Just a few weeks ahead of going into budget 2023, the Indian government plans to restructure India’s Renewable Energy and Power sectors. As electricity becomes the backbone of the future energy system, it becomes imperative for the nation to switch to greener generation. There has been a strong focus on manufacturing solar equipment, production of Renewable Energy, and energy storage facility to achieve the energy generation target of 500 GW by 2030. BofA pegs the investment in renewable energy in India at about $10 billion for 2023. To add the projected 228.54GW of capacity by FY27, the Indian power sector will have to employ around 1.67 lakh professionals, with technical manpower accounting for the lion’s share. Amidst all of this, a stock called PFC (Power Finance Corporation) has rallied by about 50% in the last 3 months which helped the stock to hit a fresh 52-week high in January 2023 and also from a 12-year symmetrical triangular pattern on quarterly charts.

The stock broke out from a 12-year symmetrical triangular pattern at Rs 154 levels with a positive technical indicator stochastic which is a positive sign for the bulls.

POWER FINANCE CORPORATION STOCK ANALYSIS

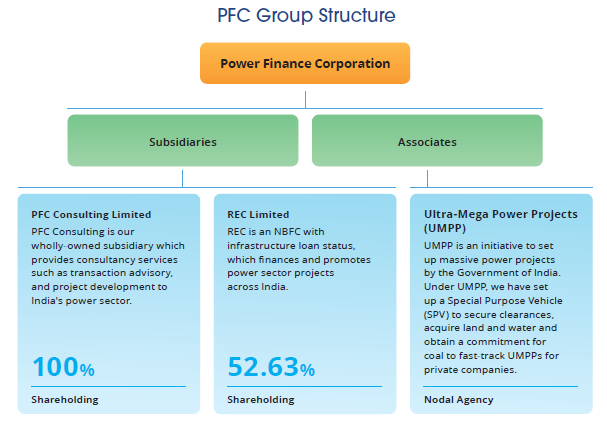

Power Finance Corporation Ltd. is an Indian central public sector undertaking under the ownership of the Ministry of Power, Government of India. Since its inception, PFC has been providing financial assistance to power projects across India including generation, transmission, distribution and RM&U projects. It is India’s largest Government-owned NBFC.

The portfolio of PFC majorly includes financial products and services

- such as rupee-term loans,

- short-term loans,

- equipment lease financing,

- transitional financing services, etc. for various power projects in the generation, transmission, and distribution sectors.

Its clients mainly include central power utilities, state power utilities, private power sector utilities (including independent power producers), joint sector power utilities and power equipment manufacturers.

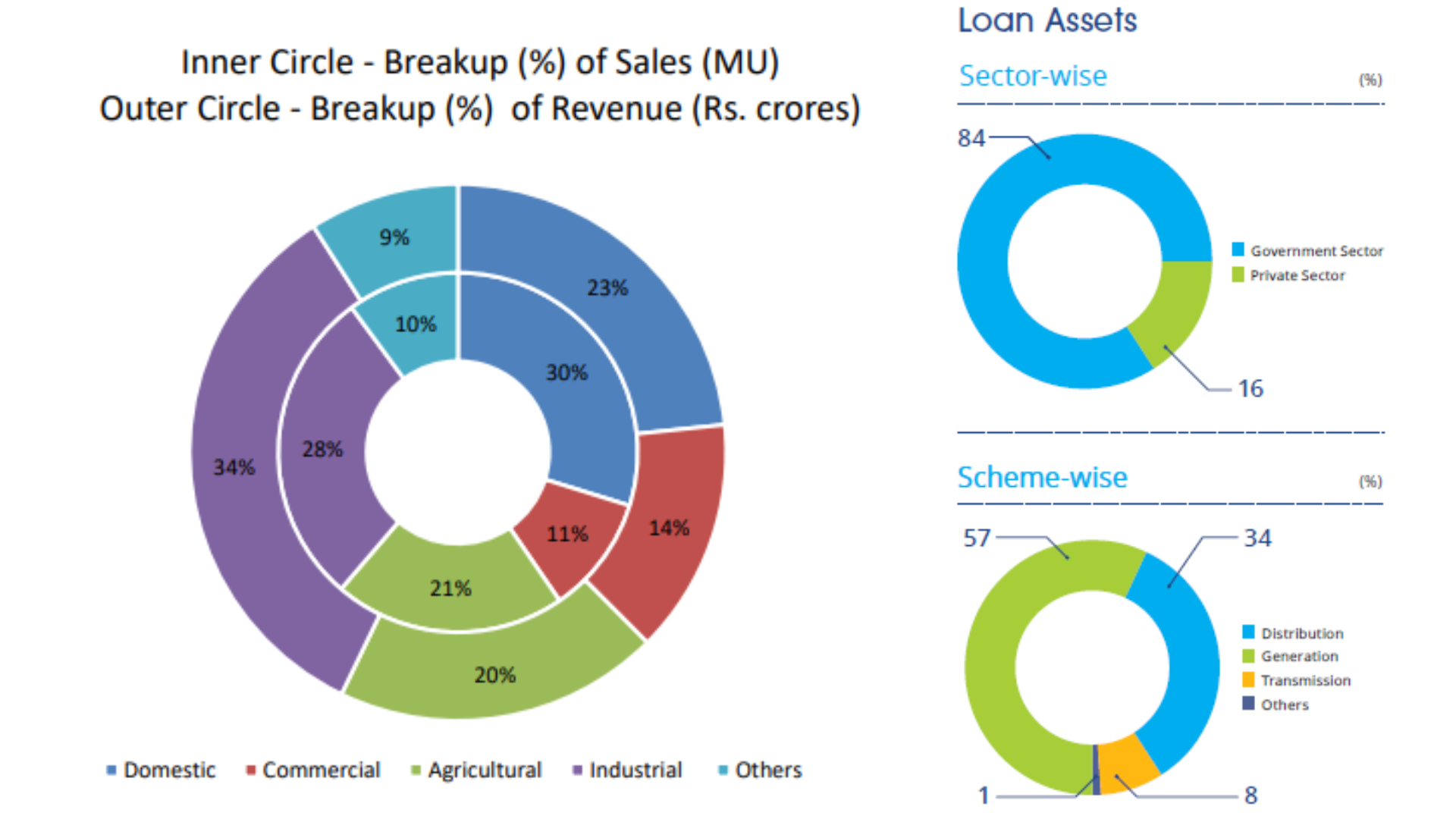

Portfolio Allocation of PFC

- PFC allocates a significant portion of its Loans to the government sector and around 54% of its revenue comes from the Agricultural and Industrial sectors.

- They also distribute loans based on schemes, under which the maximum allocation is to the distribution and generation of Power and energy.

- PFC enjoys the highest domestic rating on its loans (AAA), and its international rating is at par with the country’s sovereign rating.

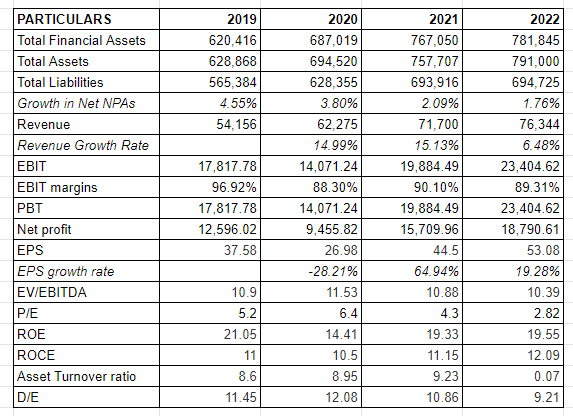

KEY FINANCIAL PERFORMANCE

Financial Highlights

- PFC improved its balance sheet position this year. It improved its capital adequacy ratio (CRAR) to 23.48% compared to 18.83% in the previous year. In terms of tier I and tier II assets, its CRAR stood at 20% and 3.48% respectively. This was because of its active resolution efforts of tier III assets.

- The company witnessed the lowest Net NPAs, as it declined to 1.76% in FY2021-22 compared to 2.09% in FY2020-21. This was a result of resolving 2,787 crores from Essar Power MP, RS India Wind Energy, GVK Ratle, Astonfield Solar & Krishna Godavari in the current year.

- PFC has declared a total dividend of 120% i.e. ` 12 per share during FY 2021-22, which was the highest payout in the history of PFC.

- During FY 2021–22, the company delivered the highest-ever net profit of ` 10,022 crores, up 19% from the previous fiscal. On a consolidated basis, the company earned a net profit of ` 18,768 crores, a 19% increase from FY 2020-21.

- PFC’s loan assets stood at ` 3.73 lakh crore on a standalone basis and ` 7.59 lakh crore on a consolidated basis.

- The company recorded a revenue of around 76,344 crores in FY 2021-22, which is roughly an increase of 6.5% from the last fiscal year.

INVESTMENT RATIONALE BEHIND POWER FINANCE CORPORATION

Government Schemes towards sustainability

- PFC aspires to contribute to the government’s thrust toward renewable and clean energy sources. It has aligned its business operations to leverage emerging opportunities in Ē-mobility and increased thrust in the transmission and distribution (T&D) space. Being a strategic partner of the Government of India, it will contribute to being an instrumental financial partner in government reform schemes for the Power sector.

- During the year, the Government of India introduced Revamped Distribution Sector Scheme (RDSS) in a bid to make the distribution sector more efficient and financially sustainable. The RDSS is a reform-based and results-linked scheme, which plans to reduce AT&C losses to 12-15% by FY 2024-25 and reduce the ACS-ARR gap to zero through financial support to discoms for upgradation of the Distribution Infrastructure and Prepaid Smart Metering & System Metering. PFC (along with its subsidiary REC) are the designated nodal agencies for the operationalisation of this scheme.

- In an attempt to focus more on the renewable energy sector, PFC financed a significant amount of renewable energy projects. In FY2021-22, 15% of its gross loan assets comprised renewable energy.

- PFC also issued its first-ever Euro Green Bonds amounting to EUR 300 million at a coupon of 1.841%. This was the first ever Euro-denominated Green bond issuance from India and the bonds are listed on the Singapore Stock Exchange, India INX and NSE IFSC. The funds raised under Green bonds have been utilized to finance renewable energy projects in line with PFC’s Green Bond Framework.

Credit rating agencies

- PFC being India’s largest government-owned NBFC, allocates around 84% of its loans towards the government sector, and it also recorded it lowest-ever Net NPA of around 1.7% in FY 2021-22, which really indicates the credibility of its credit risk analyst to not give out bad loans and to recover bad debts.

- PFC continues to enjoy the highest domestic credit ratings for its long term and short term borrowing programmes. The company’s international credit ratings continue to be Baa3 and BBB‑, which is at par with the sovereign rating of India.

Bright Future Prospects for the Renewable Energy sector

- Ahead of Union Budget FY24, it is expected that actions will be taken around climate financing and mobilising more resources by increasing allocation in the Production Linked Incentive (PLI) scheme for boosting the domestic manufacturing of green and sustainable solutions. BofA pegs the investment in renewable energy in India at about $10 billion for 2023. To add the projected 228.54GW of capacity by FY27, the Indian power sector will have to employ around 1.67 lakh professionals, with technical manpower accounting for the lion’s share.

- Initiatives such as Energy Conservation (Amendment) Bill, 2022, Offshore wind projects are some of the initiatives which move towards achieving said targets. The recent announcement by the government under the Hydrogen mission is a positive step in the right direction under which it is envisaged that India could attract investments worth ~USD100 billion by 2030. India will need ~USD2.5 trillion worth of investment by 2030 to fulfil updated commitments at COP26. Moreover, India needs more than USD10 trillion to achieve net-zero emissions by 2070.

Robust Financials

- Power Finance Corporation has good financials with its Revenue, Operating profit, and Net profit increasing steadily with an increasing growth rate, over the past few years. It also witnessed its lowest-ever Net NPA in the latest financial year, along with the highest increase in Net Profit in FY 2021-22.

- Essential Ratios such as ROE, ROCE, EPS, and D/E have also improved over the past years. This indicates the financial health of the organization and its well-being.