Disclaimer: The article below should not be taken as a buy/subscribe view on the upcoming Quick Heal IPO. Particularly, in the absence of pricing / valuation, assessment of the issue will be in vain. The article below presents an overview of the upcoming IPO.

I am bullish on stocks in the internet space.

About the Company

- Business – Quick Heal Technologies (“Quick Heal” or the “Company”) provides security software/ antivirus products for both home and enterprise users.

- Brands – Quick Heal (home) and Seqrite (enterprise).

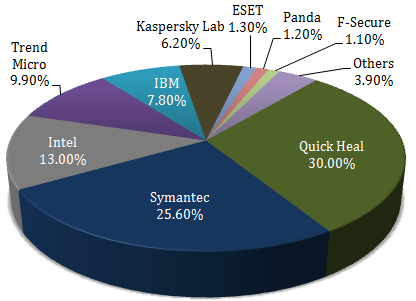

- Market share – 30 %.

- Customers – home users, small offices and home offices, Small and Medium-Sized Businesses (SMBs), enterprises, educational institutions, government agencies and departments

- Enterprise Users – Amongst the larger ones: Gitanjali Gems Limited, Sardar Patel University, Bombay Hospital, Indore, Aimil Limited, National Steel and Agro Industries Limited, Bharati Sahakari Bank Limited, Pune, and Chartered Speed Private Limited

- Market presence – The number of active licenses has increased from 2.5 million as of March 31, 2011 to 6.9 million as of June 30, 2015.

| Fee Structure for 1 year (Home Users) | |

| Quick Heal Total Security | Rs. 1,949.00 |

| Quick Heal Internet Security | Rs. 1,449.00 |

| Quick Heal AntiVirus Pro | Rs. 999.00 |

| Quick Heal Total Security for Mac | Rs. 1,549.00 |

| Quick Heal PCTuner 3.0 | Rs. 499.00 |

| Quick Heal AntiVirus for Server | Rs. 1,890.00 |

| Fee Structure for 1 year (Mobile Users) | |

| Quick Heal Tablet Security for Android | Rs. 449.00 |

| Quick Heal Total Security for Android | Rs. 449.00 |

| Quick Heal Mobile Security for Android | Free |

| Fonetastic Free | Free |

| Fonetastic Pro | Rs. 449.00 |

| Quick Heal Optimizer | Free |

| Fee Structure (Enterprise Users) | |

| Pricing on demand | |

- Distribution Network – As at June 30, 2015, Quick Heal had a network of over 15,000 retail channel partners, 230 enterprise channel partners, 279 government partners and 577 mobile channel partners

- Potential – unlimited future growth in line with growth in spamming, hacking and virus attacks.

- India accounts for 31% of the sales revenue

- Retail sales[1] accounts for 67% of the sales revenue

- Sequoia Capital, a venture capital investor, invested U.S. $12 million in 2010. As of September 30, 2015, Sequoia Capital owns a 10.25 % stake in the Company.

Anti Virus Market Size in India

Currently, antivirus market in India is valued at Rs. 5,000 Cr. The market is expected to grow at a CAGR of 12 % to reach Rs. 6,600 Cr. by 2017 [Source: Quick Heal IPO document] due to a rise in malware and virus threats. The increased use of mobile devices and the Internet have increased the frequency and complexity of these threats.

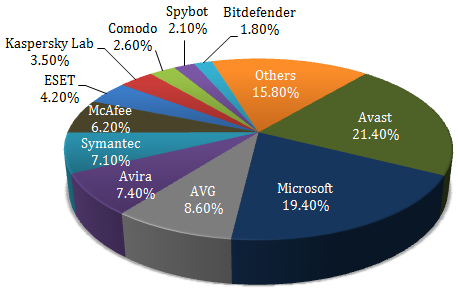

Market share of Antivirus Companies – Globally

Market share of Antivirus Companies in India

STRONG BALANCE SHEET | DEBT FREE COMPANY

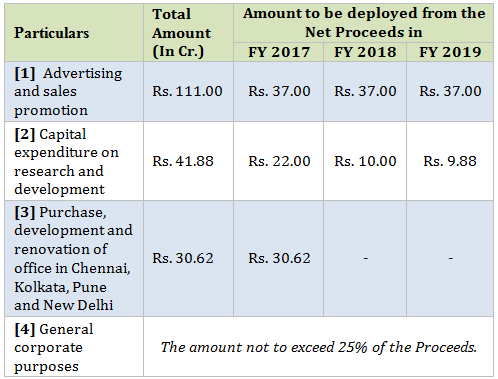

Quick Heal IPO – Use of Proceeds

Quick Heal has filed a Draft Red Herring Prospectus (DRHP) with SEBI for an initial public offering (IPO) to raise Rs. 250 Cr.

Growth Prospects

Increasing IT Penetration in India

India has the fastest growing internet population which currently stands at ~350 million (as of June 2015). India’s population is four (4) times that of the United States and less than 20% of India’s population uses the internet compared to 46% in China and 87% in the United States.

It is expected that the total number of internet connections will reach 500 million by FY 2018 (according to FICCI – KPMG | India Media and Entertainment Industry Report 2014). With the rise in the internet traffic and frequent use of internet enabled systems (laptops, desktops, tablets) and mobile devices, there is huge need for IT security.

As smartphones and personal laptops/desktops are repositories of personal data and information, the associated loss or theft of these devices and the increase in mobile malware attacks provides huge growth opportunity to antivirus market in India.

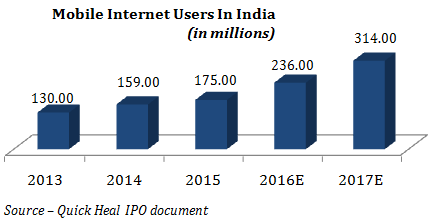

Mobile Internet

Users accessing the Internet through their mobile devices have become key driver for increase in overall Internet subscriber base in the country. The number of mobile Internet users in India is expected to rise to 314 million by 2017 as compared to 175 million in 2014 (Source – Quick Heal IPO document).

Increasing Smartphone subscription – Huge Opportunity for the Company

According to Ericson Mobility Report, the number of smartphone subscriptions is expected to reach over 750 million by 2020, up from 140 million in 2014.

As of June 30, 2015, the Company had more than 1.1 million active licenses under mobile solutions. With more and more smartphone subscription and greater internet penetration, number of active licenses is likely to go up.

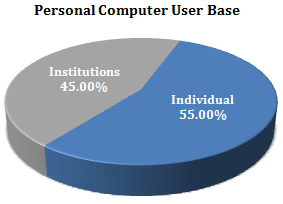

Personal Computers (desktops/laptops)

India has a large personal computer installed base of 55-60 million, growing at a rate of over 9% and is expected to reach around 70 million by 2017.

IT Security in Enterprises

Corporate spying and hacking have encouraged organization as well as individual users to spend more on sound and secure network infrastructure. Business verticals which have higher dependency on Internet and those with sensitive information such as banking & financial services, telecom, and the government are prioritizing IT security in terms of their annual expenditure.

According to Quick Heal IPO document, in 2013, the IT security market was valued over Rs. 5,000 Cr. On account of rapid adoption of security solutions and services by enterprises of all sizes; this value is expected to cross Rs. 8,000 Cr. by 2017.

Emerging Opportunities

- Opportunities like Digital India and Smart City Projects emphasize greater need for installing sound security system to keep critical data secure in such a discouraging threat environment.

- Internet of Things (IoT) & Home Automation: IoT is a seamless connected network of objects/devices, in which M2M (Machine to Machine) communication without any human intervention using standard communication protocols.

- Home automation segment includes centralized control of lighting, HVAC (heating, ventilation and air conditioning), appliances and security locks.

Challenges

Competitive Landscape

The market for security software solutions is intensely competitive. Competition is coming from both international and Indian companies such as Symantec, Trend Micro, Kaspersky, McAfee, Sophos, Fortinet, Watchguard, Apps Daily, Syska and K7.

Low-priced or free competitive products – Security protection is increasingly being offered by third parties at significant discounts or, in some cases is bundled for free. Many antivirus companies have tied up with the manufacturing companies to provide pre-loaded antivirus on smartphones, laptops, notebooks etc.

Also, there are competitors like AVAST and AVG which provide several free products to acquire users, especially those who are sensitive to pricing particularly in India.

Update Feb 5, 2016: In a price band of 300+ , it probably looks overpriced – Don’t blame me just in case it zooms on listing though.

[1] Note – Quick Heal defines retail sales as all sales other than those through enterprise channel partners, government partners, mobile channel partners and sales outside India.

Hi,

Thanks for the analysis. Couple of questions:

1. Why are the company’s operating and net margins declining despite increasing opportunity and growth in the market size?

2. Since the market is valued at Rs 5,000 Crores and the company claims to have a 30% market share, what should it be fairly valued at?

Regards

Rajat,

You mentioned that 31% of the revenue is from INDIA. The fact is that sales revenue from India is around 97% (as declared in RHP).

There are many material defects in the documents made public by Quick Heal and may alter the views completely. The Merchant Bankers and Underwriters had been made aware about the facts but they have not yet made it public.

I would advice you to go through those documents before making a final opinion and putting up the final advice.

Hi Manohar – 31% revenue comes from the RHP – thats where we took it from? Could you share your source?

But yes – do agree with defects in the prospectus.

Great call on quick heal sir, I did not apply . Thank you.

I lost huge amount wht should I do now hold or book my loss