end up making even more losses. Theyare not even switching from mid-caps to large caps. They continue to accumulate losses, even when Sensex touches the sky.

Why cant you swtich from Mid Cap to Large Cap? You mean you are in a lock-in period?

This has never been a problem for our clients so just enquiring.

I have not been able to find a meaningful comparison of relative performance of PMS offered by various entities. Unlike the case of Mutual Funds, there is no comparable data available on the PMS’ performance. The only data we get is from the respective agency itself running the PMS (not from SEBI or AMFI, etc.) and the methodology adopted for calculating the performance/returns is never quite clear. Even though the PMS could be ‘discretionary’ and ‘non-discretionary’, with corresponding differences in the returns, the performance data of the PMS do not provide any break up for the two categories of PMS schemes, and perhaps the returns are computed on the entire AUM managed by the PMS provider – which could be quite misleading for an individual investor.

Since the PMS, by definition, is meant to be a customised product as per the preference of/restrictions placed by each investor, the returns generated by the PMS of even the SAME agency/fund house across its various investors would not be quite comparable.

Any thoughts on these points or any data available on the PMS performance offered by various agencies?