If the job has been correctly done when a common stock is purchased, the right time to sell is almost never.

– Philip Fisher

The question here is one of whether the job has been done correctly or not?

THE QUESTION HAS MORE TO DO WITH ONE’S OWN ABILITIES AND IS IN ITSELF A LESSON IN INVESTING. A LESSON NOT OFTEN TAUGHT AT BUSINESS SCHOOLS.

It is only human to go wrong. The past is always filled with stocks which at one time were considered as the bluest of blue chips. A perfect case in point is Mahanagar Telephone Nigam Limited. It had an almost indestructibly large customer base and its promoter was the Government of India itself (so much for a well recognized group). How much has the stock returned in the last 5 years?

Negative 90%. Thanks to the growth of private cellular technology.

If today a fund manager says, oh! I knew it all along; he may indeed find himself in very rare company.

Having said that, why am I not talking of Unitech or DLF? In the year 2008, just before the big crash, the price earnings of these stocks had shot from ~ 10 – 15 to over 45 in less than a year. You surely could have done some homework before buying into them, irrespective of whether you anticipated the crash or did not. If you ask me, personally a PE of over 45 could hardly be justified even for the fastest growing technology companies. While in past, there have been examples of companies which have continued to outperform despite such high valuations, investing in such companies is a style I understand very little off.

To the extent a previous run up (or fall) in prices stops making any sense, you may want to investigate the matter. That said, I certainly do not believe that such sudden run up or fall alone should be reason to buy/ sell a stock.

Past Performance as Driver of Future Prices?

3 months back I discovered 2 relatively unheard of stocks. First one has already given me a 45% return (Stock A) while the other has given me only 3.4% (Stock B), despite the market having done so well during this time.

I will tell you about any one of these stocks and my reason for buying it. Which one do you wish to know about?

Something that delivered a 45% profit in 3 months surely would have exceeded my expectations and the chances that it will deliver any higher returns are remote. May be I should already sell it. On the other hand, the story for Stock B may not have possibly played out. While a rational person may want to know more about Stock B and my reasons for picking it, some others may still wish to know about Stock A. I wonder why. May be just out of curiosity to find out more? So much so that SEBI had to mandate all fund houses to put a statutory legend –

“Past performance is not an indicator of future performance”.

Do not read more than what the legend says. It does not say that past performance could not be bettered or that future performance will not be as good. It just says, – past performance has nothing to do whatsoever with the future. The chances of either of these stocks (i.e. A or B) doing well in future depend upon the current situation and fundamentals of each company.

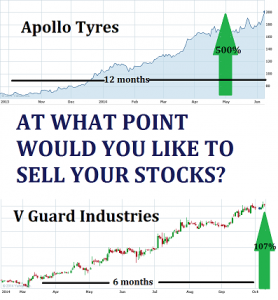

When people say that the markets have already run up a lot and its the right time to sell stocks or the other way around, there is no science behind it. The only empirical evidence, if at all you will find is that at some point a trend changes. At a philosophical level it is like saying – change is a constant thing in life. In markets it could happen after an up/ down movement of 5% -10% -15% – 20% or may be 100%. Yes all that has happened in past, the future will be no different.

Quality of Your Portfolio

Coming back to the point, learn to forgive yourself about some mistakes that you make but not for all. I am convinced that many of you who read my blogs know all about the basics of fundamental investing. I am also convinced that you all agree that there is absolutely no rocket science to this.

What you really need to be worried about is not if it is bad or a good time to sell stocks but something more fundamental – whether you are holding the right stocks at all?

If you follow a disciplined approach to managing your investments and have a life outside of stock markets, then your investigation should only be limited to the quality of your portfolio. This may not be true for equity traders, arbitrageurs, F&O traders and basically anyone else who thinks he knows what the markets are going to do in the short term.

If anybody tells you that you should sell all your holdings at any given point in time or that you should put all your money in stocks right away, one of the 2 things will happen – either you will make money over the next few months (or years) or you will lose. A lot will depend upon on your need for cash over that course of time. Irrespective of anything, in the short term you will be gambling just a little bit. Sure gamblers do make money on their days but this will not go on for long.

Instead of judging the market in the short to medium term, just focus on making a healthy long term portfolio. Divide your investments wisely; you may want to read something I had written a while back on optimal asset allocation and making a good long term portfolio.

That discussion along with what I said today is far more likely to help someone who spends not more than an average of 2-3 hours in a month looking at their portfolios. Go read a newspaper, a magazine, spend some time with friends (not talking about stocks), get better at what you do for a living. If you are fascinated by stock prices more than any of these things, then what I said is unlikely to work for you. Finally, have a goal – earn more, invest better!