Polycab India is the largest wires and cables manufacturer in India, in terms of segment revenues, with a market share of approximately 18% of the organized wires and cables industry and approximately 12% of the total wires and cables industry in FY 2018.

The Company manufactures and sells a diverse range of wires and cables and their key products in the wires and cables segment are power cables, control cables, instrumentation cables, solar cables, building wires and flexible cables. In 2009, the Company diversified into the engineering, procurement and construction business, which includes the design, engineering, supply, execution and commissioning of power distribution and rural electrification projects.

Manufacturing Facilities

The Company has 24 manufacturing facilities, including their two joint ventures with Techno Electromech and Trafigura, located across the states of Gujarat, Maharashtra and Uttarakhand and the union territory of Daman and Diu. 4 of these 24 manufacturing facilities are for the production of FMEG, including a joint venture with Techno, a Gujarat-based manufacturer of LED products.

Distribution Network

The Company’s distribution network in India comprises over 2,873 authorized dealers and distributors and 30 warehouses as at December 31, 2018. Polycab supplies their products directly to their authorized dealers and distributors who in turn supply their products to over 100,000 retail outlets in India.

Polycab India manages their sales and marketing activities through their corporate office, 3 regional offices and 20 local offices in various parts of India as at December 31, 2018.

About the Offer

- The price band of the offer has been set between Rs. 533- Rs.538 with face value of Rs. 10.

- The IPO consists of Fresh Issue of Equity shares aggregating upto Rs.400 Cr and Offer for Sale of upto 17,582,000 Equity Shares.

Issue Snapshot:

| Issue Open | April 5, 2019 – April 9, 2019 |

| Price Band | Rs. 533 – 538 |

| Fresh Issue | Upto 7,434,944 – 7,504,690 Equity Shares |

| Offer for Sale | 17,582,000 Equity Shares |

| Issue Size | Rs. 1,336.47 – 1,345.26 Cr |

| Face Value | Rs. 10 |

| Bid size | 27 equity shares and in multiples thereof |

Object of the Issue

- Scheduled repayment of all or a portion of certain borrowings availed by the Company;

- To fund incremental working capital requirements of the Company;

- General Corporate Purposes.

Shareholding of Promoter and Promoter Group

| Shareholder | Pre-Offer | Post-Offer | ||

| Number of Equity Shares (In Cr.) | % | Number of Equity Shares (In Cr.) | % | |

| Inder T. Jaisinghani | 2.35 | 16.67% | 2.15 | 14.42% |

| Ajay T. Jaisinghani | 2.33 | 16.53% | 2.13 | 14.30% |

| Ramesh T. Jaisinghani | 2.33 | 16.53% | 2.13 | 14.30% |

| Girdhari T. Jaisinghani | 2.34 | 16.59% | 2.13 | 14.35% |

| Bharat A. Jaisinghani | 0.60 | 4.25% | 0.55 | 3.68% |

| Nikhil R. Jaisinghani | 0.60 | 4.25% | 0.55 | 3.68% |

| Kunal I. Jaisinghani | 0.58 | 4.12% | 0.58 | 3.91% |

| Promoter Group -Others | 0.00 | – | 0.00 | – |

| Total | 11.15 | 78.94% | 10.21 | 68.66% |

Financial Position

| Particulars | FY16 | FY17 | FY18 | 9M FY 2018 | 9M FY 2019 |

| Revenue (In Rs. Cr.) | 5,714.24 | 6,047.01 | 6,923.92 | 4,834.42 | 5,506.70 |

| Growth | – | 5.82% | 14.50% | – | 13.91% |

| EBITDA (In Rs. Cr.) | 490.78 | 479.95 | 740.82 | 393.86 | 694.04 |

| EBITDA Margin | 8.59% | 7.94% | 10.70% | 8.15% | 12.60% |

| EBIT (In Rs. Cr.) | 379.66 | 352.06 | 607.87 | 294.72 | 586.90 |

| EBIT Margin | 6.64% | 5.82% | 8.78% | 6.10% | 10.66% |

| PBT (In Rs. Cr.) | 265.42 | 361.32 | 576.52 | 284.01 | 546.16 |

| PAT (In Rs. Cr.) | 184.70 | 232.96 | 370.92 | 180.98 | 358.22 |

| PAT Margin | 3.23% | 3.85% | 5.36% | 3.74% | 6.51% |

| EPS (In Rs.) | 13.09 | 16.48 | 26.23 | 12.79 | 25.31 |

| EPS Growth Rate | – | 26% | 59% | – | 97.9% |

| CURRENT P/E (based on upper price band of Rs. 538) | 20.51 | ||||

| Shareholder funds (In Rs. Cr.) | 1,782.79 | 1,993.76 | 2,349.52 | 2,174.60 | 2,716.20 |

| Minority Interest (In Rs. Cr.) | 2.80 | 3.05 | 4.05 | 3.37 | 6.68 |

| Debt (In Rs. Cr.) | 795.65 | 820.80 | 727.69 | 1,184.56 | 540.18 |

| Cash (In Rs. Cr.) | 50.73 | 30.16 | 10.64 | 41.48 | 7.76 |

| RATIOS | |||||

| D/E | 0.45 | 0.41 | 0.31 | 0.54 | 0.20 |

| Interest Coverage | 3.33 | 7.28 | 7.91 | 7.18 | 7.67 |

| ROCE | 14.71% | 12.50% | 19.73% | 8.76% | 17.99% |

| ROE | 10.36% | 18.12% | 24.54% | 13.06% | 20.11% |

Based on the earnings of FY 2018, the price-earnings multiple at the higher band of Rs. 538 is 20.5x, lower than the industry average PE of 36.1x. The Company’s IPO is available at discount as compared to its peers.

PROS

Market Leader in Wires And Cables in India – Polycab India is the largest wires and cables manufacturer in India, in terms of segment revenues, with a market share of approximately 18% of the organized wires and cables industry and approximately 12% of the total wires and cables industry in Fiscal 2018.

From FY 2016 to 2018, the advertising and sales promotion expenses increased from Rs.57.94 Cr. to Rs.93.69 Cr. and from Rs.72.67 Cr. for the 9 months period ended Dec 31, 2017 to Rs.75.73 Cr. for the 9 months period ended Dec 31, 2018.

Strong Product Portfolio – Polycab India has one of the most extensive portfolios of wires and cables to cater to the needs of their institutional and retail customers in different industries. Their products are either (i) made-to-stock, or (ii) made-to-order. The Company’s established customers include institutional clients such as L&T Construction and Konkan Railway Corporation Ltd. and other global leading brand companies.

Enter Fast Moving Electrical Good Space – Polycab India has diversified into the FMEG business and transformed their Company from a pure B2B company into a B2B and B2C company. The FMEG sales increased at a CAGR of 57.95% from FY 2016 to 2018 and by 41.38% for the nine months period ended December 31, 2018 as compared to the 9 months period ended December 31, 2017.

Focus On Backward Integration – Polycab India has a strong focus on backward integration in their manufacturing process, where they seek to produce a substantial portion of their raw materials and source the remaining from third-party suppliers. In 2016, they entered into a 50:50 joint venture with Trafigura to set up the Ryker Plant that will, once fully operational, fulfil a substantial part of their demand for copper wire rods.

Apart from the Ryker Plant, the Company also produce other key raw materials that they use in the manufacturing of their wires and cables and FMEGs. These key raw materials include aluminium rods (for aluminium conductor), higher size of copper rods, various grades of PVC, Rubber, XLPE compounds, GI wire and strip (for armouring).

Cons

Competition – The electrical industry is highly competitive.

- Wires and cables segment: Apar Industries, Finolex Cables, KEI Industries, Havells India, Gupta Power Infrastructure, KEC International, R R Kabel and V-Guard Industries.

- Consumer electric durables segment: Bajaj Electricals, Crompton Greaves Consumer Electricals, Finolex Cables, Havells India, Orient Electric, Surya Roshni, Usha International and V-Guard Industries.

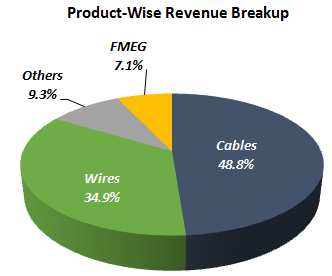

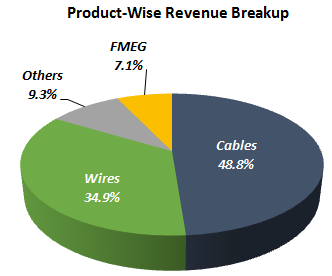

~90% Revenue From Wires & Cables

Significant increases or fluctuations in prices of, or shortages of, or delay or disruption in supply of primary raw materials could affect company’s estimated costs, expenditures and timelines which may have a material adverse effect on its business, financial condition, results of operations and cash flows.