One of the most common mistakes which investors make while selecting stocks is paying more attention than is due to the Return on Equity (ROE) or the return which the company generates on the employed capital.

While ROE is an extremely important metric it should not be treated as the holy gospel of investing. A single ratio can never be considered as the primary screening criterion for identifying stocks.

Why is it important to look at ROE along with valuation techniques?

Return on Equity – indicates how much profit a company generates on the capital invested by the equity shareholders. Put differently, ROE measures the return generated by the owners (i.e. shareholders) on their investment in the business.

Return on equity is expressed in percentage terms and is calculated by dividing the net profit generated by the company by shareholder’s equity (i.e. share capital + reserves and surplus also referred to as ‘Net Worth’).

A high ROE indicates that the management is generating that much better return for their shareholders.

What is high ROE? I could answer this in 100 ways depending upon the industry/ sector; but a more important question is this – Am I paying too much to acquire high ROE?

For example – Hindustan Unilever (HUL) for the year FY 2014 reported an ROE of 111.54, i.e. HUL earns 111.54% return per year on the money invested by shareholders. Sounds brilliant, isn’t it? Shareholder money is doubling every year. But how much must the shareholder pay to acquire this high ROE?

HUL has 216.35 Cr. shares outstanding. Let’s say an investor was to buy 1% of it = 2.16 Cr. shares. The Investor will pay Rs. 1,852.95 Cr to get 1% equity (assuming the current share price of HUL = Rs. 857.85 as of 29 April 2015).

For Rs. 1,852.95 Cr, the investor becomes entitled to 1% of annual profit = 39.45 Cr (for FY 2014, PAT was Rs. 3,945.57 Cr). Effectively this means that if this company (HUL) continues to generate a return at similar rate, it will take a little over 47 years for the investor to earn back his Rs. 1,853 Cr.

(The math above is done as – 1% of total profit in his share = 39.45 Cr. * X = 1853 Cr.)

This is just what the PE Ratio also indicates (i.e. HUL’s current PE Ratio = 46.97).

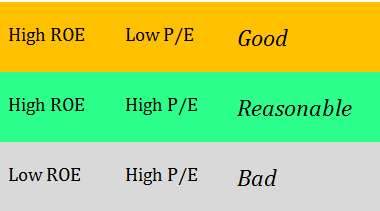

ROE can be an effective tool in selecting stocks when it is combined with a valuation technique like Price to Earnings (P/E) ratio.

P/E ratio is the simplest ratio to determine the valuation of a company. It is arrived at by dividing the current market price of a company’s equity share with its Earning Per Share (EPS).

Also Read: Detailed explanation and video on Price Earnings Ratio

How to Calculate Price / Earnings Ratio when EPS is Negative?

Naturally, it will not make much sense to invest in a company only because it doubles shareholder investment every year, if you end up paying very high for a piece of share in the company.

Higher return on equity and low P/E ratio – both these aspects should be paid equal importance when finding attractive stocks. While ROE ensures that the equity you buy is generating good returns; lower P/E ensures that you are not overpaying for your acquisition.

What do you look for in a good stock?

[1.] Low Price to Earnings Ratio (available at low price)

[2.] High expected growth in earnings (EPS)

[3.] High ROE

Naturally, it would be difficult to find stocks which are perfect on all three counts (though not impossible!). The effort however should be in finding stocks which are closest to being perfect on all these parameters.

High ROE and Low P/E – Good Companies (from the perspective of these ratios)

| Company | ROE | P/E |

| NMDC | 21.44 | 7.15 |

| Cairn India | 21.64 | 6.44 |

| Axis Bank | 16.43 | 5.85 |

| Rural Electrification | 22.79 | 5.75 |

| Tech Mahindra | 32.99 | 4.99 |

High ROE and High P/E – Be Careful When Buying These

| Company | ROE | P/E |

| Page Industries | 52.70 | 101.41 |

| Colgate | 90.00 | 51.59 |

| Caplin Point Labroratories | 42.00 | 50.21 |

| Marico Limited | 35.67 | 46.01 |

| Hindustan Unilever | 111.54 | 45.30 |

Low ROE and High P/E – Buying These Should Take Some Courage!

| Company | ROE | P/E |

| Unitech | 0.60 | 298 |

| Welspun Corp | 2.57 | 271.50 |

| TV18 Broadcast | 3.03 | 132.50 |

| Torrent Power Limited | 1.70 | 20.90 |

| Adani Enterprises | 9.35 | 17.68 |

Based on market prices as on 27 April , 2015

Keep in mind – certain companies with low equity base may report high ROE’s. Try to find out the reason behind a high (or low) ROE before concluding your research. Investing based on these 2 ratios alone is not recommended. The article above aims to only clarify how these ratios should be studied in conjunction.

So should you focus on Return on Equity or on the valuation of the company?

Of course, both!

good

wonderful article…. !!!

Thanks Purshotam

But not all profit generated is distributed to shareholder and most of it get reinvested right? very less in regular dividends and bonuses?

So it should take less than what p/e indicates to get the price back or doubling of invested amount?

Pls correct me if i am wrong

btw thanks for your site/article.

You are absolutely correct.