A lot more confusion has surrounded this subject than what it deserves. I have witnessed all sorts of discussion forums on who will get the dividend, when will they get the dividend and at times, a discussion on why the investor did not receive the dividend on their shares. Let’s end all confusion around this.

“Dividends are paid to the holders of shares as of the Record Date”

1) What happens when the company declares a dividend?

2) Record date vs. Ex-dividend date.

3) When is the dividend paid?

What happens when the company declares a dividend?

Nothing

As and when the board of directors feel that they should distribute a part of the profits to the shareholders they can declare a dividend. Typically (and not mandatorily) this is done by the board of directors at the time of approving the quarterly or annual financial statements. After the board of directors declare a dividend, two things have to happen:

Second, the company must actually pay the dividend amount (for de-materialised shares payment of dividend amount is done by ECS directly into your bank account, unless you have not provided your bank account details to the depository. In case you are holding physical share certificates you should make sure that you have received your dividend cheque from the company).

Record Date vs. Ex- dividend date

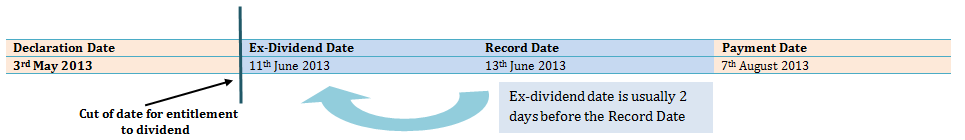

This is where a majority of the confusion stems from. Remember that share purchases in India are settled on a T+2 business day basis where T is the transaction date i.e. the date on which the share purchase transaction occurs. This means that ownership of a share purchased on 10 June 2013 will transfer from the seller to the buyer only on the 13th of June. So if a Company declares 13th of June to be the Record date, you will be entitled to receive the dividend only if you purchased the share before the 11th of June (i.e. on 10th of June or before) and hold on to it at least until the end of day on the 10th of June. The idea is to have your name on the register of shareholders on the 13th of June which is the Record date. For that to happen, you must buy the share before the 11th of June, which will be the Ex-dividend date.

(Click to enlarge)

On 11th of June the share will become Ex-dividend. Shares bought on and after the Ex-dividend date are not entitled to receive the dividend which is the reason why share prices usually adjust downward on the Ex-dividend date.

Why these dates differ and 2 points to keep in mind:

► In case the stock market is closed on any of the days between the Ex-dividend and the Record date (owing to it being a Saturday or Sunday or any other exchange holiday) then the Ex-dividend date will be those many days before the Record Date.

► While the Ex-dividend date is usually two business days before the Record Date, the actual Ex-dividend date may vary. This is because, the company sets the Record Date but the Ex-dividend date is set by the Stock Exchange and not by the company. The Stock Exchange sets this date based on its settlement cycle and working days. You can check the Ex-dividend dates for Indian Stocks on the websites of BSE & NSE.

When is the dividend paid?

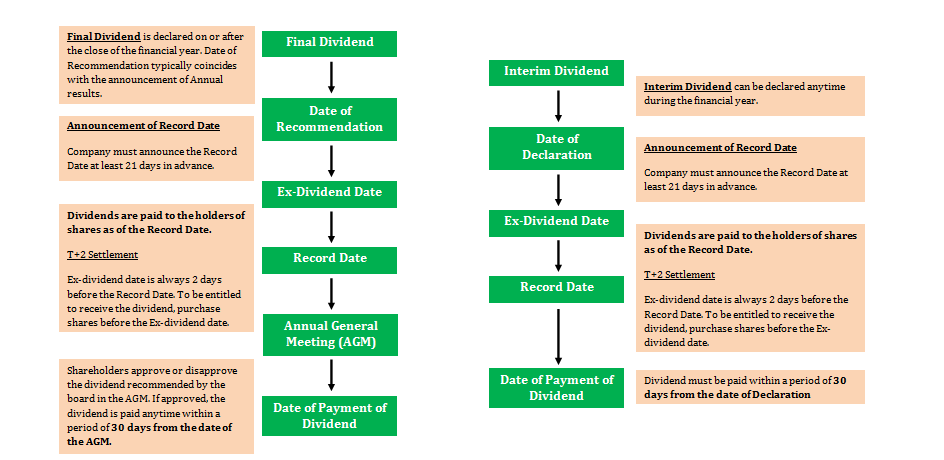

The board of directors can declare either an interim dividend or a final dividend. Legally, a company must pay the dividend within 30 days from the date of ‘Declaration’ of dividend. When is the dividend considered as declared? When does it get paid? This is where the balance of the confusion stems from.

Interim vs. Final Dividend

An interim dividend is declared and paid by the Board of Directors prior to the approval of the shareholders. A final dividend on the other hand must first be approved by the shareholders in the Annual General Meeting before it is paid. Accordingly the date of actual payment for the dividend amount could differ in both cases. It is correct that the company must make the dividend payment within a period of 30 days from the date of declaration. However, in case of final dividend, this 30 day period will start from the date on which the shareholders approve the dividend in the Annual General Meeting, while in case of interim dividend this period will start ticking from the very date on which the board of directors declare the dividend.

The charts below will clarify the above concepts

(click to enlarge)

Let’s collect every dividend ever paid – Really?

So holding a share on the record date (i.e. buying before the Ex-dividend date) will entitle you to the dividend. How about if you bought the share just a day before the Ex-dividend date and sold it the next day, will you then get the dividend? Of course you will, but at what cost?

Typically the price of a share adjusts downward after the dividend payment to reflect the amount of dividend. It may adjust exactly by the dividend amount or a little more or less (based on normal market factors) but either ways, there are no guarantees that you will capture the dividend amount and be able to sell the share at the price at which you bought it a day before.

For example: If we look at the previous example of Century Enka Limited – on 26 June 2013, the share closed for trade at a Rs. 107.25. On 27 June 2013 (i.e. next day which was also the Ex-dividend date) it opened for trade at Rs. 102. This downward correction of Rs. 5.25 eroded the benefit of Rs. 6 per share dividend. Remember, the share could have opened at Rs. 100 or Rs. 104 or Rs. 108 but any such deviation in price from the previous closing price factors in the dividend payment and the revision is purely based on regular events and market factors.

Many investors try to buy the share 15-20 days or even a month before the Ex-dividend date and expect to make a profit by selling about a month later (hoping they can still make a 6% return in a month). Practically, this is no different from buying the share a day before the Ex-dividend date and selling it the next day, because no matter how long you hold the share, on the ex-dividend date it will correct for the dividend. Historical price performance of top dividend yielding companies has shown that to the extent you make any profit or loss by trying to capture the dividend, it is based purely on market factors.

Download the Excel sheet containing the detailed analysis here.

__________________

In fact, we conducted an experiment on 4 of the safest big dividend yielding companies by hypothetically purchasing their shares at the beginning of the month of the Ex-dividend date and sold them at the end of the month. We did this for 5 years from 2008 – 2012 (both years included) and kept the amount at Rs. 10 lacs at the beginning of each year. The results are a clear lesson on what not to do with stocks.

I got my answer. I did not read the complete article.

Those dividend which is not final dividend.

Distributed by the firm when it deems fit to pay to the shareholders as firm’s profitability.

There are various reasons for distribution of such profit. Viz. Firm couldn’t find perfect investment opportunity to invest those profits.

thats correct

He should get dividend as he sold on 14th and record date is 15th and the settlement date is T+2 so he is owner till 16th…. as the buyer who brought the shares of mr deepak too will not be eligible for dividend as he is the owner only on 16th.. i.e after the record date.

@Rajat – Why NOT? The dividend SHOULD be collected for the shares sold of Ex-Div date. Please confirm

Yes you are right.

As per blog I want more clearficatiion I have 400 share of coal india and the date of ex dividend is 14-03-16 but the record date is 15-03-16

Should I get dividend if sell all share on 14-03-15 on ex dividend date

No you will not. On 14th the share started trading ex(cluding)- (i.e. ex-dividend) as the name suggests.

1. Is settlement affected by book closure of companies?

2. Regarding previous comment on Coal India. Ex-Dividend date is 14th March and Record Date is 15th. So will one receive dividend if one buys on 12th March(settlement on 14th) and sells on 13th March(settlement on 15th) assuming all are working days ???

Short answer – no.

So ex dividend date, as the name suggests is the date on which the share trades Ex(-cluding) dividend. I.e. without the benefit of dividend attached to it.

If bank detail updated by DP is wrong and dividend return at that time whether shareholder has to approach each and every company for physical instrument (Dividend warrant) or not required.

Just get your bank details corrected and that should solve this (even for unpaid dividends).

But to be honest, I can not imagine a DP going wrong with this (unless – the broker and the DP were separate entities). I say this because the broker would have got at least one pay-in / pay-out done for your account, no? Open your trading account with a proper stock broker for starters. Call me!

Sir in New Issue Market i.e. Primary Market issues are floated through:

(1)Offer through Prospectus

()Bought out deals or offer for sale

()Private placement

()Rights issue

()Book building

Could you please clarify difference between these issue mechanisms? Also what are the alternative names for these mechanisms? What is the difference between Offer through Prospectus and Book building? What type of investors are allowed in a book building process? What is 75% and 100% book building process? For a common investor of India which modes are advisable? i.e. what are the advantages and disadvantages? I shall be indebted to you for giving clarification on these? Regards.

Hi Arif – These are basic issues. Do some Google searching and you will get your answers. Lets stay connected.

Hi Rajat,

In case of de-merger , If I buy/sell the shares on record date . What happens on these scenarios ?.

Thanks,

Rama

You will get nothing in that case/ i.e. merger will not impact you.

in case of right issue same mechanism follows relates to dates jus like dividend?

Yes. That is correct.

The example you cite in your article, you state that Buy Transaction with Trade Date 10-06-13 would Settle and ownership will be transferred on 13-06-13. I am pretty sure this is incorrect. T+2 implies that the ownership will transfer to the buyer on 12-06-13.

Please confirm.

The ‘T’ of T+2 is the trade day itself. So T+2 is counted as – Actual trade date plus ‘up to’ 2 days from then, but the ownership can transfer earlier. In fact it may well be on 11-06-13 (though highly unlikely). The T+2 timelines I describe are based on what is typical.