POST UPDATED - WATCH END OF POST

A few days back someone on twitter wrote in to me:

In my view, if television experts were correct with their recommendations, they would be the richest people on earth; the fact is that they are just as right or wrong as any of us.

Like many online stock market activists and bloggers, he was convinced that paying too much attention to television experts is actually bad for your finances, let alone be of any help. Most of those who hold such views give equally strange explanations to justify their position, notably:

- Finance news is about sensationalism; their idea is to keep you hooked on so they get higher viewership which in turn gets them higher ad revenues;

- The constant recommendations will make you constantly churn your stock holding which is bad for your portfolio.

Interestingly (as I realised later), the follower who posted the above comment is an online (self-proclaimed) stock market expert. Effectively, his point becomes that you should not take note of anyone on television but in turn listen to what he says. This is a dangerous game – the guy who wants you to shut your eyes and ears has his mind working in overdrive. Do you really want to follow someone who asks you not to listen to others?

I say – hear everybody, miss no-one. THE TRUTH: Television is Just another Forum, Only More Serious! Television, just like the internet, provides a great platform to reach out. That said, while stock market experts on television spend a lot more time reading and researching, they will never be right 100% times. Nevertheless, in almost 100% instances they will have a reason, an argument or at best a view. Being aware of other’s point of view will make you question more. This should be your number one goal when it comes to stock investing. Reason, Question and then DECIDE! Personally, I have met some intelligent, well informed people on television forums. That in turn is the main reason why I find it helpful to be on such forums. It’s educating and helps in the unfolding of thought process. As for sensationalism and the constant recommendations, if you are not able to decipher knowledge from noise then the first trap you will fall into will be the one cast by someone who tells you to avoid traps laid by others. Essentially, such a person will be doing the same thing which he advocates against; with subtle modifications. Typically, they will:

- Lack conviction to recommend or reject anything;

- Yet, never fail to publicise any occasion where an analyst goes wrong;

- Try to educate you on ideas that are gripping, mostly on behaviour and psychology;

- Talk about famous investors.

Next time you find yourself getting influenced by someone, check if they have any of the above traits! Of course, I have been wrong with my stocks on occasions. But my performance record is there for all to see; and yes – I say it out loud. Also – what I say here is exactly what I say on television, on my website, in lectures and any other place you wish for me to come.

What I have been saying since March 2015? WATCH BELOW, MONTH BY MONTH.

AUGUST 2015

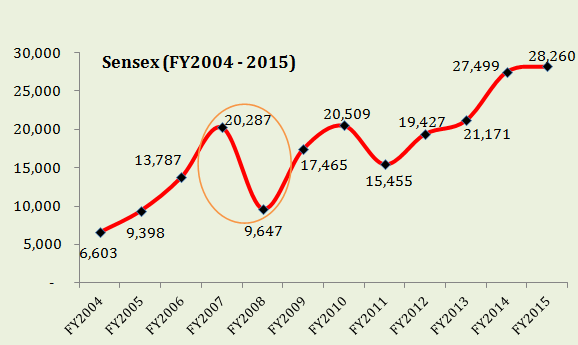

“At some point earnings have to catch up. Until October 2015 can the markets sustain at these levels? I don’t think so”.

JULY 2015

“We are not looking at stocks very positively right now. The way corporate earnings are coming out, it is unlikely that valuations will come down. We are trading on 23.8 on the Nifty . . . . THERE COULD BE UPTO 10% CORRECTION IN THE MARKET”.

JUNE 2015

“We have been cautious on the market since the beginning of this year and I don’t think anything has changed . . . . either stock prices have to correct or earnings have to improve”.

MAY 2015

How to spot a stock market bubble? A financial bubble is “a situation where the price of an underlying asset rises far above its true value”.

Click on the image below for full post:

APRIL 2015

How to prepare for the next stock market crash? “You don’t have to win first, you have to win last.”

Click on the image below for full post:

What’s the protest about? Nobody is under any compulsion to act on above basis!

But I will be happiest to hear your views if you post them in the comments section below.

Here is an End of Day Update – Posted after market close:

24th August 2015 – Post Market Crash with Sensex down 1,624 points – 5.94% in a single session. Nifty down 49.95 – 5.92%.