“Building Software is Its Business”

Persistent develops best-in-class solutions in key next-generation technology areas including Analytics, Big Data, Cloud Computing, Mobility and Social, for the telecommunications, life sciences, healthcare, and banking & financial service verticals.

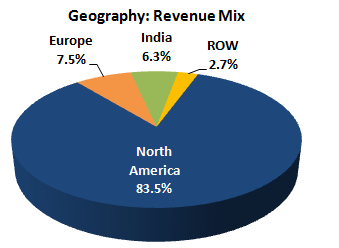

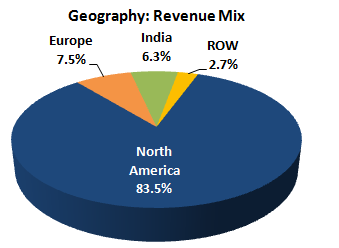

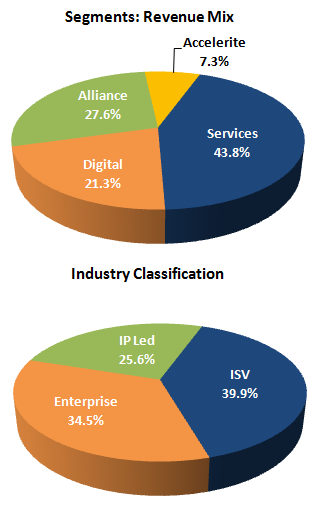

Persistent’s revenue mix in FY 2018 comprised of 3 key segments – Independent Service Vendor (ISV), Enterprises and IP Led. The Company has employees in India and Global Delivery Centres.

[1] Accelerite – Persistent’s product business. The Accelerite product suite includes solutions for cloud life cycle management, endpoint security, enterprise mobility management, and the Internet of Things (IoT).

[2] Alliance – In 2016, Persistent Systems partnered with IBM to pursue a combined Internet of Things strategy and help customers develop solutions on the IBM Watson IoT Platform.

Persistent Systems Financials

| Particulars | FY14 | FY15 | FY16 | FY17 | FY18 |

| Revenue (In Rs. Cr.) | 1,669.15 | 1,891.25 | 2,312.33 | 2,878.44 | 3,033.70 |

| Growth | – | 13.31% | 22.26% | 24.48% | 5.39% |

| EBITDA (In Rs. Cr.) | 414.29 | 390.34 | 413.79 | 465.35 | 468.73 |

| EBITDA Margin | 24.82% | 20.64% | 17.89% | 16.17% | 15.45% |

| PAT (In Rs. Cr.) | 249.28 | 290.63 | 297.36 | 301.47 | 323.09 |

| PAT Margin | 14.93% | 15.37% | 12.86% | 10.47% | 10.65% |

| EPS (In Rs.) | 31.16 | 36.33 | 37.17 | 37.68 | 40.39 |

| EPS Growth Rate | – | 17% | 2% | 1% | 7% |

| Historic P/E (Closing Price of 31st March) | 16.84 | 19.66 | 20.50 | 15.81 | 17.18 |

| CURRENT P/E (based on price of 25th June – Rs. 828.70) | 20.52 | ||||

| Shareholder Funds | 1,405.53 | 1,405.53 | 1,639.30 | 1,899.26 | 2,127.20 |

| Minority Interest | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Debt | 3.19 | 2.47 | 2.57 | 2.17 | 1.66 |

| Cash | 95.65 | 141.62 | 143.24 | 150.96 | 241.40 |

| D/E | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Coverage | NA | ||||

| ROCE | 29.41% | 27.72% | 25.20% | 24.47% | 22.02% |

| ROE | 17.74% | 20.68% | 18.14% | 15.87% | 15.19% |

*Persistent Systems issued bonus share in the ratio of 1:1 on 10 March 2015. EPS and P/E numbers are adjusted to reflect the effect of issue.

WHAT’S DRIVING THE STOCK

Change in Business Model

Persistent Systems has shifted from offshore software product development services to partnership-led platform-based and intellectual property offerings, which sets the Company apart from other Indian technology companies. As per Morgan Stanley, the changing business model will also help the Company improve its margins by approximately 200 basis points over the next three years. (Target price given by Morgan Stanley – Rs. 840, Bull Case – Rs. 1210).

Focus on New and Emerging Technology

The Company’s current focus areas include blockchain, genomics, intelligent business automation, and machine learning.

Focus on Digital | Continues to Increase in Share of overall Revenues

Over the last two years, Persistent Systems focus has been on digital, which has helped it build capabilities in key technology areas as it transforms to software-driven businesses. Digital business has been seeing a steady increase in contribution of overall revenues. Digital contributed to 24% of total revenues for 4QFY18. (vs. 22% of total revenues for 3Q FY18).

| Service Mix of Revenues | 4QFY17 | 1QFY18 | 2QFY18 | 3QFY18 | 4QFY18 |

| Services | 43.9% | 44.5% | 43.7% | 41.9% | 45.5% |

| Digital | 18.9% | 18.0% | 20.9% | 22.0% | 24.0% |

| Alliance | 27.6% | 29.2% | 27.3% | 29.6% | 24.3% |

| Accelerite | 9.6% | 8.3% | 8.1% | 6.5% | 6.2% |

Leading Player for Enterprise and Consumer Software

As per the report ‘Zinnov Zones 2017 for Product Engineering services, Persistent has achieved leadership zone for ‘Enterprise Software’ and ‘Consumer Software’ for the fifth consecutive year. Persistent is positioned as “Established and Niche” for overall product engineering capabilities – in line with the Company’s focus on software–driven businesses.

Focus on Inorganic Growth

With its cash balance now at US $175 million, the Company will be seeking more acquisitions to expand its geographical reach, mainly in non-US markets, and is not keen on acquiring legacy businesses.

Strong Management Guidance

The management is confident of beating industry body Nasscom’s growth forecast of 7-9% for next year, backed by growth in new businesses like artificial intelligence and newer technologies, which are creating a lot of opportunities. On the margins front too, it expects to maintain the same in the existing 15-16% band. Since demand environment is supportive, the management plans to increase spending on sales.

WHAT’S DRAGGING THE STOCK

Under Threat from Large Competitors

The company faces stiff competition from other large and small software companies in India.

Revenues Declined from Top Account

Revenues from top client were down by 26% QoQ. Revenues from Top 2‐5 client were marginally up by 0.2% QoQ. The revenues of the Company from top 6‐10 clients declined by 4.5% QoQ.