Nestle India (“Nestle” or the “Company”) operates in the Fast Moving Consumer Goods (FMCG) segment, with a focus on milk, coffee and nutritional products. Nestle India’s market cap stands at Rs. 66,301.81 Cr.

Nestle India is subsidiary of Nestle S.A., headquartered in Switzerland and was incorporated in India in 1956 and opened its first manufacturing unit in 1961 in Moga, Punjab. Now, the Company has PAN-India presence with 8 manufacturing facilities and 4 branch offices in Delhi, Mumbai, Chennai and Kolkata to help the sales and marketing activities.

What’s Driving the Stock?

Brand Name

The Company has extremely strong brand equity with brands like Nescafe, Nestea, Maggi Noodles, Kit Kat chocolates, Polo, Lactogen, Cerelac, and Milkmaid.

The Company’s flagship coffee product Nescafe is has become synonymous with the word ‘Coffee’ and enjoy ~55% share if the Indian coffee market. One out of every two cups of instant coffee consumed in India is Nescafe.

Robust Distribution and Sales Network

The Company has one of the best distribution network in FMCG segment. The combination of brand equity and fine distribution is evident from the fact that after the ban on Maggi noodles was lifted in November 2015, the product’s market share surged from 0% to over 50% in instant noodle space within 6 weeks. The Company’s flagship instant noodle held around 77% market share before the ban was implemented in June 2015.

Strong Parentage

The Company is part of Nestle S.A., from which it reaps various benefits including technical expertise, pre-tested product catalogue, internationally recognized products, insight to ever-changing consumer demand, etc. The Company also has access to Nestle Group’s proprietary technology, brand expertise and extensive centralized R&D facilities.

Upcoming Growth

After dealing with the Maggi Noodles issue, the Company has decided to reduce its turnover dependency on Maggi by rolling out new products. In order to deal with loss of profits of Rs. 450 Cr caused by the ban and to reduce the burden on Maggi which accounts for 25% of total turnover, the company is set to launch 25 products across various categories in coming quarters.

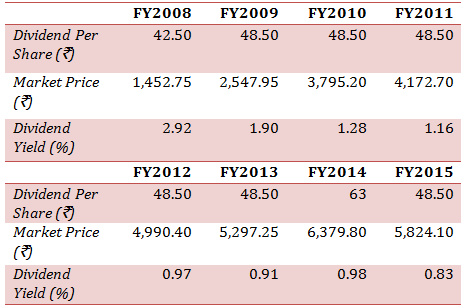

Consistent Dividend Payer

The Company is known for giving dividends consistently and has maintained an average dividend yield of 1.36%.

Average Dividend Yield (FY 2008 – FY 2015) = 1.36%

What’s Dragging the Stock?

Damage to Brand

A major concern for the company after the Maggi ban was to overcome the damage caused not just in quantity but also in quality. The number of critics the Company has increased dramatically which constituted in permanent damage in market share and product saliency. As a result, the Company is focusing on rolling out new products to recreate trust and ensure quality of products in the market. How the market perceives Maggi and other new products rolled out by the Company in future will have a crucial impact on operations and branding and consequently on the share price of Nestle India.

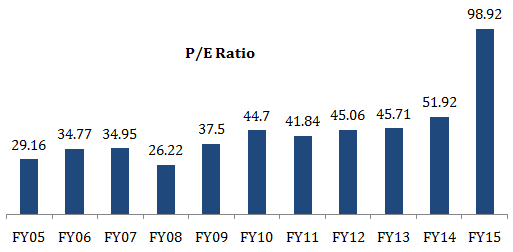

Over Valuation

Nestle India is currently trading at a P/E ratio of 83.20, almost double from its P/E for FY14. This is because of lower earnings reported due to Maggi ban in FY 2015.

Average Ten-Year P/E Ratio (FY05-FY15) = 39.18

Fierce Competition

In 2015, Nestle India was struck with double whammy, besides a ban on Maggi, Patanjali entered the FMCG market and took up large chunk of Nestle’s business with wide range of products and low prices. Although Nestle has no direct competitors in public space, it faces fierce competition product wise from brands such as Amul, Sunfeast, Mother Diary, etc.

| Nestle India Product | Competing Products in the Market |

| Maggi | Top Ramen, Patanjali Atta Noodles, Knorr Soupy Noodles, Yippee (Sunfeast) |

| Nescafe | Bru (Hindustan Unilever),Tata Coffee |

| Chocolates: Kit Kat, Bar One, Classic, Munch | Cadbury Dairy Milk, Amul Chocolates, Mars and Snickers |

| Milkmaid, Nestle Everyday | Amul Milk, Mother Diary |

| Maggi Tomato Ketchup | Kissan, Del Monte, Heinz |

Raw Material Price Volatility

FMCG Sector as whole, including Nestle India, faces tough challenge of hike and price volatility in both imported and domestic raw materials. The Company is also further dependent on agricultural commodities which need to meet stringent quality standards and on natural resources where alternatives are not viable.