Pipavav Defence & Offshore Engineering Company Limited (“Pipavav” or “Company”) is a world class defence, ship building & offshore infrastructure company. The Company is India‟s first private company to get license and contracts to build warships for the Indian navy. The Company has a diversified product mix spanning from making naval ships and systems, specialized commercial ships, ship repair and providing turnkey solutions to the oil & gas sector.

WHAT’S DRIVING THE STOCK

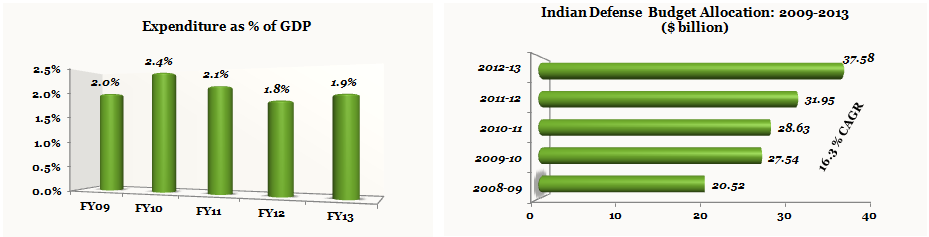

Growing Trend in the Defence Budget Allocation

For the past 5 years, India has maintained defense expenditure in the range of 1.8% – 2.4% of its Gross Domestic Product (GDP), which is in line with other major developed nations. In the Union Budget 2013-14, Rs. 2,03,672 Cr. was allocated for defence spending, representing 1.9 % of the GDP. Increased defence allocation includes a hike of 25% in defence capital expenditure for acquiring/accessing modern equipments and technologies. India is one of the largest importers of defence equipment and around 70% of Indian defense requirements are met through imports. India spends about 40 % of its total defense budget on capital acquisitions. *

By 2014, India would become the third largest defence spender after the US and China which provides huge opportunity for Indian as well as foreign manufacturers. **

* (Source: Annual Report)

** (Source: India in business Report – Ministry of External Affairs)

The chart below shows growth in the Indian Defence Budget Allocation over the last 5 year period.

Public Private Partnerships

Public sector companies are suffering from major order backlogs with insufficient capacity to execute orders in a timely manner. In such a situation they are leaning more towards private companies for meeting their order book requirements.

In February 2012, the Department of Defence Production of the Ministry of Defence released “Guidelines for establishing Joint ventures with Defence Public sector undertakings” under which companies may form suitable partnerships with Indian as well foreign companies within Government approved framework, for production of defence equipments within the country. These guidelines aim to take advantage of private sector resources, in order to increase the production of defence equipments in the country.

Pipavav is recognized as one of the leading player in the sector with world class infrastructure and technological tie-ups and the first private sector company which has been selected by Mazagon Dock Limited, the defence shipyard of the Ministry of Defence, as its partner for formation of the joint venture to build warships for the Indian Navy. The deal with Mazagon Dock will help the Company execute some of Mazagon’s order book in excess of U.S. $ 20 billion. In addition, the Company has been awarded with the contract for construction of 5 warships by the Indian navy for a total order value of Rs. 2,975 Cr.

In FY13, Pipavav joined hands with warship and submarine builder DCNS, a naval defence company based in France, to offer state of the art technology, knowledge and processes and in FY12, the Pipavav entered into an MoU with AIRBUS, a leading aircraft manufacturer to develop state of the art Maintenance, Repair, and Overhaul (MRO) facilities and associated infrastructure in India.

Encouraging Policy Reforms

India is making considerable development within the Indian defense sector especially with new reforms like the DPP (Defence Procurment Procedure, 2013), according to which first priority is given to Indian public and private sector for military procurements, with equipments being bought internationally only if manufacturing in India proves impossible. This reform aims to promote greater efficiency in the procurement process and strengthening the defence manufacturing base in the country.

The new policy also specifies that Indian private sector firms will be allowed to take part in contracts for maintenance and repair of defence systems, instead of automatic nomination of defence public sector undertakings and ordinance factories for the same. This measure is expected to have a positive impact on private sector participation in maintenance, repairs and overhaul work.

Exports to friendly countries

India has made significant progress in defence technology with global defence players building technical partnerships with Indian companies. Many developing countries such as Nepal, Mauritius, Sri Lanka and African countries do not have advanced technologies and adequate resources to meet their defence requirements. The Company is ideally positioned to gain from this.and taking a step forward in the form of exports. India exported only approx. US $93 million worth of defence equipment to countries such as Nepal and Mauritius in 2004. During fiscal year 2012-13 exports stood at US $ 1.11 billion and in the first 3 quarters of fiscal 2013-14 exports have already exceeded that number.

CAVEAT: Many veteran investors including Rakesh Jhunjhunwala have bought sizeable stakes in Pipavav. As of September 2013, his stake in the Company 1.43%. While share holding by seasoned investors points to positive future prospects for the Company, Pipavav could also be more vulnerable to stock price volatility, should such large investors sell their stakes.

WHAT’S DRAGGING THE STOCK

Dependency on Government to determine order flow

The defence procurement procedure adopted by the Government of India, of awarding contracts for defence vessels to domestic sector has to undergo stringent due diligence procedures, detailed technical and commercial evaluations etc. before any commitment as contracts for defence equipments are of strategic national importance. At times, this slows down the process.

Pipavav would be able to execute at a quick pace only if the process of order confirmation takes place smoothly.

Competition from larger players entering the market

Pipavav faces stiff competition from various private sector shipyards in the international markets such as China, Japan and South Korea. Based on their stronger market positions, competitive labour cost, government support and larger production capacities, these large corporations may resort to aggressive price strategy to put pressure on the Indian companies, which could put pressure on the margins and profitability of other defence sector companies including Pipavav.

_________________________________

** The stock analysis of Pipavav Defence including the financial analysis report linked above, is for information purpose only. This analysis should not be taken as a buy/sell recommendation. The circumstances of the company and the economic environment may have changed since the date of this stock analysis.