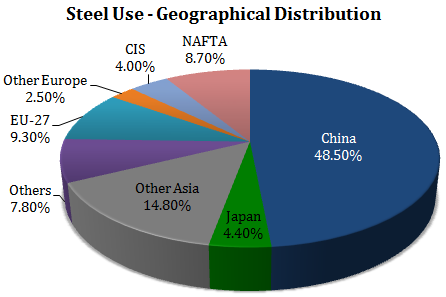

The steel sector as a whole is witnessing an unprecedented turmoil mainly on account of slowdown in China which remains the major producer and consumer of Steel. Of the ~ 1550 million tons of steel produced worldwide ~ 48% is both produced and consumed in China. Notice the geographical distribution and the pattern of use for steel.

Source: worldsteel.org | world steel in figures 2014

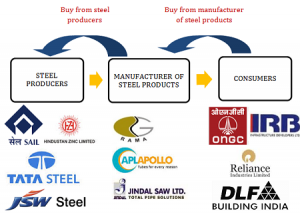

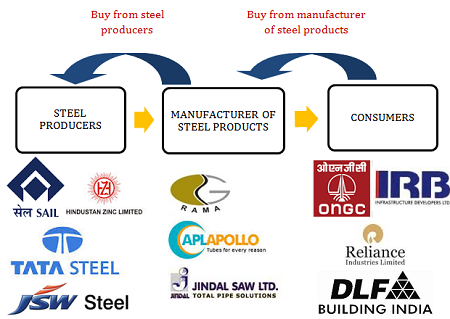

This slowdown has caused an oversupply of steel at a global level and substantial price erosion in steel stocks. Under the circumstances, it is reasonable to bargain hunt in this space particularly for those who can ‘buy and hold’ until there is revival in economic activity. Take into account that slowdown in steel prices affects different players within the steel industry very differently.

How Does Slowdown Affect Various Players?

An oversupply in steel or any other commodity is caused due to demand slowdown or when demand does not match up to what was anticipated. This leads to softening of prices as production/ mining overshoots consumption.

Slowdown in prices is great news for consumers as their margins improve on account of cheaper raw material. The negative impact of this is felt by manufacturers of steel products who compete with each other. Again, this is not as severe as it is for steel producers. The reason is simple, manufacturers work on margins; i.e., they buy steel at price X and sell the finished goods at price X+Y where Y is their profit margin.

Note: Manufacturers of steel products typically store finished inventory for anywhere between 30-60 days. As consumer demand falls, they are the first ones to take a hit in profitability margins as they sell their inventory at lower prices than what they had anticipated at the time of purchase of steel. Alternatively, as demand rises, they witness sharp improvement in profitability margins as they sell products manufactured using cheaper steel.

About Rama Steel Tubes Limited

Incorporated in 1974, Rama Steel Tubes Limited (“Rama Steel” or the “Company”) manufactures Galvanized Iron (GI Pipes) which are typically used in water, sewage, and oil and gas transmission and are also put to various uses in the infrastructure sectors. The company got approval for NSE listing on 17 August 2015 and BSE listing on 1 September 2015 and was formerly listed on the Delhi Stock Exchange (DSE). The Company operates through 3 manufacturing facilities:

Plant Capacity – 2 plants at Sahibabad (Uttar Pradesh) with capacity of 75,000 MT per annum and 24,000 MT per annum. 1 plant at Khopoli (Maharashtra) with capacity of 36,000 MT per annum. For the Khopoli plant the Company is planning to ramp up its capacity to 2,40,000 MT taking its overall installed capacity to 3,40,000 MT per annum. For FY 2015, the company reported a sales turnover of Rs. 200 Cr. with exports accounting for 40% of its gross sales.

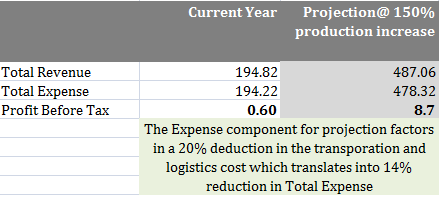

150% Capacity Expansion – Rama Steel recently added one more plant at Khopoli, Raigad, Maharashtra, which commenced commercial production in June 2015. The Company has also acquired 20 Acre of land at Khopoli, sufficient to have capacity to manufacture around 30000 MT pipes/tubes p.m. Overall, the company plans to increase its installed capacity to 3,40,000 MT per annum with a 2,05,000 MT per annum capacity addition being made at the Khopoli plant.

It is targeted for the new capacity to come into production in FY 2017.

Projected Revenue

Note that for such capacity expansion the company will need to change their capital structure and either take more debt or sell equity. Promoters currently hold 74% equity in the Company.

International Footprint

In April 2015, the Company set up M/s RST International Trading FZE, a wholly owned subsidiary company in Dubai with the objective of opening up avenues for more International business in steel products. Rama Steel already has active operations in UAE, Sudan, Ethiopia and Ghana. The Company anticipates that its Dubai footprint will serve as stepping stone in reaching other markets in European and African nations. As per company’s latest investor presentation (unaudited) during the 5 month period (April – September 2015), the subsidiary has carried out export orders worth more than US$ 1 million.

FOR QUANTITATIVE REPORT ON RAMA STEEL TUBES – Rama Steel Tubes Stock Analysis Quantitative

| STEEL SECTOR SNAPSHOT – INVESTMENT RATIONALE |

| Government Investments and economic recovery create significant headroom for growth and opportunities for steel products (pipes and tubes). The sector as a whole is likely to benefit from various government schemes and programs initiated under the Make in India initiative, smart cities project, metro & mono rail projects, development of bullet train corridors etc. |

| Growth Drivers for the Company |

| Oil & Gas – Government initiative to construct 30,000 kms pipeline (12,000 km of gas pipeline and 18,000 km of oil pipeline) by FY 2017. Also, shale gas discovery is likely to increase the global demand for pipeline infrastructure. |

| Aviation Sector – Government is planning to invest U.S. $30 billion in the next 10 years in development of airports in tier-II cities including an addition of 16 Greenfield airports. |

| Real Estate – Government initiative – ‘Housing for all by FY 2022’ is likely to result in huge demand for steel tube industry. |

| Ports and Shipping Sector – the sector is in rapid expansion mode and the national maritime agenda aims to increase the aggregate installed capacity in the sector from 1 billion tonnes per annum (tpa) to 3.2 billion tpa by FY 2020. |

| Road Transport and Highways – the Government’s ambitious plans for linking state highways to most districts of the country, construction of golden quadrilateral (i.e. Delhi-Mumbai-Chennai-Kolkata-Delhi) and the 5,000 km road network all along the borders and coastal areas under a new scheme to be called Bharat Mala will ensure increased demand for steel tube products. |

| Solar and renewable energy – Rs.10,000 crores capital expenditures was allocated in Union Budget 2015 for Ultra Mega Power Projects in several part of the country like Rajasthan, Gujarat and Tamil Nadu. In near future this paves way for great opportunity for steel tubes industry. |

| INVESTMENT CONCERNS |

| Steel Remains in an Oversupply Mode – Oversupply in steel in one market is balanced by demand in another. Because of this, cheaper steel availability in China which is witnessing an economic slowdown is transported to other geographies. The net effect is softening of steel prices at a global level. Until there is balancing of this demand-supply gap, steel prices will remain week. |

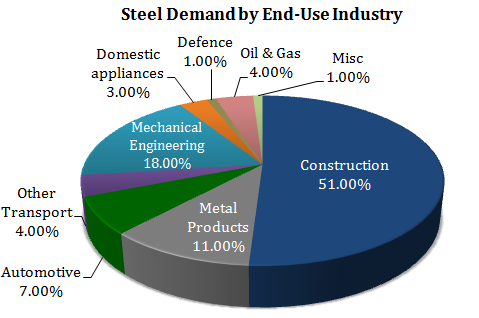

| Economic Slowdown – Steel pipe and tube industry is dependent on spending in various sectors such as oil & gas exploration, housing, infrastructure, automobile etc. An economic slowdown might stagger infrastructure development in end-user industries and adversely affect the Company’s profitability. |

| Decrease in Steel prices – Steel prices fluctuate based on macroeconomic factors including consumer confidence, interest rates and inflation rates. Also, steel prices depends on the demand in the industries, such as the automotive, construction, machinery, equipment and transportation industries, which are among the biggest consumers of steel products. When downturns occur in these economies or sectors, there is a decline in the steel prices. |

| Competition – Rapid growth in the Indian economy and huge steel pipe demand will attract more competitive players to enter. |

Thanks sir, very good information, is it good to buy at current prices Rs 195 three years prospects?