Unlike the real estate or automobile sector, healthcare sector is not as vulnerable to economic fluctuations. Despite the fragile global economic environment over the last few years, Indian Pharmaceutical companies have seen good growth and the industry is on the threshold of becoming a major global market by 2020.

The factors considered below present an overview of the Indian Pharmaceutical companies in general and stock analysis of Cipla limited in particular. For a financial report: visit here – Cipla Limited.

WHAT’S DRIVING THE STOCK

Growth in Pharmaceutical Industry

Factors that lead to an impressive performance for the Indian pharmaceutical companies include strong exports to the U.S. and the depreciation of the rupee against the dollar. Positive growth is expected to be a long-term phenomenon in the industry, promising a CAGR of 14-16% in the next 5 years.

The Indian pharmaceuticals market is witnessing large acquisitions by multinational companies, increasing investment by domestic and international players, deeper penetration into the rural markets, growth and availability of healthcare and incentives for setting up special economic zones (SEZ’s).

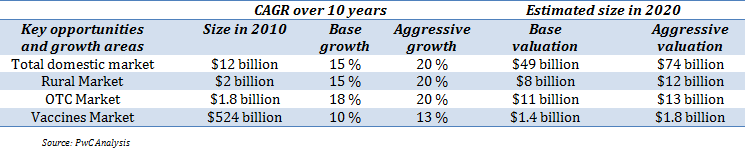

Indian pharmaceutical companies – Projected industry scenario in 2020

Growth in Domestic Markets

In the domestic market, Cipla continued to maintain its leadership position in various therapeutic segments including respiratory, anti-virals, gynaecology and urology for the period 2012-13. The Company’s domestic business constitutes ~45 % of its total revenues. Currently, it commands 5.7 % market share (as per AIOCD AWACS) in domestic pharmaceutical space. Its domestic business has grown at a CAGR of 10 % over the last five years. The growth in domestic revenues was largely on account of growth in anti-asthma, anti-biotics and cardiovascular therapy segments.

Cipla plans to increase its market share and sales by increasing penetration in the Indian market, especially in rural areas and plans to increase its offerings in new therapies such as oncology and neuro-psychiatry. For future prospects, in-licensing opportunities are also being considered, which would provide a platform to launch new and innovative products.

Expanding international footprint

Cipla’s international business continues to be a major revenue driver contributing more than 50 % to the total revnue and is further expected to grow in future. During the 2012-13, more than 59 % of the total income originated from international markets. The growth in export revenues was primarily due to growth in anti-depressants, anti-malarials, anti-retroviral and anti-asthma segments.

Cipla exports to more than 180 countries, with growth coming through marketing alliances and distribution tie-ups in various markets like South Africa, U.S., Europe and Australia. Cipla’s strategic partnerships with large generic pharmaceutical companies for product development and supply are expected to yield stable benefits for the Company in the long term. The Company had signed a long-term collaboration agreement with Meda AB (Swedish pharmaceutical corporation) to develop and market Dymista (product for treatment of seasonal allergic rhinitis) formulation for various global markets, which will make it the sole supplier for Dymista in the U.S. and other markets. It is expected to earn revenues of around $100.0 million from this product in 2013-14.

Cipla is also expanding its presence in the inhaler segment in Europe, with regulatory approvals for a few products already in place and few more in the pipeline. In the U.S., the Company has entered into a partnership with more than 22 players and has a strong product pipeline of Abbreviated New Drug Applications (ANDAs), of which 49 have been launched, while 30 are pending for approval.

Growth in biosimilars business

The biosimilars industry, globally, has been growing remarkably. According to market estimates, the global market for such drugs is seen at around $30 billion and at a CAGR of over 50 % during 2010-15.

The Company is actively involved in developing bio-similars/bio-therapeutic products through its partners in China. Cipla has already invested $165.0 million in India and China to acquire facilities and build new ones for its foray. It is expected that the clinical trials on these drugs will be completed in 2 to 3 years and subsequently the products will be launched in India. The Company has also ventured into research in stem cells with a major investment in Stempeutics Research Pvt Ltd at Bengaluru.

WHAT’S DRAGGING THE STOCK

Overcharging Issues with NPPA

The Company has some pending legal cases on account of alleged overcharging in respect of certain drugs under the Drug Price Control Order. The aggregate amount of the notices received is about Rs. 1, 655 crore (inclusive of interest).

The Company has been legally advised that based on several High Court decisions and considering the totality of facts and circumstances, these demand notices may not be enforceable. However, any unfavourable outcome in these proceedings could have an adverse impact on the Company.

New pharmaceutical pricing policy

The new pharmaceutical policy (proposed) has raised uncertainties regarding pricing of drugs in India. As per the new recommendations, the National List of Essential Medicines (NLEM) will include 348 drugs and their price will be determined by taking the average selling price of all brands of that drug having market share equal to or greater than 1 %. Currently, there are only 74 drugs that come under price control and many of them are not being used.

The new pricing policy will result in about 30 % – 35 % of the total pharmaceutical market coming under price control. At present, about 40 of Cipla’s basket of over 1000 products are under price control and this would increase to about 120 products under the proposed new regime. The new policy will impact most of the Indian pharmaceutical companies including some large Indian companies like Ranbaxy, Cipla, Lupin and Cadila who are expected to have an earnings impact of 5 % – 10 %. Any adverse move towards increasing the scope of price control could have a negative impact on earnings.

________________________

** The stock analysis of Cipla Limited including the financial report linked above, is for informational purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis.