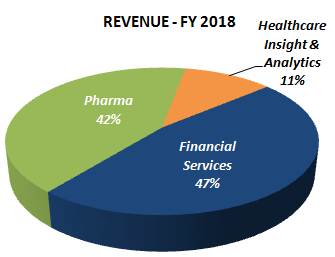

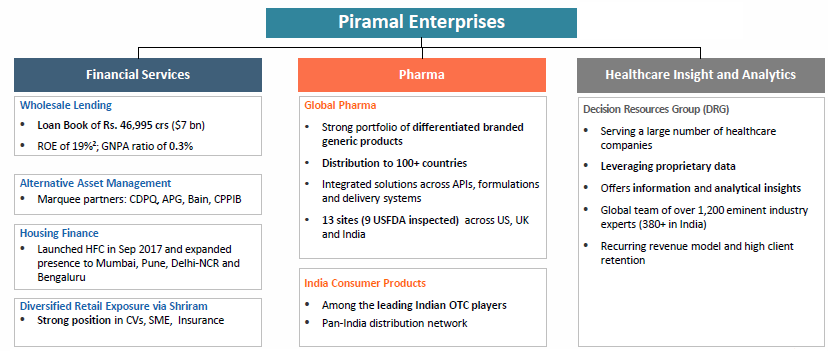

Piramal Enterprises Limited (“Piramal” or the “Company”) is one of India’s large diversified companies, with a presence in Financial Services, Pharmaceuticals and Healthcare Insight & Analytics.

[1] Financial Services – Engages in various financial services businesses. It provides both wholesale and retail funding opportunities across sectors.

[2] Pharma – Piramal sells a portfolio of niche differentiated pharma products through an end-to-end manufacturing capabilities across 13 global facilities and a large global distribution network to over 100 countries.

[3] Healthcare Insight & Analytics – Provides healthcare analytics, data & insight products and services to the world’s leading pharma, biotech and medical technology companies.

Financial Position

| Particulars | FY14 | FY15 | FY16 | FY17 | FY18 |

| Revenue (In Rs. Cr.) | 4,495.94 | 5,122.61 | 6,341.51 | 8,503.65 | 10,631.03 |

| Growth | – | 13.94% | 23.79% | 34.10% | 25.02% |

| EBITDA (In Rs. Cr.) | 632.29 | 885.48 | 1,677.24 | 3,499.14 | 5,159.87 |

| EBITDA Margin | 14.06% | 17.29% | 26.45% | 41.15% | 48.54% |

| EBIT (In Rs. Cr.) | 385.39 | 595.61 | 1,421.79 | 3,117.44 | 4,682.54 |

| EBIT Margin | 8.57% | 11.63% | 22.42% | 36.66% | 44.05% |

| PBT (In Rs. Cr.) | (436.14) | 339.20 | 714.38 | 1320.21 | 1963.77 |

| PAT (In Rs. Cr.) | (501.41) | 2,849.95 | 904.74 | 1,252.33 | 5,121.49 |

| PAT Margin | -11.15% | 55.63% | 14.27% | 14.73% | 48.17% |

| EPS (In Rs.) | (29.06) | 165.15 | 55.09 | 72.57 | 281.68 |

| EPS Growth Rate | – | – | -67% | 32% | 288% |

| Historic P/E (Closing Price of 31st March) | – | 5.23 | 18.70 | 26.06 | 8.66 |

| CURRENT P/E (based on price of 1st Oct – Rs. 2271.80) | 8.07 | ||||

| Shareholder funds | 9,321.06 | 11,735.93 | 12,948.35 | 14,882.57 | 26,445.39 |

| Minority Interest | 0.00 | 29.11 | 0.12 | 13.21 | 12.00 |

| Debt | 9,080.34 | 6,616.80 | 14,302.93 | 26,575.17 | 38,886.49 |

| Cash | 333.60 | 460.08 | 365.94 | 1,540.90 | 2,467.01 |

| RATIOS | |||||

| D/E | 0.97 | 0.56 | 1.10 | 1.79 | 1.47 |

| Interest Coverage | 0.60 | 1.73 | 1.75 | 1.72 | 1.73 |

| ROCE | 2.09% | 3.24% | 5.22% | 7.52% | 7.17% |

| ROE | -4.68% | 2.89% | 5.52% | 8.87% | 7.43% |

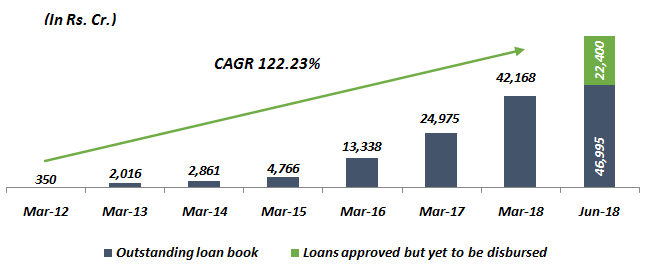

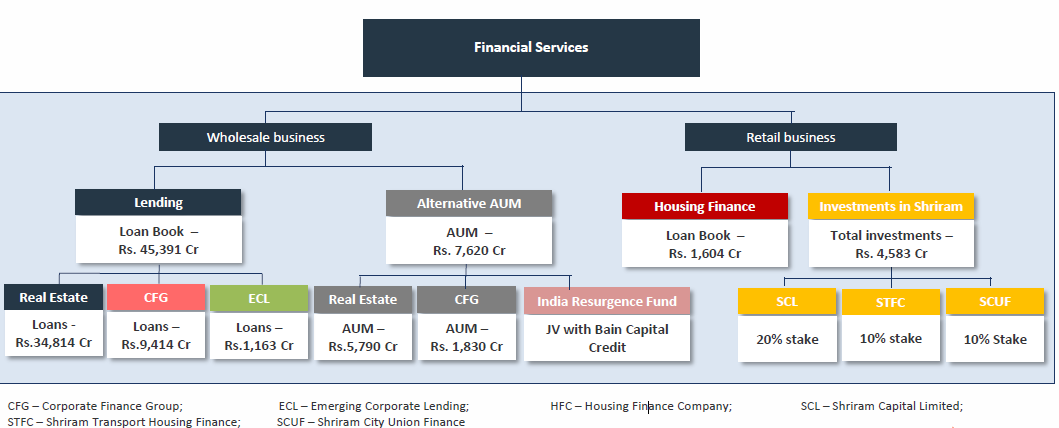

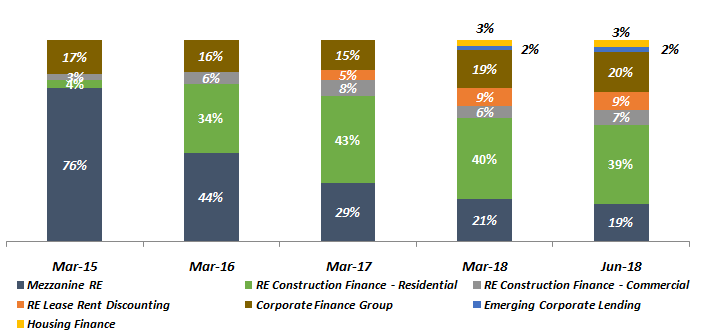

Diversified Loan Portfolio

The Company’s loan book grew at a CAGR of 122% over last 6 years. In Q1 FY 2019, the loan book grew 64% YoY to Rs. 46,995 Cr. with Rs. 22,400 Cr. of loan approved but yet to be disbursed.

The Company has diversified exposure across both wholesale and retail financing. The Company’s strategy of consistently diversifying its lending portfolio has helped Piramal to significantly lower the overall risk profile.

Breakup of Loan Book

Robust Asset Quality –

- Gross NPAs ratio remained stable at 0.3% in Q1 FY2019

- Provisioning maintained at 1.8%

Focus on Corporate lending

The Company’s corporate finance business, which was started two years back, has already grown to a loan book size of over Rs 9,000 Cr. (20% of total loan) and is expected to further gain share.

The management believes there is a huge scope in corporate lending, given that most public sector banks and some private sector banks are not very active in this space. So, while bulk of its loan book (nearly 75%) is wholesale real estate lending, the management expects the share of non-real estate corporate lending to expand meaningfully over the next three years. In this segment, while Piramal first started off with infrastructure deals, it now deals in renewable, logistics and other sectors too.

Strong Position for the Global Pharma business

Piramal has product portfolio of niche differentiated branded generics products that are difficult to manufacture, sell and distribute; end to end accredited contract manufacturing capabilities both for APIs and Formulations and a large global distribution network reaching to over 100 countries. The revenues are geographically diversified with 67% of revenues coming from North America and Europe.

Healthy Growth Prospects For OTC business

Strong portfolio created through organic as well as inorganic route with 8 brands among top 100 OTC brands of India. Entrenched Distribution network with presence in 4.2 lacs outlets in 2000 towns in India and field force of 2100 people.

In FY 2018, the Company launched 8-10 products and brands extensions like Lacto Calamine Facewash and Face scrub, Little’s Thermosensitive Silicon Sipper, Little’s breast pump, Sloan’s pain relieving spray, Tetmosol Advance soap, Caladryl Diaper cream, Jungle Magic Doodle Artz and Jungle Magic Garden Sciencz

Demerger At Opportune Time

Piramal Enterprises reiterated its intent to separate the diverse businesses but only at an opportune time, likely in the medium term.

Where is valuation analysis?

Excellent analysis. Gave insights into the functioning of a conglomerate

thanks

Sir, you have covered almost all the speheres of the comoany. But piramal Glass hasn’t been I guess any insight on this business will be more effevtive.

Pl. Message your number

9246831444