Rule No. 1 -A well-managed portfolio should be diversified to ensure safety of return on investment over time. Rule No. 2 – A well-managed portfolio should not be diversified to the point where the element of safety starts cutting into potential for profits.

Between these 2 basic rules runs a portfolio management industry worth billions of dollars. How much should you diversify then becomes the focal point of three major portfolio management policies –

- Aggressive Portfolio Management – focus on capital appreciation;

- Defensive Portfolio Management – focus on minimizing risk; and

- Balanced Portfolio Management – with focus on “maximum return and minimum risk”.

Naturally, the way these policies are defined makes most investors choose the third option. Maximum return with minimum risk. This is partly because of the beauty of language. The right way to think about this third option would be by adding the word possible twice in the sentence.

Maximum possible return with minimum possible risk.

Mainly due to lack of time and understanding of financial products, and for the fear of losing money while investing independently, people prefer portfolio management services including mutual funds and professional money managers.

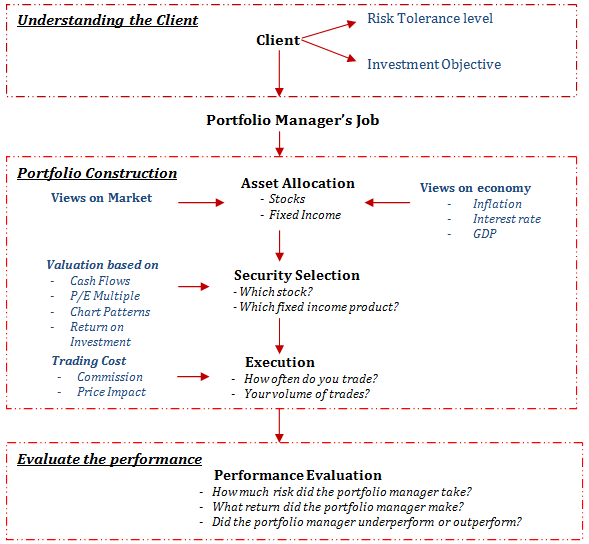

What does a Portfolio Manager Do?

A Portfolio manager provides ongoing management of your investments based on your objectives and risk tolerance level. They may actively manage your portfolio (i.e. you typically give authority to the portfolio manager to make investment decisions without getting prior approval from you for each transaction) or they may act as advisors whereby you invest/trade as per their direction.

The Investment Process

Maintaining a healthy stock portfolio and earning consistent or long term returns is a difficult task and involves many complexities. If you are someone who likes to research, follows the news and enjoys the investing journey, you probably do not like the idea of using a portfolio manager. You would rather research, get cues from independent advisory firms and execute your own orders. In the process you will also save up on commissions and transaction costs.

I have in past written a lot about stock selection process for those of you are looking to make a healthy long term portfolio. In this post today, I will focus on managing a short term trading portfolio.

Managing a short term Trading Portfolio – Strictly “Not Based on Technical Analysis”

If you are someone who likes to invest on his own and aim to profit from short term market movements by buying and selling stocks actively, then you must regularly do the following:

- Watch your stocks regularly: Closely watch companies and the industry in which you have invested. You should, at the least have a very good idea about the industry earnings (growth), PE multiples and be reading news about the stocks and the industry on a regular basis.

- Rebalance your stock portfolio: Stock markets move in cycles. Different sectors and companies become favorable based on market and industry events. You must stay on top of news flows and happenings in the market to profit from such events. In addition, you must have discipline in terms of maintaining strict stop losses and squaring of positions once they hit the targets.

* This is not the same as pure chart based / technical trading where you try to cut the noise completely and do not get influenced by news flows.

- Stop tracking stocks once you have sold them: There could be situation where you have chosen a stock with strong fundamental characteristics, but the stock did not perform well and you eventually sold it at a loss. If you are now looking at that stock on a daily basis, you are just corrupting your thinking. Accept that were too quick or the general market conditions did not go as per your expectations and move on.

- Learn to take losses – stop loss is not a concept only for technical traders: Typically, short term fundamental traders hold on to a stock until its price rises above their purchase price. They hope to keep enough cash to buy more quantity if the stock falls further so that they can average out their positions. While this approach makes sense on paper, in practice you must work with some stop loss and target price in mind. I have tried both on many occasions, i.e. (i) holding on to loss making positions for long times to wait for them to rise above my purchase price; and (ii) Selling off the stock which falls below my stop loss price, to use the cash to take positions in other stocks. 8 out of 10 times this I believed proved to be beneficial. Of course, eventually the stock you sold at a loss may also rise above your price but in short term trading, the concept of time value of money is of immense importance.

Remember – selling at the right time is as important as buying at the right time. It’s easy to fall in love with a stock which may have advanced a lot from your purchase price.

Also read – What do you need to be a Successful Stock Investor.

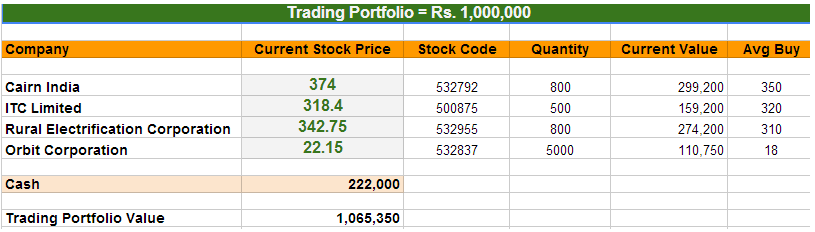

A Word about Our Trading Portfolio Management Template

Managing your own portfolio requires substantial time commitment. In addition, no matter whether you are an institutional investor or a beginner, having an insight into how others around you are trading will benefit you immensely. Our trading portfolio template reflects our actual market positions i.e. it is a live excel sheet which changes as per how we change our stock portfolio.

By paying a small amount, any investor can watch how we go about making money. Every time our mangers make any changes to, or rebalance this portfolio, subscribers get an SMS and an email about the changes. It is a straightforward tool that enables you to create, track and manage your investment portfolio. Find below how it works:

- Our trading portfolio template can be used by subscribers to replicate our live market positions. You will be able to see our stock purchase and sale moves as they happen.

- Receive updates in real-time – Get instant updates on any changes in the trading portfolio through SMS and emails.

- This model provides subscribers with an efficient way of investing in stocks as compared with complicated asset management platforms where you have to pay high amounts of commission and fees irrespective of whether you made a profit or loss.

Following our portfolio can potentially improve your performance, reduce your research time, and will help you avoid common mistakes in constructing and managing portfolios. You can write in to us with any enquiries at – info@sanasecurities.com or call us at +91 11 41517078.