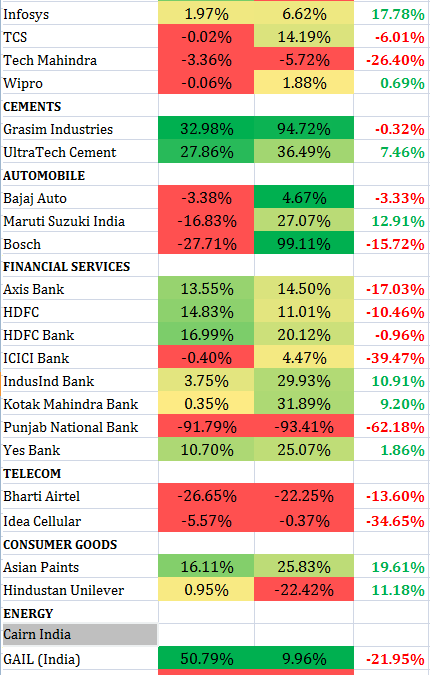

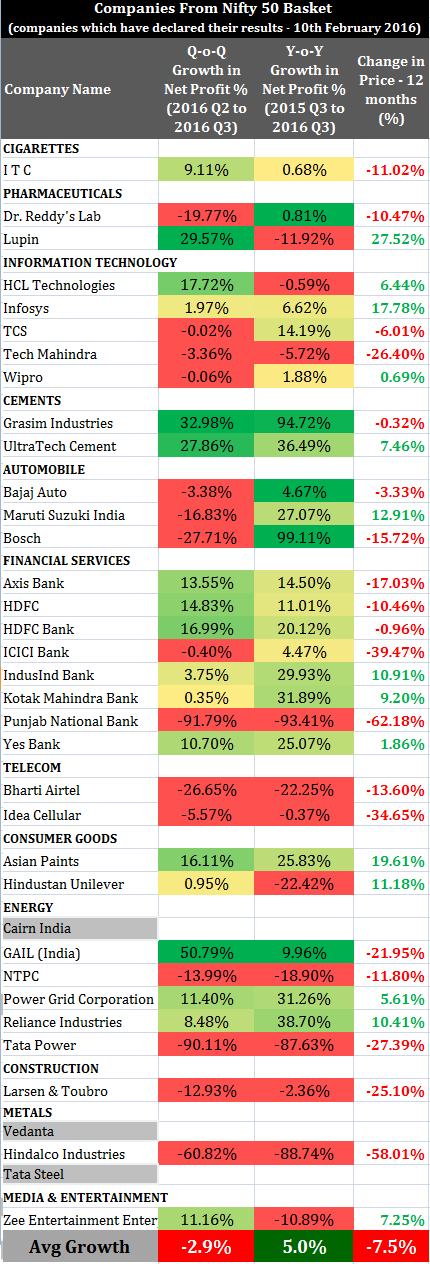

Yesterday we analyzed earnings trend for constituent companies of the S&P CNX Nifty. On year-on-year basis (Q3 2015 to Q3 2016) earnings showed a growth of 5.0%. In comparison, average stock prices went down by 7.5% during the same period*.

* Based on stock prices as on 1st January for each year.

Current PE Valuation of the Nifty = 19.46

Excel Calculation sheet here – 33 Nifty Company Result

Key Points about Nifty Results for Q3:

- The analysis is based on the results of 33 out of 36 Nifty companies which have declared results so far.

- The analysis is a broad indication of earnings trends. We have excluded 3 companies from this analysis – Vedanta Limited,Cairn India and Tata Steel due to uneven numbers on account of change in accounting policies /exceptional items.

- Earnings are improving while stock prices are showing a declining trend.

- On year-on-year basis there is an average growth of 5.0% in profitability. The benchmark Nifty went down 7.50 % in the same period.

- We expect the markets to rise by 10-20% over the next 6-9 month period.

- Valuation-wise markets are not expensive; trading at PE multiple of 19.4 on trailing basis, a discount of 18% from the PE multiple of 23.6 from the peak of last year. This is on account of correction in stock prices and not because of any substantial improvement in earnings.

- The broad analysis shows mixed bag of earnings from most sectors other than financial services which witnessed major decline in profitability.

- Fundamentally (besides valuations) things are looking good at macro level.