Page Industries Limited (“Page Industries” or the “Company”) is engaged in the manufacturing, distribution and marketing of Innerwear, Athleisure, Sleepwear and Swimwear for men, women and kids.

The Company is the exclusive licensee of Jockey International Inc. (USA) in India, Sri Lanka, Bangladesh, Nepal, UAE, Oman and Qatar, and for Speedo International Limited (UK) in India and Sri Lanka.

Jockey products are retailed through 620 exclusive brand outlets (EBOs), over 800 departmental stores and 50,000+ multi brand retail stores in 2000 cities and towns across India.

As of 31st March, 2019, Speedo brand is available at 1299 stores including 42 exclusive brand outlets and 46 large format stores across 155 cities.

Online presence – Exclusive Online Store – jockeyindia.com. Also available at amazon, Flipkart, Myntra, Jabong, Koovs, Paytm, Zivame, Nykaa, Limeroad, Tata Cliq, Shopclues.

Installed capacity across various units spread is over 2.40 million sq. ft in 14 locations in the state of Karnataka & 1 location in Tamil Nadu.

Product Portfolio

| Innerwear (Men) | Innerwear (Women) | Athleisure (Unisex) | Juniors | Socks |

| · Vests

· Briefs · Boxer Briefs Trunks · Boxer Shorts · Inner Tees · Thermal Wear |

· Brassieres

· Sports Bra · Panties · Camisole · Crop Top · Tank Tops · Shapewear · Thermal Wear |

· Bermudas

· Track Pants · Lounge Pants · Sports Shorts · T- shirts · Polo T-shirts · Gym Vests · Yoga Pants · Sleepwear · Jackets · Sweat shirts |

· Vests

· Briefs · Trunks · Camisole · Panties · Shorties · T-shirts · Polo T-shirts · Boxer Shorts · Knit Shorts · Knit Tracks · Tank Tops · Shorts · Leggings |

· Formal

· Casual · Sports Performance |

| Towels

· Face · Hand · Bath

|

Financial Position

| Particulars | FY15 | FY16 | FY17 | FY18 | FY19 |

| Revenue (In Rs. Cr.) | 1,543.02 | 1,783.43 | 2,127.33 | 2,551.37 | 2,852.20 |

| Growth | – | 15.58% | 19.28% | 19.93% | 11.79% |

| EBITDA (In Rs. Cr.) | 319.00 | 377.10 | 413.22 | 540.67 | 616.92 |

| EBITDA Margin | 20.67% | 21.14% | 19.42% | 21.19% | 21.63% |

| EBIT (In Rs. Cr.) | 301.36 | 353.30 | 388.50 | 512.68 | 585.86 |

| EBIT Margin | 19.53% | 19.81% | 18.26% | 20.09% | 20.54% |

| PBT (In Rs. Cr.) | 293.31 | 344.28 | 394.82 | 517.51 | 606.03 |

| PAT (In Rs. Cr.) | 196.02 | 232.66 | 266.28 | 346.98 | 393.94 |

| PAT Margin | 12.70% | 13.05% | 12.52% | 13.60% | 13.81% |

| EPS (In Rs.) | 175.74 | 208.59 | 238.73 | 311.08 | 353.19 |

| EPS Growth Rate | – | 19% | 14% | 30% | 13.5% |

| Historic P/E (Closing Price of 31st March) | 78.13 | 58.09 | 61.24 | 72.92 | 68.65 |

| CURRENT P/E (based on price of 18th June – Rs. 20230.35) | 57.28 | ||||

| Shareholder funds (In Rs. Cr.) | 386.76 | 505.23 | 665.78 | 847.30 | 774.99 |

| Minority Interest (In Rs. Cr.) | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Debt (In Rs. Cr.) | 134.40 | 73.43 | 67.26 | 49.56 | 72.53 |

| Cash (In Rs. Cr.) | 4.42 | 8.65 | 20.58 | 66.88 | 44.05 |

| D/E | 0.35 | 0.15 | 0.10 | 0.06 | 0.09 |

| Interest Coverage | 19.15 | 24.71 | 22.93 | 32.49 | 37.94 |

| ROCE | 57.82% | 61.05% | 53.00% | 57.16% | 69.13% |

| ROE | 50.68% | 46.05% | 40.00% | 40.95% | 50.83% |

Quarterly Performance

| Quarterly Results | Q4 FY 2018 | Q3 FY 2019 | Q4 FY 2019 | Q-o-Q % | Y-o-Y % |

| Revenue (In Rs. Cr.) | 608.40 | 738.32 | 607.86 | -17.67% | -0.09% |

| EBITDA (In Rs. Cr.) | 146.84 | 165.25 | 119.68 | -27.58% | -18.50% |

| EBITDA Margin | 24.14% | 22.38% | 19.69% | ||

| PAT (In Rs. Cr.) | 94.22 | 101.89 | 74.98 | -26.41% | -20.42% |

| PAT Margin | 15.49% | 13.80% | 12.34% | ||

| EPS (Rs.) | 84.47 | 91.35 | 67.23 | -26.40% | -20.41% |

Q4 FY 2019 Highlights:

- Jockey has a market share of 19-20% in premium men’s innerwear, 5-6% in women’s innerwear, 6-8% in athleisure/ outerwear category.

- Sales from EBO’s constitute 16% of total turnover.

- Ecommerce constitutes 4% of sales.

- Volume growth was mere 1% for Q4 and 6% for FY19

- FY 2020 Guidance:

- Strong Guidance – Management has indicated volume growth of 10% and value growth of ~20% for FY20E led by premiumization, price increases and improved sales mix.

- EBITDA margin is likely to be ~20-22% in FY20E.

- The Company increases prices in range of ~3-5% every year. No price increase is expected in Q1 FY20.

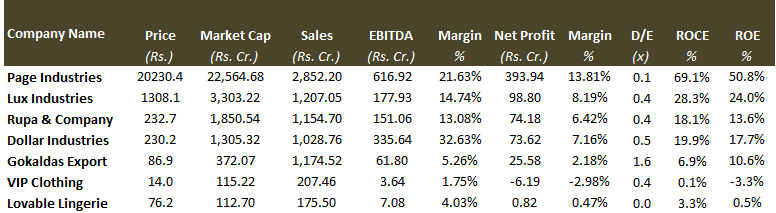

Peer Comparison

WHAT’S DRIVING THE STOCK?

Strong Brand Recall of Jockey and Diversified Product Portfolio

Page Industries (Jockey) currently has ~19-20% market share in men’s premium innerwear 5% market share in the premium women’s innerwear and ~ 8% in the athleisure segment. With its strong brand recall, the Company rarely resorts to discounting and is able to pass on raw material price hikes. The product portfolio is being diversified to increase the contribution of women’s wear children’s wear, active wear and athleisure.

Increase in No. of Stores

Page Industries has added ~150 stores in FY19 taking the total store count to 620 EBOs. The management has confirmed its aggressive store expansion plans wherein it expects to take the total store count to 1000 stores over the next two years.

Asset Light Business Model

To keep the business model asset-light, Page Industries is outsourcing a bigger chunk of its manufacturing operations to third parties. By FY20, nearly 40% of such activities will be undertaken by external suppliers, in comparison to the 20-25% in FY19. In the long run, the management intends to focus primarily on branding and retailing.

Capacity Expansion – The Company is working towards doubling its installed capacity from the existing 260 million pieces to 520 million pieces in the next 5 years through greenfield expansion projects in Anantpur (Andhra Pradesh) and Mysore (Karnataka).

- Anantpur (Andhra Pradesh) – Page is setting up a manufacturing facility of 0.60 million sq. ft built-up area to meet the growing demand of Men’s business. The plant will get operational by Q4 FY 21.

- Mysore (Karnataka) – A unit with 0.2 Million sq. ft., for manufacturing & raw material warehousing at a leased-out building will be functional from Q2 FY 2020.

The Company has done a capex of ~Rs. 47 Cr. in FY19 and is planning a Rs. 40-50 Cr. capex for FY20.

Kidswear Will Be Focus Area

Going forward, the Company is focusing to expand its kidwear segment. The Company has set up a separate team for the segment. Page Industries had launched ‘Jockey Junior’ last year. In FY19, it launched the girl’s kidswear and also kids athleisure products.

WHAT’S DRAGGING THE STOCK?

Subdued Demand

In FY 2019, the Company experienced subdued consumption, due to the general weaker market and footfalls. Jockey overall revenues grew by 11.71%, (men’s by 10.85%, women’s by 11.19 %, socks by 18.13% and kids wear by 56.6%) and volume grew by 5.63 % (3.02%, 5.84 %, 19.13% and 41.63% respectively).

Competition – from both organized and unorganized players.

The innerwear market is estimated to be Rs 24,000 Cr. in India and the unorganized sector accounts for 50-55% market share. In addition, entry of foreign players like XYXX, Tailor, Circus, Jack & Jones, Calvin Klien and even private label brands of sports goods retailers like Decathlon and Nike are entering into Jockey’s space.

Expensive Valuation

Although the Page Industries stock has fallen more than 40% from its peak but still the stock is trading at price-to-earnings multiple of 57x, which is higher compared to its peers.