Remember the number of times you dipped into that coin box we all have at our homes? It’s the best form of contingency reserve to pay small (or often big) bills. Such boxes keep life moving when everything else fails. Isn’t it?

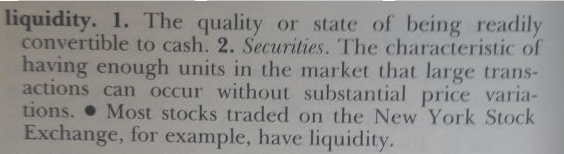

Liquidity in stock markets is like that coin box. It can bail you out when you over commit yourself but you never realise when the box runs dry. In case you have missed this ….. Of course, improvement in earnings is the key to sustainable rally in stock prices. There are times when stock prices nevertheless keep rallying for a fairly long period of time without a corresponding improvement in earnings – this is the power of Liquidity. None have been able to fight it. This single phenomenon can make the smartest of investor look really stupid.

For the past about 18-24 months, Indian stocks have been expensive. In many cases, very expensive. Pure value buyers would (or should) have either put most money in fixed income or could continue to find excuses and justify stock prices to stay relevant in the market.

Earnings have been very slow in catching up with stocks prices. But given the kind of liquidity in the market we may actually continue to see stock prices moving higher and higher.

There have in past been long periods where market-wide valuations remained low for a very long time and yet not much interest was generated in equities. Equally, there have also been occasions where stock markets continued to trade at very high valuations for a very long period of time. In each case what really made it possible was liquidity ….. less or more of it.

A look back at the last (and closest to current) period of excess liquidity

To look back at a dramatic period:

From June 2003 to June 2006, the FED raised interest rates 13 times from 1% all the way up to 5.25%. Despite this hyperactive effort to contain liquidity, NYSE Composite went up by over 51% during this period. For the record . . . during the same period Nifty went up by over 250% from a low of 1020 to a high of over 3650.

Was anything different back then?

During the above period despite a 250% rise in stock prices (on the Nifty), the Nifty PE touched a low of 11.60 but never in the entire 36 month period did it cross 17, staying in the 13-15 range for most part. Such was the improvement in corporate earnings. Today, while liquidity is driving the markets, the sustainability of this rally is simply not possible. In the last 36 month period, the Nifty PE hovered from 20 to 24.5, staying in the 22-23 range for most part.

A Billion $$ Question that Nobody Wants to Answer

What next?

A few days back a rather well known face in Indian stock market community openly admitted that he had sold of most of his stock holdings with Nifty @ 8300. He was not alone; many others said the same before he came around. These fine gentlemen have already seen stock prices run up by at least 10% from where they exited (perhaps for good reason).

Such is the power of liquidity in stock markets.

That said, some do have an answer to this liquidity puzzle. If you asked me the above question other than on a public forum, I can give you a precise answer. Perhaps one that you should know and remember at all times.

No wonder the midcaps are soaring. Nifty stocks are not so hot.