Public Sector Banks (PSBs) in India have performed rather poorly over the past 3-4 years. For the most part this has been on account of Non Performing Asset (NPA) related worries which have so far been brushed under the carpet. The current level of NPAs as disclosed by most public sector banks are far from reality and made possible because of the flexibility enjoyed by PSBs in terms of disclosure requirements.

Non Performing Asset (NPA) – Meaning

NPAs refer to loans which are in risk of default. Reserve Bank of India (RBI) defines NPAs as below:

An asset, including a leased asset, becomes non-performing when it ceases to generate income for the bank.

As per guidelines issued by the RBI, banks classify an account as NPA only if the interest due and charged on that account during any quarter is not serviced fully within 90 days from the end of the quarter.

Basis of Classification of Non Performing Asset (NPA)

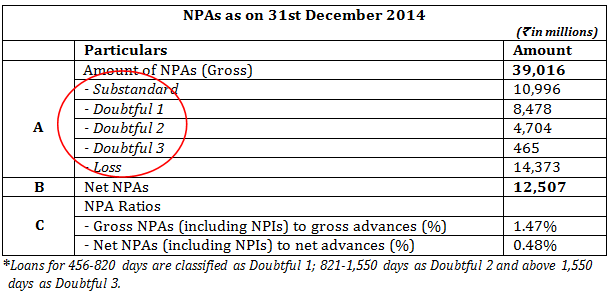

Banks are required to classify NPAs into the following 3 categories based on how long do they remain non-performing.

The three categories are – Substandard Assets, Doubtful Assets and Loss Assets.

- Substandard Assets – If an account remains as NPA for a period less than or equal to 12 months

- Doubtful Assets – An asset would be classified as doubtful if it has remained in the substandard category for 12 months.

- Loss Asset – A loss Asset is one where loss has been identified by the bank’s internal or external auditors or upon an RBI inspection.

Example- Axis Bank Classification of NPAs

Implication of High NPAs for Banks

Banks with high level of NPAs effectively have lesser funds to advance i.e. lesser funds on which they can potentially earn interest income. Other negative impact of high NPAs –

- High level of provisioning [See Footnote] (banks are required to keep aside a portion of their operating profit as provisions, higher NPAs will increase the amount of provision thereby impacting the profitability);

- Burden on maintaining capital adequacy ratio;

- Increased pressure on Net Interest Margin (NIM);

- Reduce competitive position

Key Ratios for Asset Quality

Gross Non-Performing Assets (GNPAs): Gross NPA is the sum of all loan assets that are classified as NPA as per RBI guidelines. Gross NPA Ratio is the ratio of gross NPA to gross advances (loans) of the bank.

Non-Performing Assets (NPA) ratio: Net NPAs are calculated by deducting provisions from gross NPAs. The net NPA to advances (loans) ratio is used as a measure of the overall quality of the bank’s loan book.

Net non performing assets = Gross NPAs – Provisions

NPA ratio = Net non-performing assets / Advance

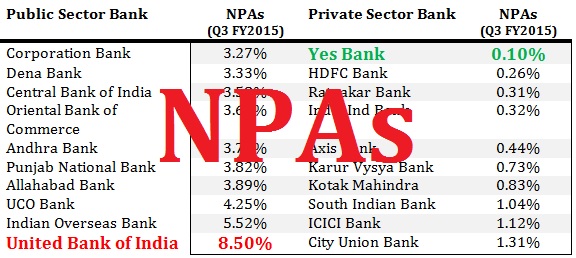

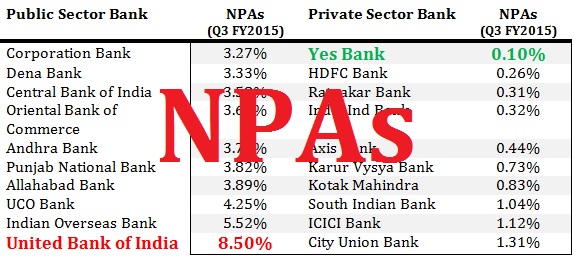

Non Performing Asset (NPA) | Public Sector Banks | Private Sector Banks

| Public Sector Bank | NPAs (Q3 FY2015) | Private Sector Bank | NPAs (Q3 FY2015) |

| Corporation Bank | 3.27% | Yes Bank | 0.10% |

| Dena Bank | 3.33% | HDFC Bank | 0.26% |

| Central Bank of India | 3.58% | Ratnakar Bank | 0.31% |

| Oriental Bank of Commerce | 3.68% | IndusInd Bank | 0.32% |

| Andhra Bank | 3.70% | Axis Bank | 0.44% |

| Punjab National Bank | 3.82% | Karur Vysya Bank | 0.73% |

| Allahabad Bank | 3.89% | Kotak Mahindra | 0.83% |

| UCO Bank | 4.25% | South Indian Bank | 1.04% |

| Indian Overseas Bank | 5.52% | ICICI Bank | 1.12% |

| United Bank of India | 8.50% | City Union Bank | 1.31% |

For Private sector Banks, Yes Bank is the best performer, followed by HDFC, IndusInd, and Axis. At the other end, for Public sector Banks, United Bank of India is the worst performer followed by Indian Overseas Bank, UCO Bank, and Allahabad Bank.

Some of the other public sector banks which have significant amount of NPAs include IDBI Bank (3.05%), SBI (2.80%), Bank of India (2.50%), Canara Bank (2.42%) and Syndicate Bank (2.38%).

Increasing bad loans have been a concern for the RBI for many years. The NPA problem is far graver for PSBs compared to their private sector peers.

Increasing bad loans have been a concern for the RBI for many years. The NPA problem is far graver for PSBs compared to their private sector peers.

RBIs Proposed Relaxation – An Even Bigger Worry

In order to help PSBs struggling with high NPAs, RBI proposed relaxed norms on April 6th 2015. Accordingly, banks are now spared from classifying certain assets as NPAs for two more years. This will reduce the amount of loans which need to be classified as bad loans.

In other words, banks can now go easy on provisioning against these bad loans. Less provisioning helps banks in not only reporting higher net profit but more importantly the banks effectively have more capital to deploy. This is because once an asset has been classified as NPA, it reduces the advance-able deposit available with the bank.

IF BANKS DO NOT CLASSIFY AN ASSET AS NPA, THEY NATURALLY HAVE MORE MONEY TO ADVANCE TO EARN INTEREST INCOME ON. IF A LARGE PORTION OF NPAs GOES UNREPORTED, THE BANK COULD REACH A SITUATION WHERE IT HAS ADVANCED MORE MONEY THAN IT HAS AVAILABLE – A TECHNICAL BANKRUPTCY.

By giving this leverage ultimately RBI is delaying the inevitable, at some point of time the NPA bubble will burst. I have been negative on public sector banks for over 3 years. I maintain this view (read here).

[Footnote]

Provisioning Norms –

- For substandard loans, a general provisioning of 15% on the total outstanding amount is made if the loan is secured, for unsecured loans the total provisioning that needs to be done is 25% on the outstanding balance;

- For doubtful assets, provisioning of 100% on the total outstanding amount is made if the loan is unsecured, for secured loans the total provisioning is in the range of 25% to 100 % on the outstanding balance depending upon the period for which the asset has remained doubtful;

- Loss assets should be completely written off. If loss assets are permitted to remain on the books for any reason, 100 % of the outstanding amount should be provisioned.

Hello, your article was quite informative. I have worked in US Mortgage Foreclosures. I am trying to understand the Foreclosure procedures in India. Can you please tell me how is the NPA in India managed? What happens to the properties in default and the borrowers who have defaulted on their payments?

please write me an email with this – rajat@sanasecurities.com

I have written extensively about these issues. Search on google you’ll find my older works on this.

While the media reports are highlighting the sever problem of rising NPAs, it is surprising to note that the Banks appear to be not worried about the gravity of the problem. Many accounts are allowed to flourish and been refinanced despite clear signs of stress. I have details of many such corrupt practices…

Valuable information

I HAVE TAKEN HOME LOAN FROM UCO BANK ON 2000 BUT CURRENT STATUS IS IN NPA SO CAN I KNOW WHAT IS THE FINAL REPAYMENT UNDER OTS SCHEMES reply as soon as possible

I have no idea.

We have taken loan from Apsfc for 77 lacks and paid 122lacks towards principal and interest our account NPA in the year of 2014.Apsfc as per their accounts principal as 71lacks and interest as 14crores .pl advice us how to settled our account.

I am reading this article in Mar 2020, your below statement in the article is very true now and its happening …

“By giving this leverage ultimately RBI is delaying the inevitable, at some point of time the NPA bubble will burst. “