Return on Capital Employed (ROCE) and Return on Equity (ROE) (also called– Return on Net Worth (RONW)) are both used to measure the profitability of a company based on the funds with which the company conducts its business.

ROE measures the amount of profit generated by the company on the total amount of shareholder’s equity whereas; ROCE highlights the profitability of the company taking into account all the money (i.e. shareholder’s equity + debt) with which the company operates.

Put simply, ROCE vs. ROE is return for all vs. return purely for the owners.

Formulas:

Return on Capital Employed (ROCE) = Operating Profit / Capital Employed * 100

Return on Equity (ROE) = Profit After Tax / Net Worth * 100

The only difference between the two ratios is the fact that, ROE excludes the amount of debt with which the company operates while ROCE takes this into account.

ROCE vs. ROE – Example

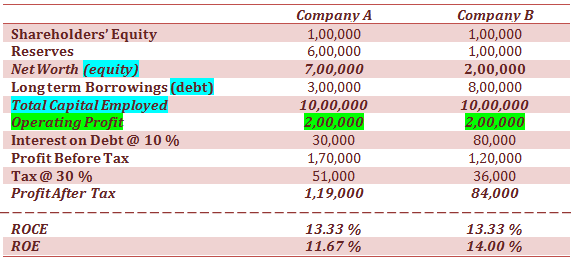

Let’s take an example of 2 companies in the same sector, which operate the same amount of (total) capital but with different capital structures (i.e. one operates with a higher equity while the other operates with a higher debt). How do you judge which is the best business to invest in?

Company A operates with a lower level of debt compared to company B. If you look at the figures and calculations below you will see how this benefits the shareholders (i.e. business owners) of Company A even though both companies generated the same amount of operating profit.

Key Points

- Smaller equity base results in higher percentage earnings for the shareholders.

- A company may operate with a very healthy ROCE but it may not add much value to a shareholder if most of the income generated is used up in servicing the company’s debt (i.e. interest charges).

- More debt may be good or bad – If a company can generate a return higher than the interest charges which it pays on servicing its debt, then taking higher amounts of debt will increase shareholder profitability (in other words, in such a situation shareholders will be able to earn profit for themselves using debt or loaned money). So debt is not always bad. However, in case of economic slowdowns or business setbacks, companies with higher levels of debt often cannot maintain higher profitability and interest charges often overtake profitability.

Video