Orbit Corporation Limited (“Orbit Corp” or the “Company”) is a real estate development company with significant operations in the Island City of Mumbai. The Company is a provider of premium realty solutions to High Net Worth individuals (HNIs) and eminent personalities from corporate houses. Orbit Corp businesses include: redevelopment projects in Mumbai and developing high-end residential and commercial properties.

This Stock Analysis report presents a long term outlook and the future prospects of Orbit Corporation.

WHAT’S DRIVING THE STOCK

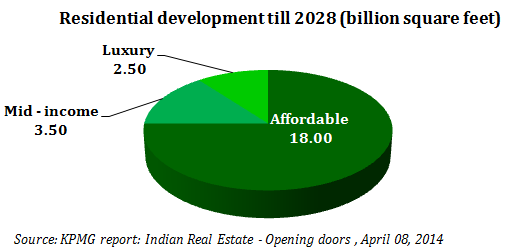

Latest trend in Real Estate: Luxury Housing

Luxury housing is one of the fastest growing segments among residential housing. According to KPMG report: Indian Real Estate – Opening doors – 2014, between 2008 and 2013, about 182 luxury projects comprising 25,570 units were launched and many of these are already owned by high net worth individuals (HNIs). In India, it is expected that HNI population would more than triple to 3,29,000 by 2018. According to the report, it is expected that India will require 1.5 million luxury houses over the next 15 years, which gives immense opportunity for the Company which caters purely to the luxury segment.

The latest trend among luxury housing is branded residences and gated townships. Orbit Corporation has already taken steps to avail this opportunity and started its planning to develop a luxury gated township with high-end amenities and features at Mandwa to attract more HNIs and other eminent customers.

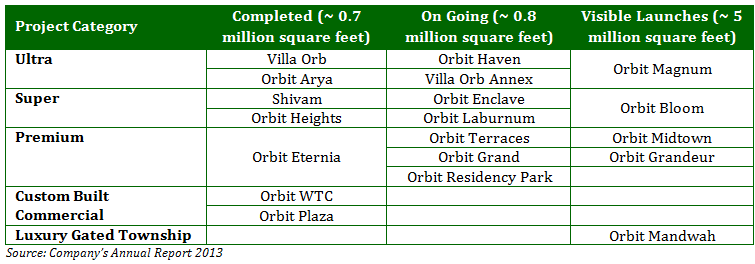

Orbit Corporation – Strong Project Pipeline

Orbit Corporation project portfolio consists of luxury residential apartments being developed in South Mumbai, South Central Mumbai and Suburban Mumbai. The Company has a strong future pipeline of projects in all the project categories like ultra, super and premium. Custom built commercial and luxury gated township. Future sales from ongoing projects like Orbit Enclave, Orbit Terraces, Orbit Residency Park, Orbit Grand, Orbit Laburnum, Orbit Haven and Villa Orb Annex is likely to increase the revenue stream and profit margins of the Company in the near future.

Redevelopment Projects – Huge opportunity

The Company’s business model is primarily driven by redevelopment of old and dilapidated buildings in Mumbai. The Company focuses on redevelopment of old and dilapidated buildings in South Mumbai. This business model enables the company to strengthen its position in South Mumbai, where there is a scarcity of land. The redevelopment projects present huge opportunity as there are 19,642 dilapidated buildings waiting for redevelopments, according to MHADA data.

These old and dilapidated buildings offer huge opportunity for the Company and enable it to increase its revenue stream in near future by taking in large redevelopment projects.

WHAT’s DRAGGING THE STOCK

Risks related to real estate projects – Long gestation period

Real estate sector is a highly capital-intensive industry with long gestation periods. Revenue generation could take many years after the initial conceptualization of a project. Since most of the projects have a long gestation period (4-5 years), the uncertainties and risks involved are high. Any delay in the construction period leads to increased cost and the same affects the profitability of the Company.

Missing out on Mass housing & mid-size housing opportunity

With the economy back on track, mass housing or the mid-size housing requirement is expected to witness good growth over the coming years. The growth in these segments is attributed mainly to lower interest rate on housing loans, increase in disposable income with salaried class, increase in urban middle class population, and shift in preference from rented house to owned house etc.

Since the Company has a focus on select group of buyers – high end or up market buyers, it may lose out on the opportunity presented by the mass housing or the mid-size housing market. Moreover the luxury or high end segment may not witness the growth in revenues and profit in line with mass housing market.

Intense Competition

The Company competes with players such as the Lodha Group, Indiabulls Real Estate, Raheja Developers, etc. The entry of new and established players with local and national presence can affect the acquisition of potential targets in the existing and new markets. With growing competition, it will be difficult for the Company to sustain its prices as numbers of high end or luxury houses from other developers give the company tough competition.

Geographical Concentration

The Company’s strategy is highly concentrated in luxury real estate development in South Mumbai. Any adverse changes in the demand pattern in the Mumbai region, changes in local development control regulations or local political situation, etc may affect the sales of the company and thus could impact Orbit’s financials and valuation significantly.

________________________________

** The stock analysis of Orbit Corporation including the financial analysis report linked above, is for information purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis.