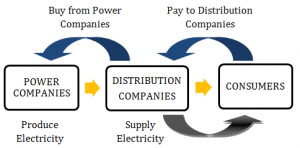

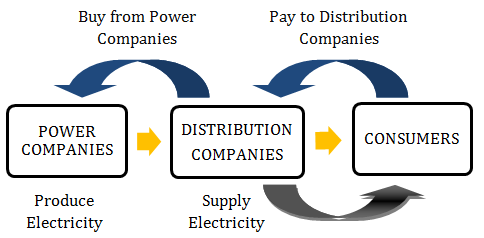

There is a shortage of power in the country – there is excess power available with power producers – consumers have the capacity to pay – distribution companies (i.e. State Electricity Boards (SEBs)) can’t afford to buy power!

THE PROBLEM

Concession Agreements

Over the past 2-3 decades projects were awarded to power companies with clearly laid out terms with regard to the price per unit of electricity which distribution companies will pay to the power companies. Further, these concession agreements in most cases prohibited power generating companies from selling any electricity to anyone other than the SEBs (i.e. distribution companies). At the same time, the SEBs guaranteed power generating companies that they shall buy 100% of the power produced by them at the agreed per unit price for power.

Power generating companies took large sums in loans to build power plants hoping to repay the loans once they started producing electricity. In a majority cases, such loans were securitized (i.e. the future revenue flow to be received from these projects was pledged as security for these loans).

This meant that in case distribution companies (i.e. SEBs) failed to pay the power generating companies full money for the power produced by them, the latter were either (i) likely to default on their loans; or (ii) take a significant hit to their operating margins.

In reality both happened consistently for a fairly long time.

Why Can Distribution Companies (SEBs) Not Pay?

Distribution companies are burdened in huge debt (approx. Rs. 4.3 lakh crores owed to various banks). For Financial Year ended 2015, they reported accumulated losses of over Rs. 3 lakh crores. As a result, they are unable to buy more power from power generating companies and are forced to impose power cuts on consumers.

In the first place, distribution companies got burdened with debt on account of their commitment to buy all the electricity produced by power generating companies. While they purchased this power, they were unable to sell the same at profit. In fact, they effectively distributed power at losses.

Why did SEBs Sell Power at a Loss?

[1] Power Theft: This is the single biggest factor bringing about these losses for SEBs. By one account approximately 40% of the power supplied by the SEBs gets stolen due to shortages in the power delivery infrastructure. Power theft is either direct or indirect where small and medium industries steal power from what is subsidized for farming, often due to their close proximity to agricultural lands.

[2] Lack of Power in Fixing Tariff: SEBs have the responsibility of purchasing power from power generating companies and distributing the same to the end-consumer. In this power supply chain, distribution companies have no authority in determining the price at which power should be sold to consumers. Power tariffs are regulated by state run body, for example in Delhi, it is regulated by Delhi Electricity Regulatory Commission, or DERC.

Annually, the DERC considers proposals from distribution companies for fixing tariffs and makes adjustments in the rates every fiscal year for different levels of consumption. For the FY2016, for instance, the DERC fixed a tariff of 400 Paisa/kWh for those consuming 0-200 units of power in one month. Often, distribution companies are forced to sell power at subsidized rates and are unable to break-even.

As a result SEBs have to borrow heavily to compensate for the lack of revenues from consumers.

THE RESULT

In June 2015, power companies were utilizing only 59% of their plant capacity (based on what SEBs could afford to buy) while the country was facing long and frequent power cuts, highlighting the problem of bankrupt SEBs.

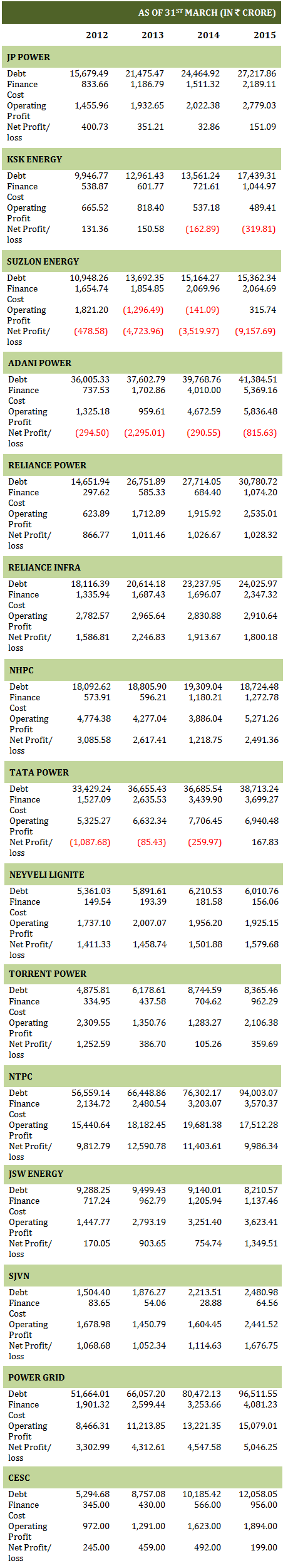

The overall profitability for power companies has suffered on account of unutilized capacity and in many cases debt burden has come close to critical levels.

Top 15 Power Sector Stocks Based on Market Capitalization

Stocks in the table are arranged based on ascending order of % change in prices.

| Company Name | Price as on 12th Oct 2009 | Price as on 12th Oct 2015 | Change % |

| JP Power | 78.90 | 7.00 | -91.13% |

| KSK Energy Vent | 201.85 | 37.20 | -81.57% |

| Adani Power | 102.05 | 26.25 | -74.28% |

| Reliance Infra | 1357.00 | 363.90 | -73.18% |

| Suzlon Energy | 86.70 | 23.90 | -72.43% |

| Reliance Power | 164.20 | 46.15 | -71.89% |

| NHPC | 33.00 | 17.10 | -48.18% |

| Tata Power | 127.32 | 69.70 | -45.26% |

| Neyveli Lignite | 135.75 | 77.90 | -42.62% |

| Torrent Power | 297.15 | 177.40 | -40.30% |

| NTPC | 210.00 | 126.00 | -40.00% |

| JSW Energy | 100.75 | 86.10 | -14.54% |

| SJVN | 25.05 | 26.25 | 4.79% |

| Power Grid Corp | 108.25 | 132.55 | 22.45% |

| CESC | 374.40 | 580.05 | 54.93% |

Deep Value or Junk Buying?

While it may seem like a tempting proposition to buy into power stocks when you notice how much they have declined, fundamentally some of these stocks are beyond repair from any rational standpoint. Take the case of Suzlon or KSK Energy, both these companies are consistently making lesser operating level profit than what they should make in order to service their outstanding debt (i.e. the interest charges on their debt are higher than what they make at a gross level).

In the chart below compare the interest coverage ratio for each company to get a sense of how close they are to defaulting on their loan obligations.

When Will Power Stocks Rebound?

At the same time, not all power companies are struggling. In the table above, you will notice that a few of them are actually making decent profits even as they operate below 100% capacity utilization levels. Further, some of these companies have reduced the total debt on their books and are looking well placed to benefit from any reforms in the sector. For example – SJVN which is currently trading at a price to earnings multiple of 6.25 and a good dividend yield of close to 4% at current price.

At current prices, stocks like SJVN present a good buying opportunity, particularly for investors who are willing to wait for reforms in the sector (whenever that happens!) and are content with a 4% tax free dividend yield until then.

4% – Dividend yield of SJVN calculated at Rs. 26/ share.

Very lucid explanation. in short stay away.

Thanks Rajesh, but I don’t know if you should stay away from all power companies. There surely are some of the best options in this space.

Thanks for sharing a very simple & effective article … Definitely there is merit in power companies .. I am holding some shares of Adani and would like to own some strong ones from the above .. Wish you good luck

Thanks Suresh, I will soon be coming out with recommendations in this space!

Really superb explanation. Every beginner like me will be happy after reading such a posts.lot of people would benifited.

Thanks Amit. Help me share the post with others, use the share buttons.

Simple and effective explanation. Maybe one should look at sectoral (thematic)funds for long term value?

Sir i just checked the fundamentals of PGCIL everything is at good position but the one thing that is changing the whole game is it’s debt to equity which is 2.27.

Sir,i want to know more about this and what is your opinion because every year company’s profit is increasing opm is increasing but loan is also increasing.