When I don’t know how to get attention of people, I try this:

Do you know that there are more people alive today than have ever died.

Yes, you can fact check this. The number of people alive on this planet today outnumber (by far) the number of people who ever died on this planet.

Now that I have your attention, I will talk about the markets. One of the most interesting things that I learnt as a statistician is that numbers never tell the full story. They can be broken, stitched together and multiplied with very real facts to form bizarre belief systems.

Try this as we end 2019:

Indian markets have outperformed all other emerging markets this year. Nifty 50 has gone up by 15% from 10,663.5 (23rd December 2018) to 12,273.45 (23rd December 2019).

Yes, you can fact check this.

Earnings growth | Lower corporate tax rate | Earnings growth because of a lower corporate tax rate are some of the verifiable reasons that have contributed to this.

Cleaning up of bad assets at banks | surprisingly above average monsoons | and a final solution to the non-existent global trade tariff problems should also find a notable mention.

Cleaning up of bad assets at banks | surprisingly above average monsoons | and a final solution to the non-existent global trade tariff problems should also find a notable mention.

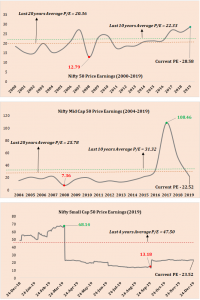

Now if you want disparity to truly stand out, then contrast this bumper outperformance of the Nifty to the Nifty Midcap 50 and the Nifty Smallcap 50 index. Both these indices continued their bad performance with Nifty 50 midcap falling by 3.32% and the Nifty50 small cap companies falling by 10.87% over the last 1 year.

No, it is not because they went up a lot in previous years.

Absolute returns below:

Yes – Nothing has moved and if somebody proves to you otherwise, then he just knows how to get your attention. In fact the not so liquid Group B stocks have fallen by over 60%.

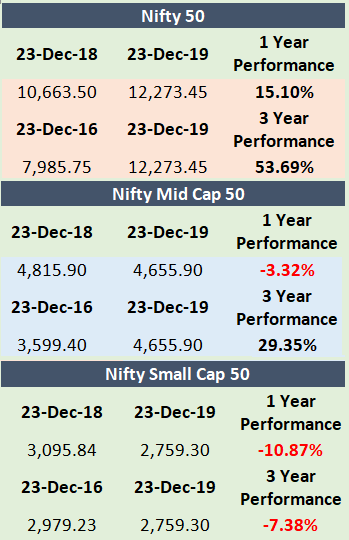

As you would have heard by now, on a close analysis, you will realize that the recent rally in the Nifty 50 is only supported by the top 10-15 constituents. Excluding the top 15 gainers, the Nifty would have returned negative in the same period.

Let’s take a close look at Nifty50’s one year performance to understand this:

Why are the broader markets on a tear?

There are multiple explanations for this, I will talk about each of these in the order in which I favor these (the most probable explanation first).

Hope Trade: That there is hope that markets will perform better in future given all the reforms that the governement has done and that earnings will improve in times to come. Too much money has been pumped into the system on the back of constant rate cuts post the demonetization exercise. The hope if at all is that more reforms will be undertaken and more investors will jump in at which time the smarter ones dealing with their own money (and not client money) will quietly make an exit.

FIIs are back: Recent figures highlight that FIIs are back to investing aggresively in India. So what if everybody knows that FII money is just hot money which comes in and out once every few weeks. For now though, FIIs have gone crazy! They don’t know what to do with the wealth that just keeps multiplying. Perhaps we are half way into that cycle where people believe they have found the formula after all.

There is no other asset class that is making money: Stocks have been making good money for a few years now. That traditional asset classes like real estate and gold, where prices have been stagnant for the past 6 odd years. So it is true that a rise in stock prices itself is fuelling this rally further. Until there is a big enough correction, people are unlikely to stop their investments and redeem their existing holdings.

What Does the Future Hold?

Never before have I witnessed so much awareness amongst the financial community and the retail investors alike. Investors are certain, that markets will fall. So certain infact, that the most educated investors are waiting with stacks of cash to invest in markets when they fall.

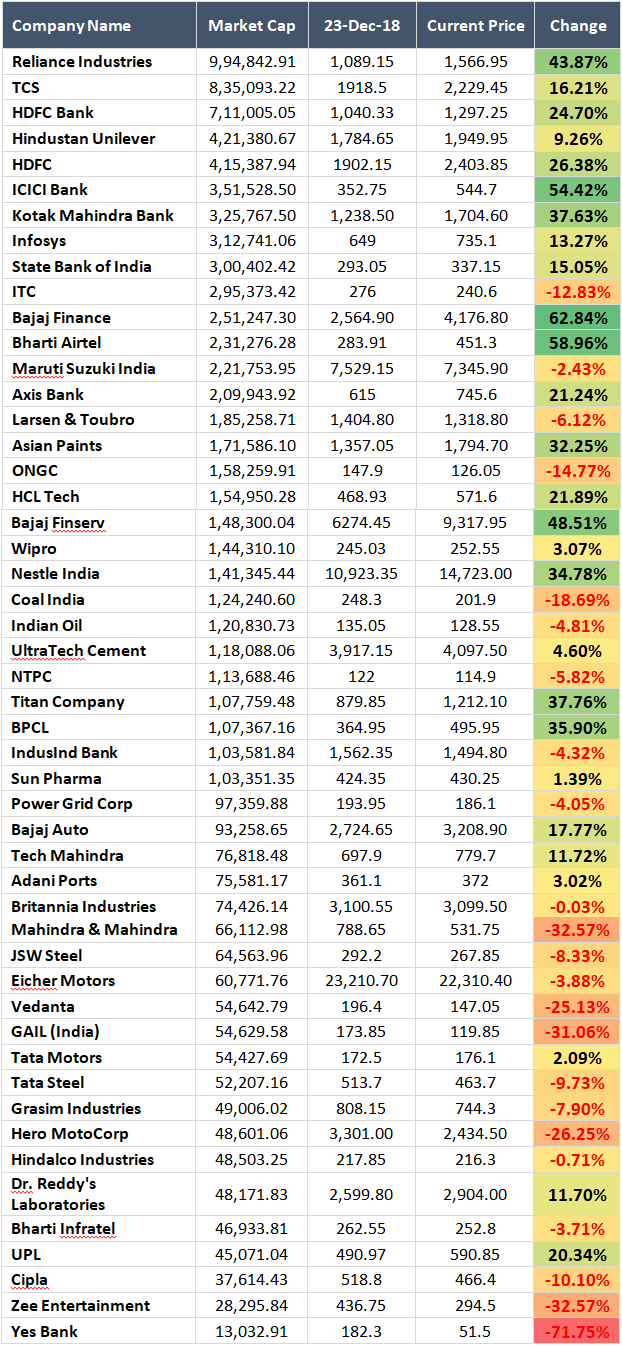

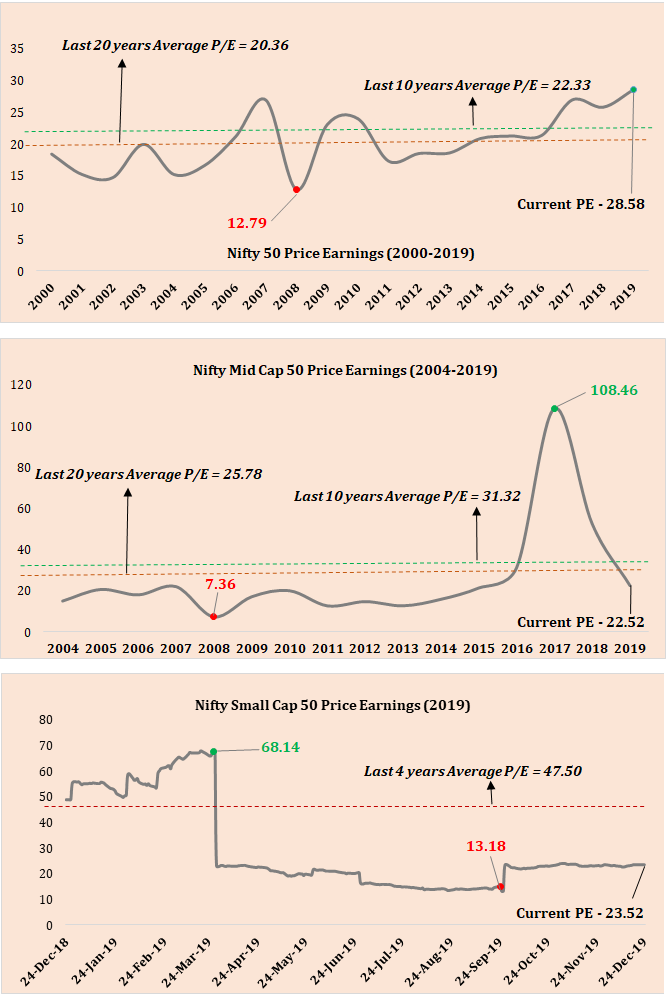

Sure the top end of the market is not valued right but markets don’t fall with such unanimity and harmony of thought. Further, the overvaluation is limited only to the top 15 stocks, a point which comes out well in the valuation chart below.

In fact, the more you go down in the list of stocks, the more value you will find. Going forward one of these 2 things will happen:

EITHER, there will be rebalancing – fund managers and investors sell frontline stocks and buy small and mid cap stocks (which is rational). But this will happen only if there is no global slowdown or catastrophic event.

OR, things will end badly whenever they do. The reason why this might happen is because unlike in bull markets where investors rely on factors like growth, earnings, economic outlooks and a host of numbers before they invest; in bearish markets there is no bottom. The reason why people sell is always the same – fear and genuine margin pressure. If things go bad, the selling could be quite brutal. That said, I still dont find many overleveraged investors.

A good thing to do would be to rebalance your portfolio and add more the undervalued stocks in the mid and small cap space and increase allocation to fixed income products.

You are right about the awareness amongst many about the high valuations of stocks. Of course there are also a lot of doom and gloom videos on Youtube and watsapp to this effect. In short, this is the ”most hated bull market”.

As it has happened in 1992, 2001 or 2008; its the retail who will lose it all. In the previous bull runs, most of the retail were active investors. Now they are mostly passive as they invest via SIP’s and mutual funds.

The same game is being played what was earlier played out by Harshad Mehta or Ketan Parekh. In that era, all kinds of stocks was being played up. This time, the top 20 stocks is being taken up. The pump and dump operations will be done by the FII’s. Its also surprising about why these FII’s should invest when the macro fundamentals of the economy is bad and the prices of these hallowed stocks are high.

A year or so ago, MD Nalapat; a right wing economist wrote an article where he pointed out to a cabal of operators who have parked funds abroad and will get it in to play havoc on the markets and dent the economy. Probably sounds like a conspiracy theory, but looking at the insane way ”the FII’s” are buying, maybe its worth a thought.

Its going to end badly and once again the retail investor is going to get singed and bring an end to this miserable bull market.

I hope you are wrong, even if I agree with you in part 🙂

VERY MUCH LOGICAL AND PRAGMATIC EXPLANATION. I APPRECIATE YOUR ANALYSIS. BUT AS THE SAYING GOES ……Financial Markets are governed by only two emotions, GREED and FEAR. And the sane minds always do opposite to that of crowd mentality. Emotional Control is real pathway to WISDOM, whereas Intelligence is a masking eclipse over our Wisdom!

Totally.