What are payment banks?

According to RBI guidelines: the objectives of setting up of payment banks is to further financial inclusion by providing – small savings accounts and payments/remittance services to migrant labour workforce, low income households, small businesses, other unorganised sector entities and other users.

What does it mean?

Nothing too complex – it means that these upcoming payment banks are intended for (but not exclusive to) unbanked and under-banked population of the country. It allows consumers to have a bank account through the means of their mobile phones.

Do normal banks not do that?

Yes and no. Taking in light that the access of mobile phones in these unbanked and under-banked (rural, sub-suburban, small villages, etc) areas is much more penetrative and cost efficient compared to brick and mortar bank branches, the intention was to reach these unexplored markets by creating and incentivizing such payment banks. The convenience and ease of account opening and handling process should (ideally) give an edge to these banks.

To understand more on a micro level, step into a farmer’s shoes in a small village who needs a bank account, who can either travel the distance to nearest bank branch or use his mobile phone to open and operate his bank account.

Okay. So is that all?

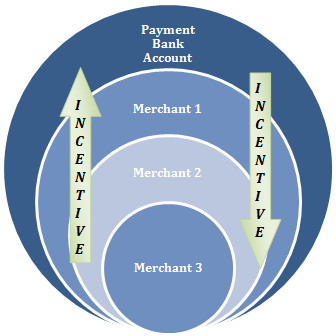

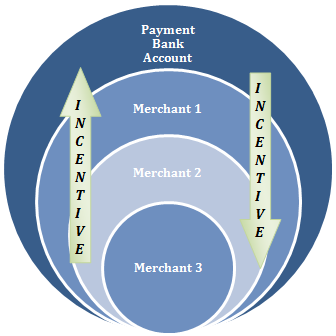

Definitely not! Payment Banks work on “Merchant Acceptance Infrastructure” (like that of Paytm, Freecharge, Airtel Money, and other Prepaid Payment Instruments) which incentivizes both the merchant and customer to accept cashless payments through digital means. This gives these unbanked masses the ability to deal in cashless money without having/requiring physical access to a bank branch.

VS

Merchant Acceptance Infrastructure Incentivizes Payments which Regular Banks Don’t

What does it take to be a payment bank?

To get RBI license payment banks are required entry capital of Rs. 100 Cr, maintain maximum balance limit of Rs. 1 lakh per customer, maintain RBI regulated cash reserve ratio (CRR) and comply with zero credit risk –that is – payment banks aren’t allowed to provide any sort of loan/credit to the customer.

How will payment banks make money without extending loans?

75% of total assets under management (customer’s money) by these banks are to be invested in Government bonds, and 25% in corporate bonds from reputed companies. Dealing with bonds and steering clear of any credit risk, is what give these banks a special stature. Payment banks could also cross sell financial services to their existing databases – as prepaid payment instruments (PPIs)– through their business correspondent network and digital channels to generate additional revenue.

Are there any players in the game right now?

Reserve Bank of India has given licenses to 11 entities to launch payment bank:

- Aditya Birla Nuvo

- Airtel M Commerce Services

- Cholamandalam Distribution Services

- Department of Posts

- FINO PayTech

- National Securities Depository

- Reliance Industries

- Dilip Shanghvi, IDFC Bank – Telenor JV

- Vijay Shekhar Sharma – Paytm

- Tech Mahindra

- Vodafone M-Pesa

Of which, Tech Mahindra, Cholamandalam Finance and Dilip Shanghvi-IDFC Bank-Telenor JV have dropped out due to strict RBI restrictions, profitability concerns, coupled with limited scope of business activity.

My View

The government is set to fulfill its long term goal of cashless society to curb the use of unaccounted / black money as also to cut down on RBIs printing expenses. The enthusiasm with regard to its digital plans is evident. That said, it is one thing to promote the use of virtual money and quite another to push for such use.

With changing demands of financial customers, payment banks are set to toss away the longstanding trend of queues and complicated procedure.

As a success story – Paytm, which is one of the 11 entities to get payment bank license from RBI, has already achieved the feat of 100 million wallet users amounting to double of VISA + MAESTRO users in India because of company’s robust services developed through its sturdy “Merchant Acceptance Infrastructure.”

On the downside, payment banks are not as money fostering as one may think. The recent drop out by 3 out of 11 entities to acquire the license from RBI is because of major concerns of low profitability and scope of business of these standalone payment banks. The government is focused to get payment banks in rural and unbanked areas, where the revenue generation is rock-bottom. However, due very low customer acquisition cost, and boom of Prepaid Payment Instruments (PPIs) in top cities in India, the upside looks pretty limited.

Moreover, think about it, if the premise on which these payment banks are expected to grow is in the fact that people in rural areas need not visit a bank on a daily basis and an app on the smartphone will help them achieve this; then, what stops a big bank to create and give them access to such an app. No body has to open a branch in remote areas.

If you think about it, the only thing by which payment banks can lure new customers is by doling out incentives and by offering a few percentage point discount for payment of small bills like – mobiles, electricity etc.

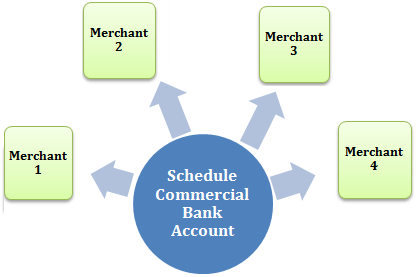

But again, big banks can also do that; and they sure will if payment banks were to cut into their customer base. In fact, if payment banks were to prove successful at all, I don’t see why big banks will not replicate their model of business. Technologically, a regular Scheduled Commercial Bank (SCB) can offer everything which a payment bank seems to offer, just more of it!