Expense Ratio: the amount an investor pays to a fund manager every year to manage his money. Expenses include fund management fee, agent commissions, registrar fees, and selling and promotional expenses.

Note: According to regulation 52 of SEBI Mutual Fund Regulations, there are limits on the total expense ratio (which includes investment management and advisory fees) charged by mutual fund schemes. Accordingly, equity mutual funds can charge a maximum of 2.50% every year to its unit holders while debt funds can charge 2.25 %.

Before, SEBI (Mutual Funds) (Second Amendment) Regulations, 2012, there were additional internal limits on these expenses. Mutual funds had to allocate a maximum of 1.25 % as management fee and 1.25 % as other expenses incurred by the AMC for marketing, distribution etc.

After SEBI (Mutual Funds) (Second Amendment) Regulations, 2012, SEBI has removed the sub-limits on expenses, giving AMCs the freedom to allocate the 2.50 % expense ratio the way they want to. What this means is that mutual fund companies are now incentivized to cut all middlemen (i.e. distributors) to try and earn the maximum of the 2.5% they are allowed to charge.

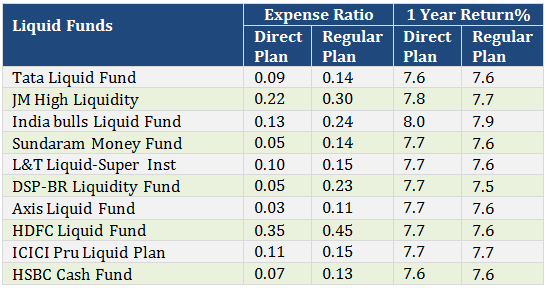

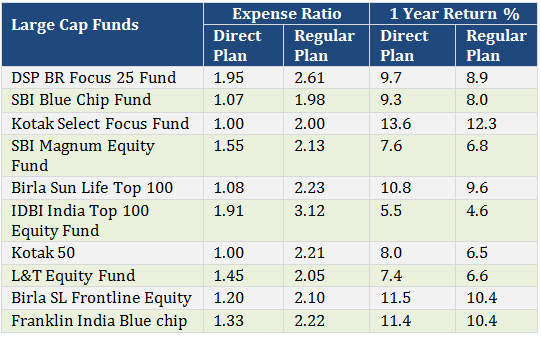

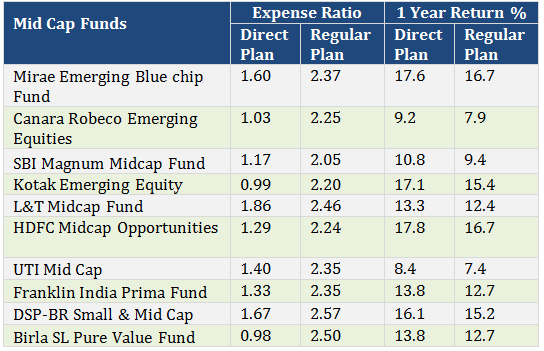

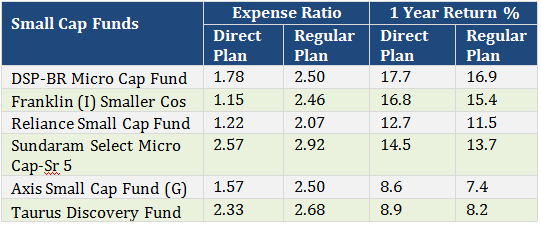

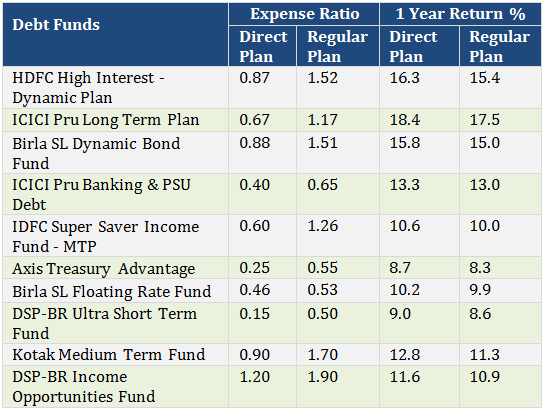

Expense Ratio of Top Performing Mutual Funds in Different Categories – Based on CRISIL Rankings

1 Year Return % – As of 10 January 2017

Different Expense Ratio results in different NAVs

The direct plan has a lower expense ratio (by 0.70%-1.00%) as compared to regular plans in the same schemes since there is no commission to be paid to the distributor under the direct plan.

Different expense structure for direct and regular plans results in different NAVs for both plans.

Though the portfolio for the regular and direct plans is same, the NAV for the direct plan is higher than regular plan due to lower expense ratio. For example, NAV for DSP BlackRock Micro Cap Fund – (Growth), Regular Plan is Rs. 51.307 and NAV for DSP BlackRock Micro Cap Fund – (Growth), Direct Plan Rs. 52.747 **As of 11 January 2016.

In DSP BlackRock Micro Cap fund, the expense ratio for regular plan is 2.5% and for direct plan is 1.78%, the difference is 0.72%.

Also Read: Difference between Direct and Regular Plan

What Does This Mean To An Investor?

Due to the difference in the NAV (because of lower expense ratio), the return you make on a direct plan is higher by approximately 0.5-1%. But choosing direct plans because they offer some 0.5% better return is not always the most logical investment decision.

Do not fall for a mere 0.5% to 1% p.a. excess return in direct plans. Cost of bad fund selection and poor investment discipline can be much higher. Further, a good investment advisor could add far more value and investment return compared to what he will charge. What’s more important is to select a good advisor and let him suggest when you should add/ reduce and switch. That said, if you are skilled and understand markets well; going for direct plan will help you in long term.

Services You Get While Investing Through a Regular Plan?

- Investment Recommendations: Investing through an Investment advisor will help you choose better fund across different categories depending on investors risk/return profile. The choice of a good fund vs. a poor fund could result in major performance difference over time.

- Investment Services: Investment advisor will review your portfolio periodically. By reviewing your portfolio and helping you re-balance, the advisor can further improve performance of your holdings.

For me the biggest concern area with direct plans is that an investor will always rely on the fund house for everything rather than a dedicated investment advisor who will offer choice of funds across fund houses.

how could an investment adviser could add far more value and investment return compared to what he will charge?

Try one to understand.

Thank you for telling the difference between direct and regular plans.As i was bit confuse regarding this.Now i got better picture about this, than before.Hope you will keep on posting to update us.