Reliance Industries (“Reliance” or “Company”) operates across a large value chain of energy (spanning Exploration and Production, Refining and Marketing and Petrochemicals) and in consumer businesses (Telecom and Retail) and other businesses like textiles, SEZ development and Media.

THE MAJOR BUSINESS OF RELIANCE INDUSTRIES CAN BE DIVIDED INTO 2 DIVISIONS

[1] ENERGY VALUE CHAIN – Vertical Integration through Refining & Petrochemicals

- Refining and Marketing

- Owns and operates two of the world’s largest and most complex refineries with crude processing capacity of 1.24 MMBPD

- Petrochemicals

- Manufacturing of Polymers, Polyester, Fibre intermediates, Elastomers and Chemicals

- 2nd largest producer of polyester fibre/yarn globally

- Exploration and Production

- Significant expertise in deep-water operations

- Substantial exposure in US Shale

[2] CONSUMER-CENTRIC BUSINESSES

- Retail

- Pan India presence across 532 cities of Reliance fresh and digital branded stores

- FY16 Number of stores: 3,245

- Reliance Jio

- Building a pan-India next generation digital platform to provide high-speed broadband network, digital content, applications and services

Watch More views on Reliance Diversification – Here

MAJOR PRODUCTS AND BRANDS

| REFINING AND MARKETING | |

| Refining | Liquefied Petroleum Gas, Propylene, Propylene, Gasoline, Kerosene Oil, High Speed Diesel, Sulphur , Petroleum Coke Fuel and Alkylate |

| Petroleum Retail | Reliance Petroleum Retail, Reliance

Aviation, Auto LPG, R-Care, Relstar, Trans Connect |

| PETROCHEMICALS | |

| Polymers | Repol, Relene, Reon, Relpipe |

| Chemicals | Relab |

| Polyester & Fiber Intermediates | Polyester Staple Fibers, Polyester

Filament Yarns, Specialty Polyesters |

| OIL AND GAS EXPLORATION | |

| RETAIL | |

| Reliance Retail, Reliance Fresh, Reliance Digital, Reliance ResQ, Reliance Jewels, Reliance Trends, Steve Madden, Superdry, Kenneth Cole, Marks & Spencer, Hamleys, GAS, Ed Hardy | |

| OTHERS | |

| TELECOM | Reliance Jio |

| TEXTILES | Vimal, Vimal Gifting |

| MEDIA AND ENTERTAINMENT | |

| TV Channels | CNBC TV18, CNBC Awaaz, IBN 7, News18 India, ETV, Colors, MTV India, Comedy Central, Nickelodeon, History TV18 |

| Filmed Entertainment | Viacom18 Motion Pictures |

| Digital Content | Moneycontrol, News18.com, Firstpost, Burrp |

| Digital Commerce | HomeShop18, BookmyShow |

| Publishing Business | Forbes India, Better Interiors |

| Allied Business | Topper Learning, Colosceum, Capital 18 |

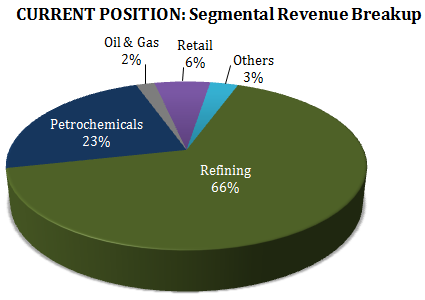

Reliance Financial Position

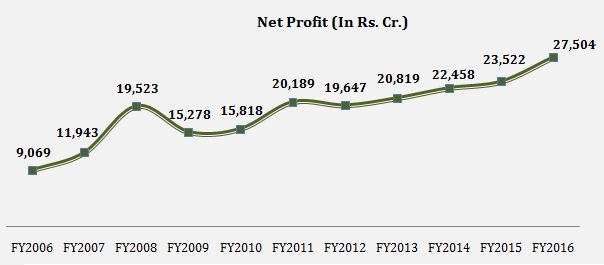

Reliance has shown consistent growth over the last ten years (i.e. 2006-07 to 2015-16). It’s net revenue from operations over this period grew at an impressive CAGR of 18.29 %. For FY 2016, PAT increased by 16.93 % to Rs. 27,504.00 Cr. from Rs. 23,522.00 Cr. Reliance has reserves in excess of Rs. 243,643 Cr and operates with 0.52 debt/equity on its books

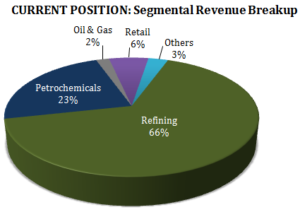

Robust Downstream Performance but Upstream Fall

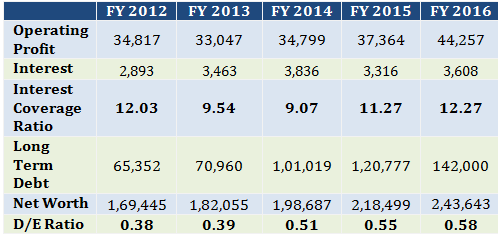

Reliance Industries derives 66 % of its revenue from refining and marketing segment. Refining business is inversely related to crude oil prices. For FY 2016, the Company’s operating profit from refining segment increased by 49.1 %. Reliance’s Gross Refinery Margins (GRM) for the year stood at $ 10.80/bbl as against $ 8.60/bbl in the previous year. For FY 2016, EBIT margin has improved to 16.0% from 9.95% on the back of GRM improvement by 25.6% as compared to previous year.

Installed capacity as of 1st April, 2016 MMTPA – million metric tonnes per annum

Source – Petroleum Planning & Analysis Cell | May 2016

According to the Company’s presentation May 2016| Reliance posted highest GRM at $10.8 per barrel which is one of the highest recorded among other refiners. Reliance owns and operate the world’s biggest state-of-the-art single-location refinery, where they are able to convert the last ounce of crude into finished product. Reliance refinery currently has an average complexity of 12.6, while BPCL’s Bina refinery has close to 9 and HPCL’s Bathinda unit has a complexity of 8.

In addition, the Company also source crude oil from its own exploration and production segment and imports cheaper crude oil from Iran.

*A complex refinery is one with an ability to process heavy or very low quality crude that can be sourced cheaper than light or good quality crude and be processed into fuel.

The Company’s Oil and Gas segment revenue for the same year decreased by 34.7% to Rs. 7,527 Cr and EBIT declined by 88.1% to Rs. 378 Cr because of lower oil and gas price realizations and decrease in domestic upstream volume. U.S. shale operations were also impacted by low commodity prices.

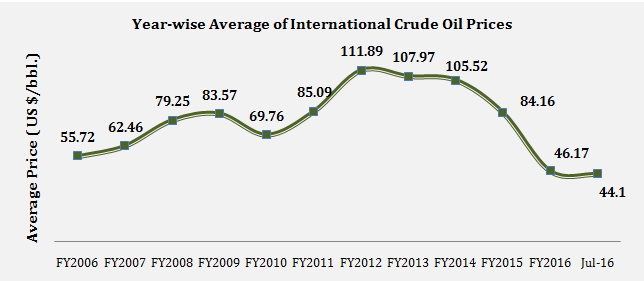

Increasing Profits | Fall in Crude Oil Prices

| Months | Crude Oil Prices |

| April | U.S. $ 43.86 |

| May | U.S. $ 46.53 |

| June | U.S. $ 47.24 |

Over the last quarter, however, crude oil prices have started to creep back up again, rising to ~U.S. $50 per barrel. This could put pressure on refining margins and profitability for the quarter ended June 2016.

Retail Business | Country-Wide Retail Chain and Growth Prospects

| Zone | Number of Stores (as of March 2016) |

| North | 661 |

| South | 1,168 |

| East | 404 |

| West | 1,012 |

Reliance retail business is growing at a CAGR of 29% over the past five years. For FY 2016, Reliance Retail’s revenue increased by 22.5% to Rs. 21,612 Cr. from Rs. 17,640 Cr. in FY 2016. Reliance has pan-India presence with 3,245 stores across 532 cities as of March 31, 2016.

Over the years, the Company has enhanced its presence across various sectors. Reliance Retail operates 2,621 stores across 200 cities, Reliance Trends now operates over 271 stores and Reliance Digital operates over 1748 stores.

Reliance has also entered into franchise arrangement with many international brands such as Diesel, Superdry, Hamleys, Ed Hardy, Marks and Spencer, Paul & Shark, Thomas Pink, Kenneth Cole, Brooks Brothers, Steve Madden, Timberland, Grand Vision and many more. The Company’s brand portfolio spans across the entire spectrum of luxury, high-premium and high-street lifestyle space.

Going forward, Reliance is poised to increase its reach to customers through rollout of online stores for fashion and lifestyle, and grocery verticals. It is expected that combined physical and online business would help sustain Reliance’s leadership in retail segment in the coming years.

INVESTMENT CONCERNS

Entry into Telecom Sector | Reliance Jio

In 2015, the Company announced launch of 4G -based service. The Company has invested over Rs. 1,50,000 Cr. in its 4G internet and telecom venture, Jio, making it one of the largest startup venture anywhere in the world. The biggest hurdle that Reliance Jio will face to have its market presence is that Jio is completely 4G based services but there is neither strong infrastructure nor evident demand for this service. Already, Airtel, Idea and other competitors are offering the same 4G service. Reliance Jio will also have to struggle to source its customers who will be willing to pay for the premium price for its 4G services.

Note: The share price of telecom companies like Airtel and Idea have fallen by 13.11% and 38.83% respectively over the last 1 year.

Also Read: Are Telecom Stocks Heading for a Crash?

Too Much Unrelated Diversification

Reliance Industries is a perfect example of Diworsification, a term coined by the legendary investor Peter Lynch in his book One Up on Wall Street, where he suggested that a business that diversifies too widely risks destroying their original business because management time, energy and resources are diverted from the original investment.

The Company has expanded its business portfolio in too many unrelated divisions. Currently, Reliance is into refining, Oil exploration and production, retail and more recently telecom.

Nice article.

I think Reliance is never a bad stock to pick up at a low prices. It has the second highest market capitalization out of all stocks on the Nifty. Reliance’s success is directly related with India’s macroeconomic picture which looks bright in my opinion. The company is also fundamentally strong and looks lucrative as a defensive investment for the long term. It is also one of the only stocks that gives you entry into some e-commerce businesses directly which is not possible otherwise, but it is important to point out that they are a very small percentage of the company.

Reliance is good share in what sense? I could not see much growth for the last ten years in share price. What is the fate of Reliance Jio? Mukeshji can make miracles that Anilji could not do?

I am not sure if I said it is a good stock to buy? Where are you getting this from??